Friday Chart Book

Tranquility to Fragility?

Could the relative tranquillity be deceiving? I wonder how fragile the current pricing is, especially in risk assets, which see hardly any decent dips for those willing to add to their exposures. It’s like a running train, with people hoping to jump when the opportunity arises. The current shutdown and data scarcity are somewhat welcome by many market participants.

What can go wrong when no data is available? Yesterday was supposed to be a relatively calm day, and in the end, it kind of was, yet some markets exhibited massive swings. Silver, for example, rallied steadily during the day before turning down by 5% within an hour. I didn’t see any news on the move. I warned subscribers of reversal signals in Gold & Silver the day before.

This gappy market action does not happen in highly liquid conditions, so I am wondering whether these are first tremors in markets, signalling possible other dislocations ahead.

US 30-year treasury yields are holding in very well, and it is notable that the recent steepening trend is again stalling out. Is it a signal of upcoming economic weakness, or does it tie in with the “carry” environment we are currently in? After all, the Fed is going to probably cut twice this year, bringing repo rates below 4%, while you pick up nicely in long-dated bonds and get convexity should the economy face recessionary conditions.

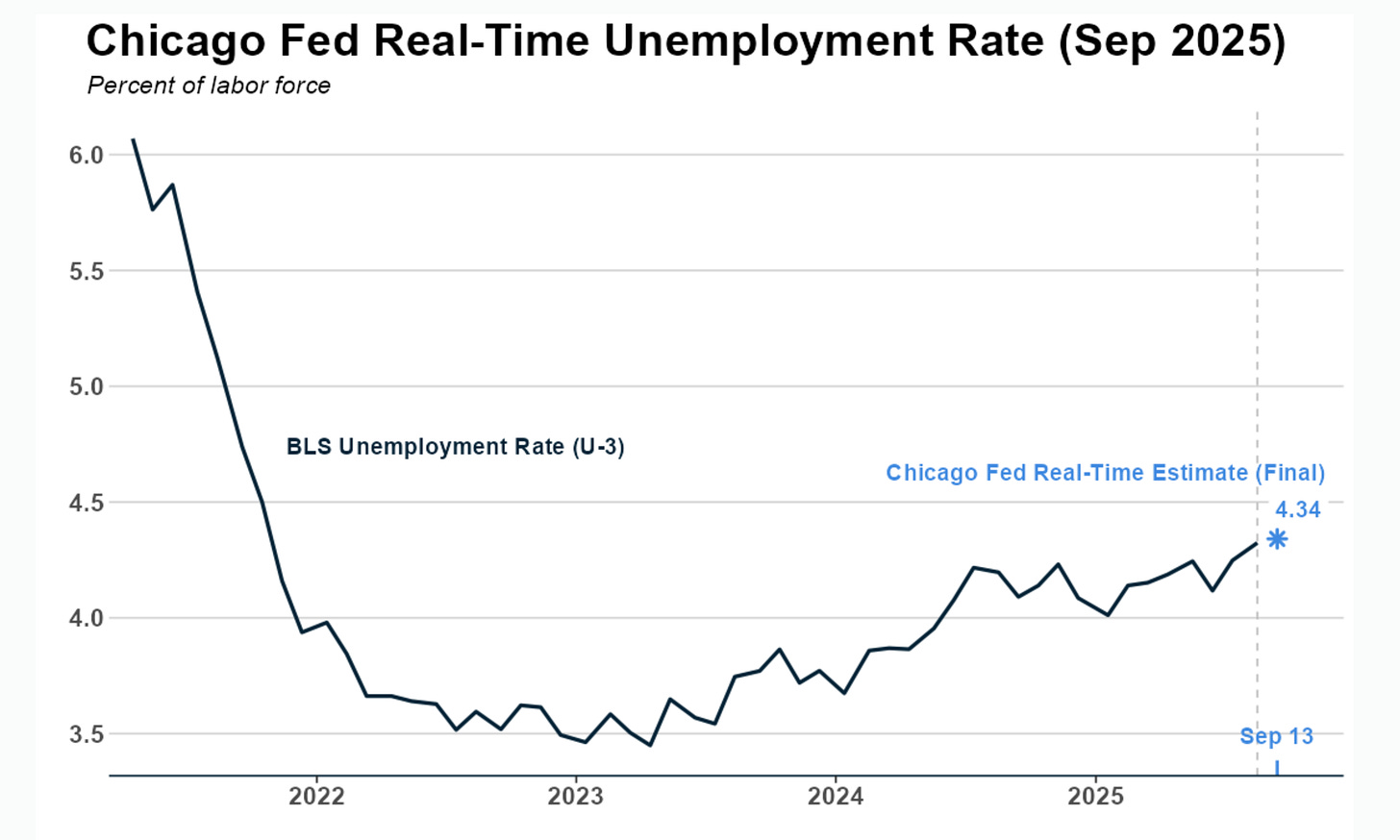

The bit of data we got this week was a bit weaker, which was a surprise, although ADP numbers were somewhat skewed because of a change in methodology. I was not expecting a negative print, I have to say, although the market reaction in rates & FX turned out to be relatively subdued. The Chicago Fed is running a real-time unemployment rate tracker, which is inching up but still at the relatively low reading of 4.3% currently.

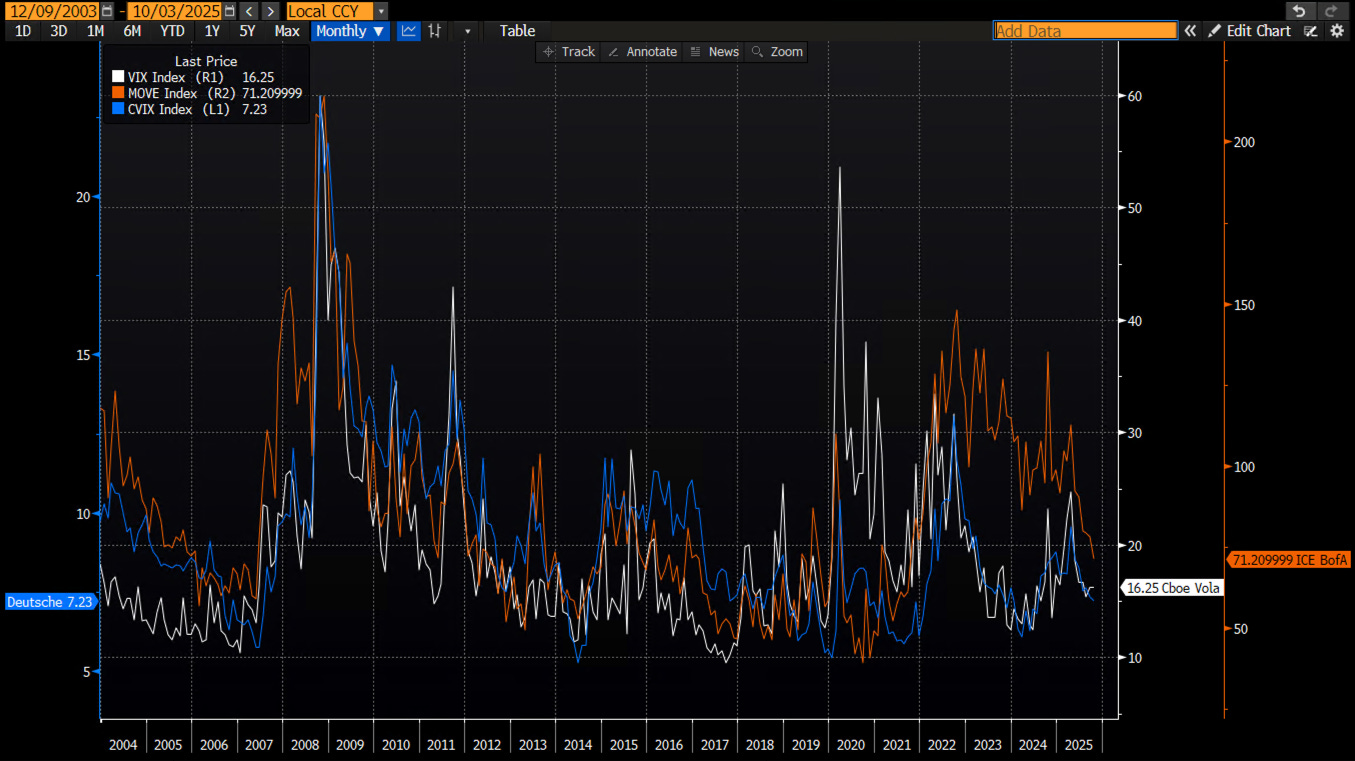

The subdued volatility across macro markets is a reflection of a lack of durable opportunities and a favourable carry environment, although much of the juice has already been taken out.

This is the time when I am preparing for a correction. Don’t get me wrong, I am still long risk assets here, but my stops are tight, and I am looking at option structures to hedge for a potential swift Silver-style downmove. Stocks are rallying globally, with European stocks breaking out (see charts below). It feels like capitulation buying rather than being fuelled by optimism. Call it a hunch, but I dislike quiet markets.

The chart below shows the most shorted stock basket index, which is also climbing to new highs, indicating that indeed long-short funds are covering their much-beloved shorts. This doesn’t indicate market strength.

Could we melt up? Of course, and I cater for any eventuality, but I am covering blind spots here. I've had a great year so far (+21.3% in my buy-and-hold portfolio alone), so it makes sense to cover some bases and prepare, observe, and execute as planned. I will be sharing more thoughts through Substack Chat and on here, of course.

Another overriding question is regarding the US Dollar. If you had to list things that would cause the Dollar to depreciate further, you would have ticked all the boxes, yet the reserve currency hasn’t moved since the summer. This tells me that we are either running out of narratives or that most of it has been reflected, while the US economy is weaker but still powering on. There are a few narratives that are slowly losing their impact, which means that we are ready for a new regime to be born. This means that a new narrative can derail the calm. I am fully prepared.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read Macro D’s latest thoughts on the shutdown. In addition, you will find the updated chart pack of all 250+ charts across the global macro universe.

Have a wonderful weekend!