Friday Chart Book

BoJ credibility / Thoughts for 2026 / BoE and ECB paths / 250+ charts

We are quickly approaching the illiquid Christmas and New Year period. Today, we have option expiration across the US and European stock indices, as well as European and US bond futures, and WTI Oil futures. It’s going to be a noisy day, but we can take stock of what has been a rather choppy December so far.

The BoJ has finally delivered the second hike of the year, although Ueda didn’t offer any further clues about the path forward, which wasn’t well received by either the JGB bond market or the currency. If this year has taught us anything, it’s that markets will punish non-credible policymaking.

This chart summarises those points. As we see the highest short-term rate in 30 years, JGBs and the JPY clearly indicate they are still miles away from where they should be. The BoJ is emphasising that wages will be the determining factor for future policy making. That might be true, but by keeping real rates negative, they are risking a spiral. I don’t know what their plan is, but clearly, they want to keep the JPY weak as a political decision.

The BoJ and its actions are going to be elementary, not only for Japanese assets but also for what’s at stake for global financial markets next year.

Elsewhere, I want to share a few thoughts and questions that are occupying my mind as we enter next year.

The ECB’s “we are in a good place” mantra is an unstable equilibrium; growth is stagnant, and demand is structurally weak. Fiscal stimulus is the only lever that might revive growth, and that’s why German bonds are trading weak while inflation expectations are still subdued. A Ukrainian peace deal is elusive, and even if there were peace, it wouldn’t be a substantial economic boost. ECB on hold is just a posture, and as such, Schnabel’s latest remarks about being comfortable with markets pricing the next move as a hike should be a fade.

The bubble talk around AI is intensifying. The antithesis of a bubble is that people identify it as such. I think there is misallocation of capital that will likely never pay for itself, and the AI phenomenon has spread into credit, raising systemic issues. More importantly, I ask whether both AI's success or failure will have overall negative economic consequences. The failure path is apparent, but success could be profound at the societal level, where job displacements and an ever-growing political and wealth distribution strain the social fabric, which in turn fuels a negative economic transition.

The much-anticipated transition at the Fed gets everyone anxious and excited. I thought about this deeply. The FOMC is not some sort of machine, but a collegial decision-making body, led by its chairman. Having been part of many decision-making panels and management boards, I can tell you that relationships and your credibility within that committee matter. I think that’s underappreciated. Miran, to his credit, puts valid points on the table as to why we should already be at neutral. But he entered a room of a well-established network, trying to shake things up. He was put in as a bully, much like Trump would have wanted him to be. I think he has blown his voice and credibility in the process. Whoever the next chairman is will also need to establish himself and nurture the network and his credibility. A bully won’t be tolerated, and his power will be greatly diminished. My take is that Waller (14% probability), having already established his credentials as a board member, will probably have an easier time convincing others of his view than someone like Hassett (56% probability), who would first have to gain credibility among his colleagues.

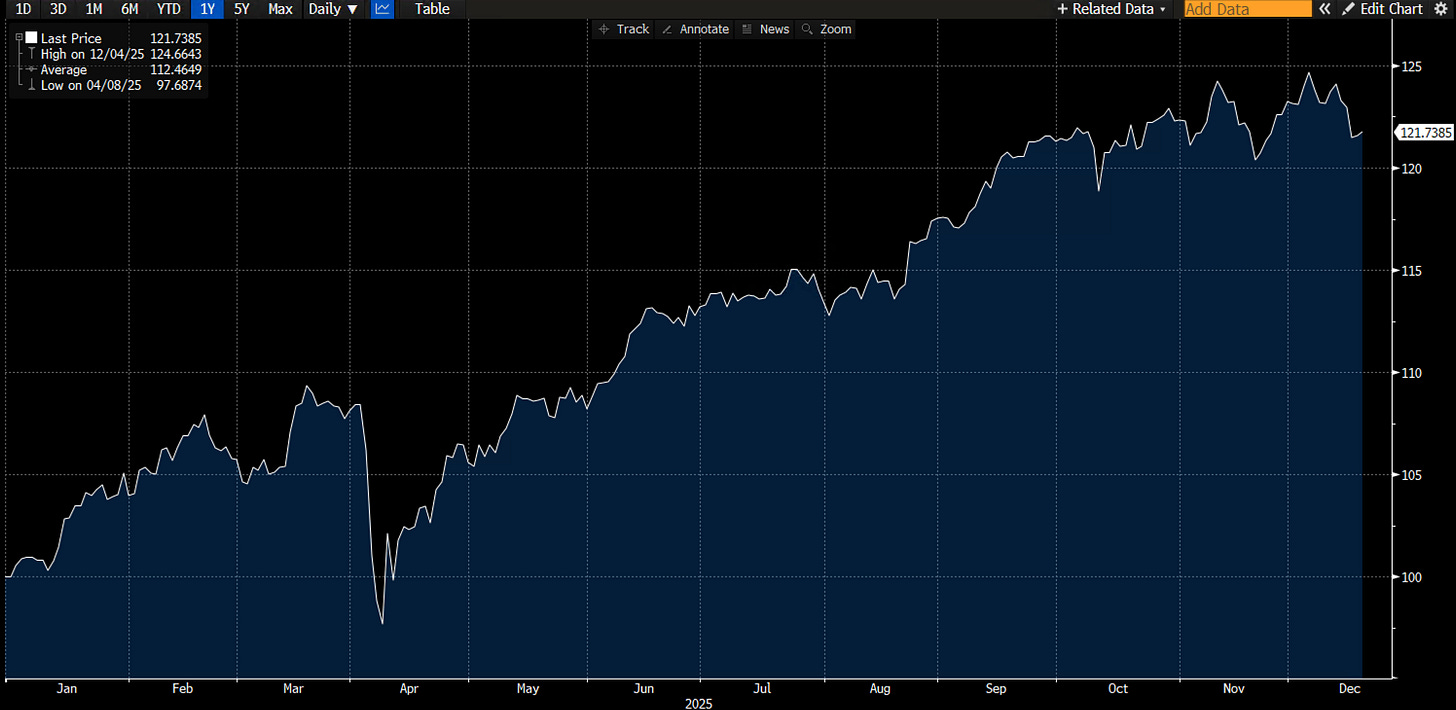

Either way, I will follow all developments closely. Over the next few weeks, I will focus on the buy-and-hold portfolio for 2026. For this current year, we are at +21.7% YTD in USD terms. I anticipate the portfolio to make quite a few changes as I am expecting a wild year ahead.

In addition to that portfolio, Paper Alfa offers much more. We have trading models based on my technical approach to markets. In addition, we have an asset allocation model that dynamically allocates between bonds and equities every week. I have a few more ideas brewing, but the alfa, education and thought pieces will continue in full force next year.

A reminder that you can now also use my trading models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read some of my friend Macro D’s detailed thoughts and analysis on the FOMC, BoE and ECB before we go through the entire chart book.

Have a blessed weekend!