Friday Chart Book

Ahead of Payrolls / Bonds on key levels / Sovereign risk & yield curves

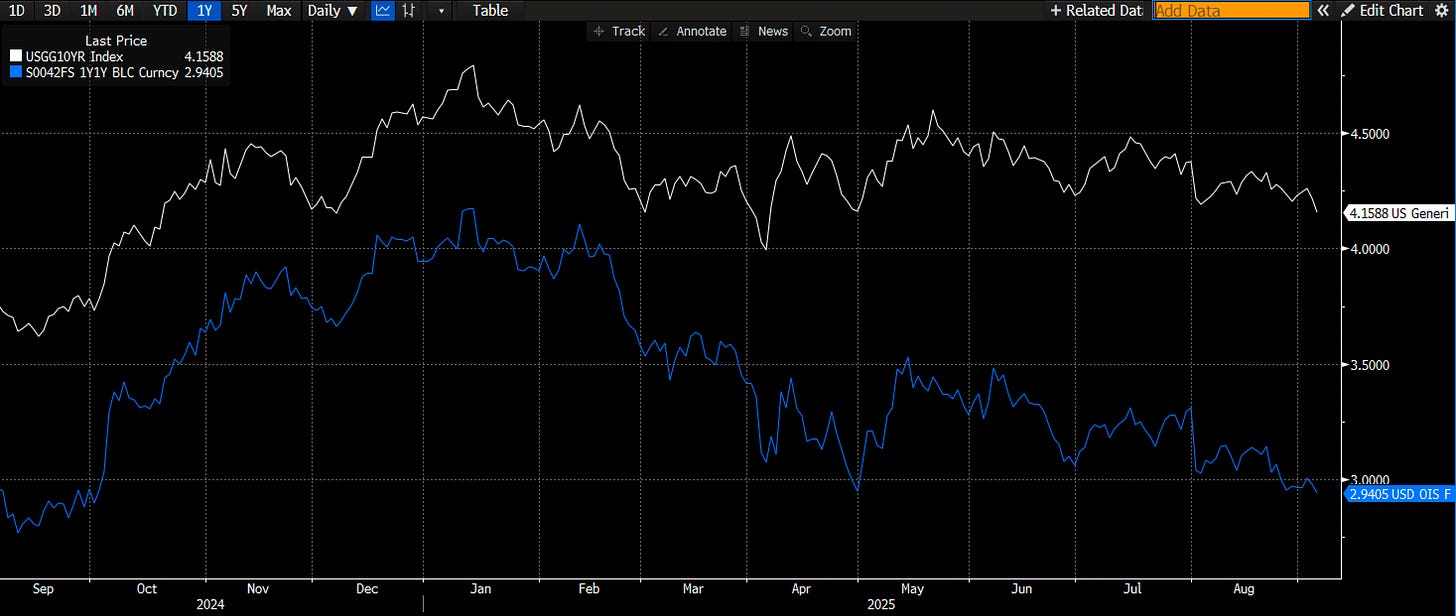

I am writing this ahead of Friday’s payroll release, which is expected to come in at around +75k. ADP was slightly lower compared to expectations, which catapulted the Treasury market to new lows with 10-year yields now tracking 4.16%. Equities are also holding up well in an environment where the market sits quite comfortably with the view for the Fed to deliver a first rate cut in September and then gradually get us back to the neutral rate around 3%. In many ways, this is a beautiful soft landing scenario. US 10y yield and 1y1y OIS (blue) below.

Can it materialise? Of course, but this cycle has been anything but straightforward, so I would expect such a path to be challenged in the weeks and months ahead. First of all, labour market weakness has to be viewed in the context of the impact of migration, which could naturally make the NFP run-rate much lower. Danny Dayan wrote an excellent piece following Thursday’s data. He highlighted a new paper which shows the run rate under different scenarios. For net zero immigration, the research paper foresees a 27k run rate. That’s not too far from where I would expect tomorrow’s number to fall. I will, however, be watching the unemployment rate more closely, given that it was Powell’s preferred barometer.

Another boon for bonds came from the reversal in some of the long-end pressure dynamics, with the UK’s 30-year bond yield posting a quite bullish reversal candle after Tuesday’s mini crisis.

Bond markets are expecting a soft print, and it would be interesting to see how a more robust labour market reading would impact markets. Clearly, the market is currently more excited to embrace the slowdown and cutting narrative. A higher print could likely show a short-lived market reaction given the BLS revisions are due on 9th September, with the CPI following next Thursday. Given the large standard error for the number itself, it wouldn’t be outrageous either to see a negative print.

I will share my trading thoughts with paying subscribers in the Substack chat as usual. In the meantime, the momentum and reversal models are helping us navigate through the macro setups presented.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not free and incurs an additional cost. These are my momentum, reversal and intra-day models I am often referencing.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Below, you will find Macro D’s latest thoughts on France and the ECB. In addition, you will find the updated chart pack of all 250+ charts across the global macro universe.

Have a wonderful weekend!