Friday Chart Book

June 21, 2024

Today is the summer solstice, the longest day in the northern hemisphere. It sure felt like the longest day for me, as I have been pretty much awake for the past 24 hours due to a family emergency. Apologies to those who expected the charts to drop on Friday morning as usual, but family always comes first.

The Friday chart book now includes the Friday closes, which you will hopefully find useful as you prepare for your coming investment week.

For the intro, we have Macro D at hand, who will give us his latest thoughts.

Enjoy!

We can't help it; we start from the United Kingdom this time. Some time ago, when Rishi Sunak announced the July 4th elections, I immediately referred to the polls. The result? The vote should reward the Labour Party after 14 years of opposition. What situation would those who come to the Government find? In the last two quarters of 2023, economic activity decreased, causing the United Kingdom to enter into recession due to two factors.

The exit from the European Union.

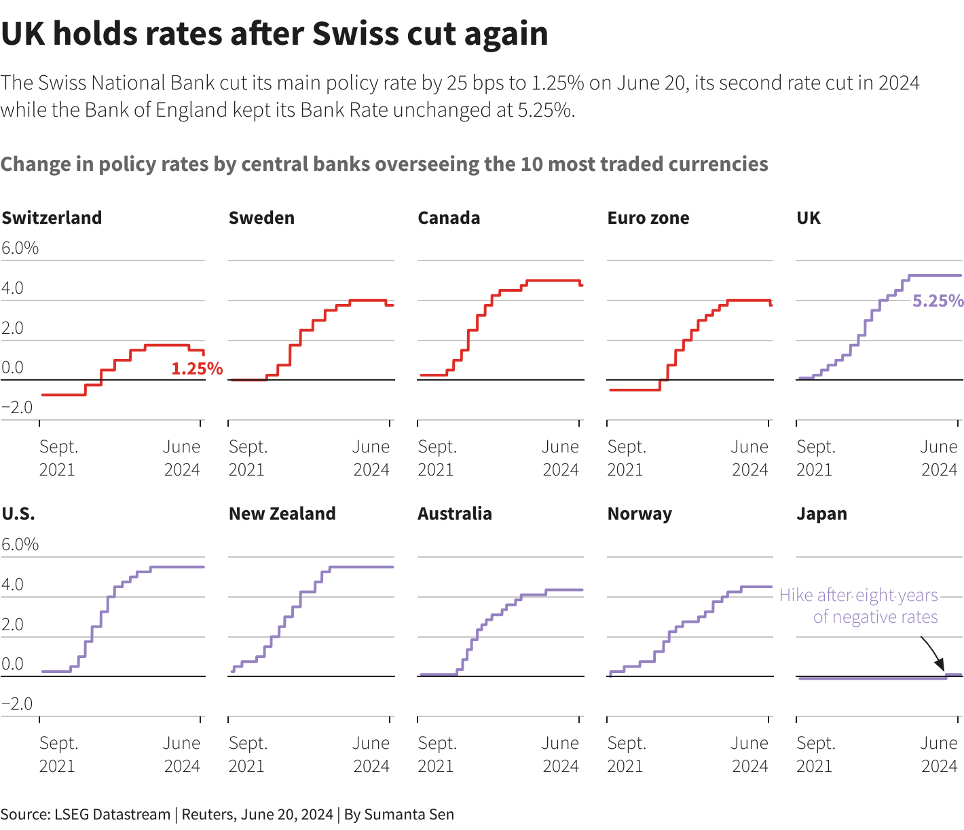

The reduction in the influx of workers from Eastern Europe resulted in a need for more workers in specific sectors accustomed to using this work. This resulted in a slowdown in production and supply, which increased prices. Inflation reached over 10%, and the BOE responded by raising the official rate to 5.25%. Inflation has been downward to 2.3% over the past year. Still, the labour market is on edge as wages are growing faster than inflation, and the BOE appears set to lower policy rates to support economic activity.

So, the United Kingdom is about to embark on a 1) change of political government and 2) a change of monetary policy.

Since the start of the week, I've been carefully considering whether this monetary easing could potentially commence in June. Or will they opt for a more cautious approach in August?

A bet on a rate cut in June seemed too risky; the general election in Great Britain would arrive the following week. Therefore, the vision of Bailey making such a noisy move just before the vote seemed unlikely to me. Since no press briefing was planned, I was preparing to turn my attention to the voting patterns to understand the monetary direction taken by the members who had yet to show a univocal vision in the previous meeting. Rates in Great Britain are very high compared to inflation, and there is also an apparent numerical disproportion compared to the rates proposed by the ECB. This difference makes me think that the room for manoeuvre available to Bailey is quite large. The inflation data of Wednesday 19 (in particular, the inflation of services that exceeded the forecasts) have definitively put to rest the hypothesis (that, in truth, I have never cherished) of a monetary easing for the current month.

Meanwhile, what was being said on Wall Street at the beginning of the week? The star-spangled markets were little moved but received support from retail sales that grew less than expected.

From this data arose the classic rigmarole regarding Jay's hypothetical (immediate or not) interest rate cut. At this point, the words of the various regional governors of the Fed began to take hold of the winds, starting with John Williams (New York Fed), who declared that rates would have to fall judiciously over time and, therefore, outlined a slow and stale path of descent.

I limited myself to reasoning along the lines of simplicity: “If retail sales go at a moderate pace and simultaneously, the unemployment rate rises, and inflation lowers its head, then Jay could immediately take those scissors that he keeps on his desk and observe them”.

In the meantime, while waiting for news from the central banks of the United Kingdom and Switzerland, I turned my mind elsewhere and proceeded with some reflections relating to the macro sphere.

A question.

"But why is the cost of housing rising?"

US housing costs are 6.5% higher than in 2023, but they are not the only ones that have increased. Australian housing costs have also increased by 5%, and Portuguese housing costs are skyrocketing.

But how can a sector that has been accompanied by years of interest rate hikes be growing?

I await the following real estate data to understand whether it is appropriate to reason around a hypothetical macro heterogeneity[1] or a hypothetical micro homogeneity[2].

A consideration: China has responded tit for tat to the European duties on electric cars and has taken the station head-on by attacking pork. It might seem like a disagreement/bickering between children, but unfortunately, it is not. When the retaliation concerns national states and not classmates, there is always the risk that some hothead will raise the stakes too much. Immediately after the tariffs on the import of Chinese electric cars, China launched an anti-dumping investigation into the import of pork products from the European Union. Could there be a new tariff war? Never say never, but if Trump returns to the White House, “the game of revenge” could spread like wildfire across dozens of commercial categories, moving from Europe to the United States.

At this point, my attention once again turned to the United States, and when I decided to line up what had caused me some discomfort in recent days, I couldn’t help but consider one graph in particular.

When this graph shows levels like these, I am naturally led to remain alert. If there is reason to worry, it is only because a graph of this size has always rhymed with the word “recession”.

It's a recession when your neighbor loses his job; it's a depression when you lose yours.

- Harry S Truman

I look around, and I see that most people today are not employed (with stable and full-time jobs).

During the night between Wednesday and Thursday, the New Zealand economy came out of recession, albeit with a modest leap forward relative to the first quarter.

This exit from the labyrinth occurred at a cost that was too high, and the country's economy certainly cannot be considered in total health. Minister Willis himself had to recognize that inflation continues to dominate. This situation of lights and counterweights, shadows and half-lights makes me think that the RBNZ is one of those that could surprise the markets in the following meetings with choices that could opt for either a cut or a rise in interest rates.

By now, I was inside the night before the central banks of Switzerland and the United Kingdom released the data, and where could I go to stick my nose if not in the house of Europe?

As I pondered over the hypothetical scenarios relating to the situation that is unfolding in France, I tried to discern the reasons (and the potential scenarios that could arise) following the words of Lane (of the ECB), who spoke of a rate cut more likely in September rather than in July. He also stated that the ECB has no intention of making a showy purchase of French bonds to calm the spread and please President Macron, shedding light on the potential future actions of the ECB.

Suppose the term spread becomes the recurring nightmare above the Eiffel Tower. In that case, I wait to see if the reaction of this ECB will be the same as the one that, in its time, forced the Berlusconi government to resign (in Italy), when at that time, it was the Bel Paese that shed bitter tears over the spread between Bunds and BTPs.

The French spread has soared to its highest levels since 2012, and this time, the French public accounts are looking at the Italian ones with ill-concealed envy. The scenarios that could open up are capable of creating devastating chasms. It's crucial to understand that integration is not a one-sided process, but a mutual understanding that can only be achieved if the one who proposes it dares to speak from the heart to the heart of those who should undergo this integration.

I continue to see a Europe that speaks to the people's intellect, partial conveniences, and particular interests, and this undaunted aim at what is destined to perish only pushes away the era of what could last.

Following the European elections, I do not expect any immediate political agreement before the French voting booths are assembled and then dismantled again. It's crucial to note that other embers smoulder under the ashes in the Old Continent, hinting at the ongoing economic and political uncertainties that demand our attention and caution.

A piece of news and a graph forced me to make a dutiful grimace of circumstance.

In May, Europe imported more gas from Moscow than the United States. Question: But wasn’t the narrative in power shouting from the rooftops that Europe was now happily free from Gazprom’s blackmail?

And then, when Thursday morning appeared before my eyes ... what did I see?

The Swiss central bank cut rates to 1.25%, and my mind immediately went to the anchor with which the SNB tried to free itself from the clutches of the entire world a decade ago, in that era in which it seemed that every human being on the face of the earth wanted to have a little piece of Switzerland in their wallet.

What did the SNB say in its press release?

"Underlying inflationary pressure has further decreased compared to the previous quarter. Today's cut in the SNB key rate allows the National Bank to maintain appropriate monetary conditions. It will monitor the evolution of the situation carefully and, if necessary, adjust monetary policy to ensure that medium-term inflation remains within the area of price stability".

So, with this second cut, the SNB has become familiar with scissors with particularly sharp blades.

And then it was the BOE's turn. What did they do?

The Bank of England kept its primary interest rate unchanged at 5.25%. The BoE's Monetary Policy Committee voted 7-2 to leave rates unchanged, although Deputy Governor Dave Ramsden and external MPC member Swati Dhingra are advocating a cut to 5%.

Bailey has been confident about inflation for some time despite believing it is too early to cut interest rates.

The governor of the English central bank has always been a banker looking for certainties, and we consider this latest statement in this regard.

"We need to be sure that inflation will remain low, and for this reason, we have decided to keep rates at 5.25% for now."

For this reason, I believe that the BOE will only move based on data that leaves nothing to chance.

The economic data that strike me, in particular, are the ones relating to the inflation of service prices, which has decreased less than expected by the BoE in the May meeting (it fell to 5.7% and not 5.3%), and the increase in private sector wages, which is now at a level double that which the BOE believes is compatible with an inflation of around 2%.

My analysis diverges from the prevailing sentiment among traders, as I am not convinced that the BOE will cut rates in August. Now, for the markets, there is over a 50% chance of a cut at the next meeting, given that policymakers have shown their openness to loosening monetary policy. Despite this, I remain attached to Bailey's consistency. He has always declared his absolute need to recognize stable inflation within the 2% target.

I am still waiting to see this stability.

To conclude, just as the BOE began to increase rates at the end of 2021, that is, ahead of the most important central banks, given the current macro situation, the statements of the various central bankers, and the primary data to which these central bankers refer, I am currently of the opinion that the BOE will be the last (among the leading central banks) to lower interest rates.

[1]Global dyshomogeneity regarding a fundamental inconsistency between the general economic context and the social fabric that moves on this economic framework.

[2] Micro homogeneity is data conformity between the particular economic context and the social fabric that moves on this economic framework.

We now turn our attention to the charts. By now, most of you will be familiar with the models and their signals. If not, please study the guide I have published.

The full book of 250+ charts covers the whole asset spectrum from equities, bonds, commodities, FX and Crypto to give you the most extensive view. On average, it will generally provide a good 5-10 set-ups on a weekly basis.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts for a fee. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s go