Friday Chart Book

May 24, 2024

by Macro D

“Life can only be understood backwards, but you live forwards.”

- SØREN KIERKEGAARD

Sometimes, a total understanding of an event is impossible. Can you hold the air in your arms? The April data on US consumer prices was released on Wednesday, 15 May, which is the result.

We remind you that this graph is particularly awaited by investors who are trying to predict when future rate cuts by the Fed will take place. The result was a slight decline in annual consumer prices, a key indicator for market trends, that sent U.S. stock and bond indexes soaring. This was because investors instantly had more faith in the disinflationary process and felt that Fed cuts were imminent. Therefore, investors were intrigued by the quiet slowdown in the growth rate of the services sector and from there came yet another breath of optimism. In short, the market looked Medusa [1] in the eye and was petrified.

However, the Fed has repeatedly made it clear that the data it is interested in is now another, namely the trend in prices of services net of rents; this price, after having reached 2.7% in September 2023, has now returned to around 4.8%, demonstrating that there is no reason to be optimistic about the disinflationary process concerning the market.

Inflation of services net of rents (annual % change)

Not having understood the momentary euphoria of the markets, I took refuge in the words of a good writer and his "Problem of Pain."

“There is a sort of invisible blanket between me and the world. I struggle to understand the meaning of what others tell me.”

- CS Lewis

Only three days had passed since the release of that data. What happened? This happened. Fed governor Michelle Bowman says she sees no progress in the battle against inflation, and she even adds that she is in favour of raising rates again this year if new increases in the inflation rate occur.

These are her exact words, spoken in Nashville, Tennessee:

"After seeing considerable progress in inflation, which weakened last year, we have yet to see further progress this year. Although the current monetary policy approach remains restrictive, I am still prepared to raise the target range for the fed funds rate at a future meeting".

Thus, you go up and down, you go up and down.

Although Jay had ruled out this possibility, Bowman went straight ahead, setting the bond market in fibrillation again. The 10-year Treasury yield reached a cruising speed of 4.447%. The general picture was completed by publishing the minutes relating to the last FOMC meeting. Participants noted that, although inflation has eased over the past year, there has recently been a lack of further progress towards the institution's 2% target. Recent months have indicated significant increases in the inflation of components of goods and services. Meanwhile, while the political bigwigs head to Stresa [2] for the G7 meetings, I have started to nit-pick at the Bundesbank for the simple fact that, when it comes to making its own internal needs known, this central bank never backs down.

Question:

What if the Bundesbank's intention (the umpteenth mission impossible) was precisely to delay the first rate cut (by now already decided) to put a brake on the wage growth that has recently appeared in Germany? And then there is always the fact that German banks are not in iron health, so a higher cost of money would be a welcome gift.

Speaking of Germany.

Today, its biggest problem is a competitor who, without attracting attention but stepping back an inch, has occupied those commercial spaces that were once the total prerogative of the German industry. At first, China specialized in electric cars but later invaded the fuel-powered car market. Germany is certainly not an isolated case, and what is happening to the car market is not an isolated case either. The Chinese economic model offers no discounts or prisoners, and what is the solution the Western world is moving towards? A heavy dose of protectionism. Will it be enough? Will it be decisive? However, let us look further and ask ourselves: if the keys to the house are once again entrusted to the guardian of protectionism, what will be the consequence? Inflation? Depression? Deflation?. The overarching context is this: China, with its multitude of car manufacturers, cannot possibly sell all its cars domestically, especially with the domestic market experiencing a slowdown. So, what does China do? It floods global commercial markets with its cars, often at significantly lower prices.

Can the rest of the world watch? No.

Whenever he has had the opportunity, US Secretary of State Antony Blinken has always said that the issue of China's excess capacity cannot go unnoticed, and Olaf Scholz has also expressed the same concerns. If the problem only concerned the automotive sector in Washington (at this historical moment), they could look the other way. The problem, however, is that the automotive sector is one of many sectors (not the only one) flooded by Chinese overproduction. The Chinese steel industry continues to operate at total capacity despite declining domestic demand. I think that Xi Jinping's primary intent is to buy less and less from other countries and, at the same time, sell more and more to other countries based on a mere profit, which is based on a fact:

I think Xi Jinping is asking himself:

If I can afford to do something, why shouldn't I do it?

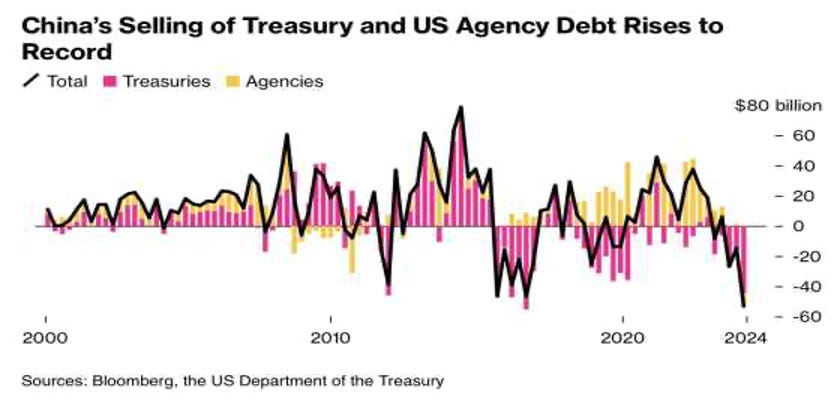

China, the mighty dragon, recently sold off US government bonds worth 53.3 billion dollars. But what did it do with this handsome sum? The answer might surprise you, and I'll reveal it shortly. After imagining Xi in conversation with his closest collaborators, I abandoned myself to a liberating breath and immediately afterwards sought comfort in the vision of an index that could easily find its space in one of the best paragraphs written by the magical pen of Stephen King. I am talking about the VIX, the fear index. The VIX monitors options activity on the US benchmark S&P 500. It keeps an eye on the "implied volatility" of the index. A VIX above 30 indicates higher expected volatility, while a lower VIX number indicates the opposite expectation. Today, we find ourselves in a calm situation (which I would define as apparent calm), leaving me perplexed. This calms the preamble to a tailspin that could take hold overnight.

I prefer to look at Etna[3] when it is not acting up rather than when it is in the throes of an unbearable nervous breakdown. “Etna VIX” is at peace with itself today, but tomorrow?

I never trust the calm of the markets; I have always thought that the most dangerous thief is not the one who enters the bank with a shotgun in his hand and a balaclava on his face but the one who crosses the entrance threshold with two big blue eyes on display and wearing a tailored suit valued thousands of dollars.

Now, we have come to an end, asking ourselves for clarification regarding the most popular word in recent times: INFLATION.

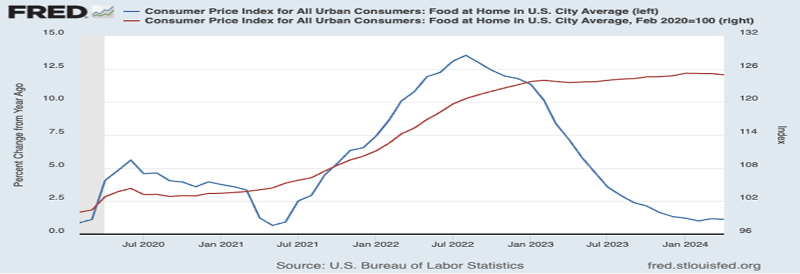

This is the graph from the St. Louis Federal Reserve that explicitly refers to the cost of food:

The blue line signals that inflation was at its best in 2021 and then bowed its head in 2022. The Fed is most interested in inflation, and it is to put a stop to this "potential monster", which Powell did not hold back in 2022 and raised rates without batting an eyelid. Moreover, now, what would the situation be? Inflation is a guest that does not follow the saying "a guest is like a fish; after three days, it stinks[4]", and therefore, now that it has sat on the sofa of the US economy, it does not want to hear reasons for its removal. At this point, I ask myself: Could Jay and his gang get into the idea that the American economy (and politics) must shoulder the burden of forced coexistence with a higher inflation target?

The minutes revealed the harsh truth that families, particularly those with low incomes, are bearing the brunt of the situation. This is a classic downside risk for consumption prospects, painting a grim picture of the economic landscape.

But here's a question: Would cutting rates be a viable solution in the short, medium, or long term? This is a puzzle that requires careful consideration.

If you know that your economy needs to appeal to a higher inflation rate, why should you lower rates? Around you, everything tells of an economic context that is going the other way. After all, if you're heading to the Aspen Snowmass ski area [5], you don't pack a pair of Bermuda shorts, flip-flops, and two t-shirts.

As I write, the powerful have arrived in Stresa, and it seems that during the trip, Yellen managed to convince everyone that the 300 billion in assets seized from Russia must be used in a certain way, that is, to help Ukraine. This would be a bad blow for Germany, who once again expected to be able to land the big shot without attracting attention. As? At least half of those 300 billion were hoped to end up in Germany to give German banks some breathing room. We'll see.

Moreover, could we turn the other way and avoid looking at what, even in the phantasmagoric world of commodities?

This happens.

Prices are soaring.

Gold, in a surprising turn of events, rose by a staggering 40%, surpassing even the remarkable growth of Standard & Poor's which reached 29%.

Silver was no exception; here, my proverbial ignorance reveals a doubt incapable of remaining dormant.

But if someone “outside the grace of nature” decided that the time had come to move from the order written on a terminal to physical delivery (via an actual container), then what would that blessed container be filled with? Is there really that much silver around? What if this also happened to copper?

Earlier, I told you that I would tell you where the money that China earned by getting rid of US government bonds ended up. Well, it was spent on investing in raw materials: gold, silver, nickel, and copper.

Considering we are in the area, can we avoid looking at what is happening in Japan? This happens.

Now, yes, when my ignorance pulls its head out of the sand again with a new question:

What if Japan felt the need (even the Great Rising Sun) to do like China and sell US government bonds to give breathing space to the yen, which seems to be marching again towards the 160 targets with the dollar?

I fear that Washington would not be happy then.

Let’s now turn our attention to the charts. By now, most of you will be familiar with the models and their signals. If not, please study the guide I have published. I have now also recorded a brief video tutorial, which you will find further below.

The full book of 250+ charts covers the whole asset spectrum from equities, bonds, commodities, FX and Crypto to give you the most extensive view. On average, it will generally provide a good 5-10 set-ups on a weekly basis.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts for a fee. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.