Friday Chart Book

May 9, 2025

Habemus Papam. A new pope, a new reign. New air also entered the room after our monetary spiritual leader delivered his speech on Wednesday’s FOMC presser. Excluding pre-emptive rate cuts and even suggesting the Fed might not cut rates at all for the remainder of the year caught my attention. You can’t blame the Fed for not knowing and holding the course until they have more clarity. We are all in the same boat. However, rate markets rely on a proactive and forward-looking monetary policy response. Given the number of rate cuts priced, it wasn’t long until we had to retrace some of the pricing during Thursday trading. With it came a quite sizeable rally in the USD, yield curve flattening, gold selling off, and equities ramping on positivity surrounding a first trade deal between the US and UK, as well as the hope for others to be announced soon.

SFRZ5 is now trading below the April 1st levels.

USD Index, meanwhile, is still ranging close to the lows of April.

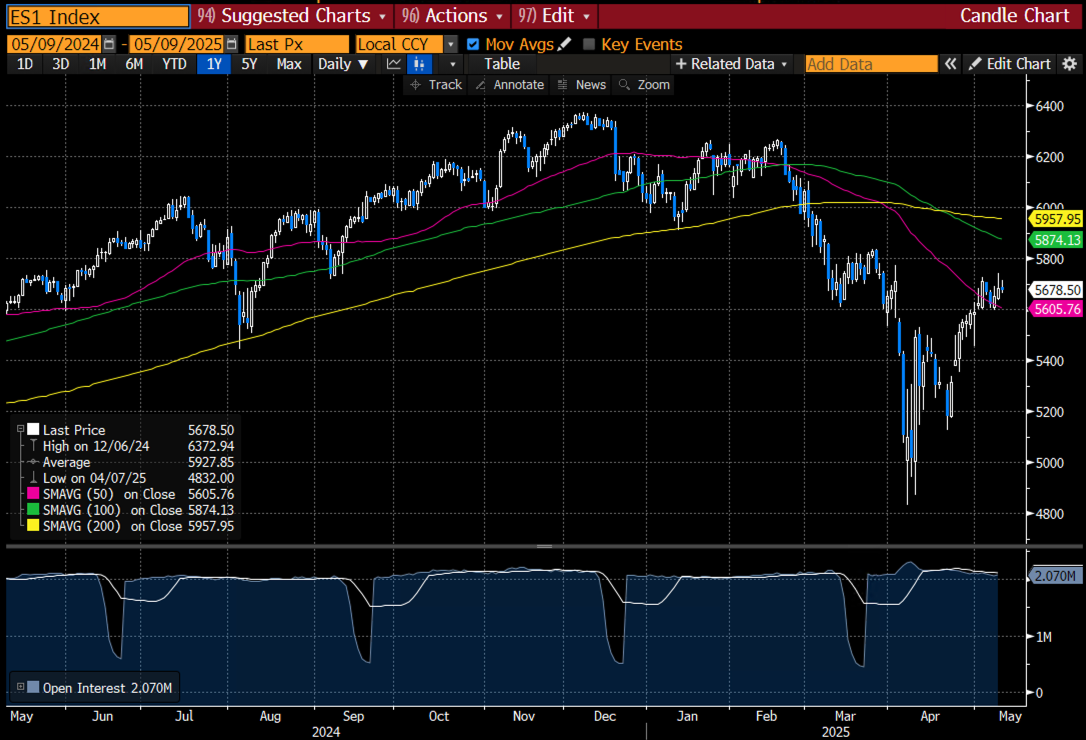

ES is so back, fuelled by tariff deals, trading in buy-the-dip fashion again close to early April highs.

Gold, similar to the USD, is holding a ranging pattern close to the high plateau reached during April’s epic ascent.

Oh, and BTC is above the 100k level again.

Who would have foreseen those levels merely a few weeks ago? I certainly did not. Although we know from experience that politically driven market turbulence is relatively short-lived, markets and their punters still seek the likely path ahead.

These are potentially frustrating times. The pain trade for equities is possibly higher while we are awaiting hard economic data to roll over, which might take months to play out. A young trader I mentor voiced his frustration to me, raging about the stupidity of the current environment. Markets aren’t stupid, but they will test every single cell of your conviction, that is for sure. As such, it’s prudent to adapt and be open-minded. “Be like water, my friend”, as Bruce Lee would tell you.

In times like these, it’s warranted to take the clues from markets and their developing structures rather than fall victim to predictions and firmly held views.

That’s where our longer-term models, tactical momentum, reversal, and intra-day signals work their magic in tandem to decipher what moves are likely ahead. More recently, they indicated an overbought condition in the US front end, which helped us navigate and avoid a strong reversal since the labour market report last week. In the absence of strong macro impulses and following our roadmap, we take cues from shorter-term setups.

Paper Alfa’s 2025 buy-and-hold portfolio is up close to 7% YTD, outperforming the SPX barometer by 12%. This is no accident.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read some of Macro D’s latest thoughts before we go through all 250+ chart setups across Rates, FX, Commodities, Crypto, Stocks, and ETFs.

Let’s go!