Friday Chart Book

Party Hangovers / Macro Levers / Japan / 250+ Charts

The party music has suddenly stopped, and people are scrambling for the exits. We haven’t seen a risk-off event since April of this year, with many anticipating a Christmas rally into year-end. Markets don’t write scripts based on fairytales, unfortunately.

What started with a seemingly Crypto-centric reversal in risk appetite has now morphed into general equity weakness, especially in momentum and technology names. I mentioned in the previous few posts that the setup feels, in many ways, similar to 2018, when the Fed (although in a hiking cycle) kept pushing its hawkish tone, spooking markets that were anticipating monetary policy to be eased as growth slowed.

This current visionary impasse stems from many FOMC members seemingly still worried about inflation, which is at odds with the committee's having previously noted that it is putting insurance cuts in place to protect the labour market. This flip-flopping and incoherent messaging is causing confusion, and possibly a reaction function that might be regarded as inadequate and inflexible should markets need it.

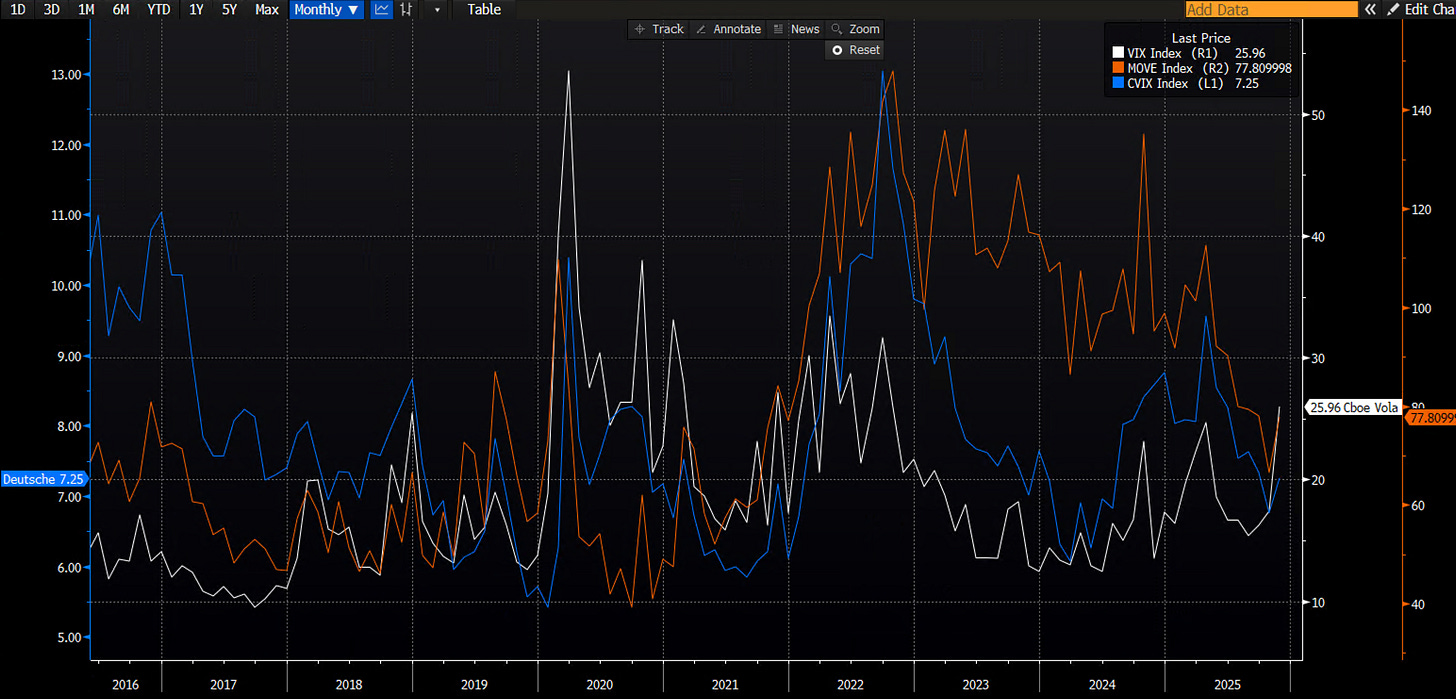

The low-volatility environment and relatively stable correlations made portfolio construction and leverage easy to manoeuvre. This all works until volatility picks up and/or correlations change. The inability of rates and FX to diversify risky positions, as well as Gold, which previously worked, leaves levered portfolios with only one option: deleverage their risky positions.

Sentiment has deteriorated quickly, and I noted how good news was punished, symptomatic of an incoming reversal. I was eagerly anticipating NVDA’s results, but I really wanted to see how markets would respond 24 hours after that. What started as a sizeable rally quickly fizzled into a painful reversal. The clearest signal for me is that optimism is changing its tune pretty quickly. The Nasdaq reversed 5% lower. This is not good news, and I am expecting rallies to be sold from here.

Remember when tunes change, you have to dance differently. This doesn’t mean throwing in the towel on all positions, but to think through many possible scenarios. Could this be over in a few weeks? Yes, sure, maybe even faster than that. Could this lead to a much more severe risk of dislocation? Absolutely. In either scenario, think about what would make sense. For a risk-off episode, for example, I considered the Gold/Silver ratio (shown below), which tends to do well when volatility spikes. The entry for this trade is also attractive from a level perspective, with a clear stop below the double-bottom lows.

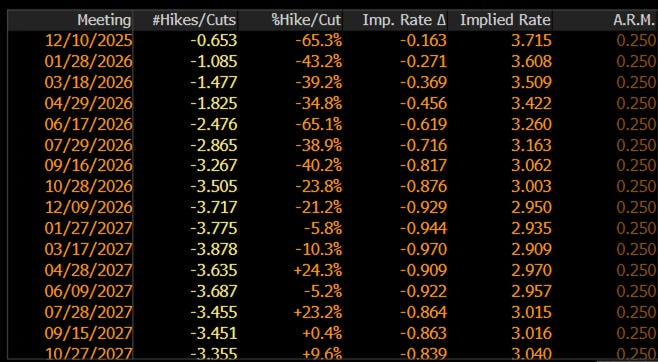

Another consideration, of course, is the reaction function of the Fed. December is still modestly priced, although we are now pricing odds of more than 50% for a cut. Note, however, how only one cut is priced across both Dec and Jan. Depending on your conviction of at least one cut occurring, this trades like an option on having more aggressive cuts or two cuts coming in.

There are many levers a macro trader can pull. But you have to be careful about correlation risk, especially in the current environment. I am, for example, always reducing the number of trades and keeping those I believe in and sizing them up appropriately. Risk management, as always, is paramount in any environment you find yourself in. Last, but certainly most importantly, is to keep an open mind and a cool head in these markets. Higher volatility means things can fool you more than you think, as gyrations will hunt your true convictions and press all emotional levers. Reducing the number of decisions is something I always tell myself. And yes, keeping things simple helps.

Subscribers have access to the full Friday Chart Book, which goes through all macro markets, including crypto, single stocks and FX. More than 250 charts are highlighted below. It is based on my momentum and reversal models, which have warned us about momentum shifts and exhaustion patterns.

A reminder that you can now also use my trading models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Paper Alfa turned 3 a few weeks ago. As a sign of gratitude, I am running a 20% discount for life on new subscriptions during November. Please use the link below.

Let’s now read some of my friend Macro D’s thoughts on NVDA, Japan and new/old macro data before we go through the entire chart book.

Have a blessed weekend, and good luck out there, everyone!