Friday Chart Book

September 6, 2024

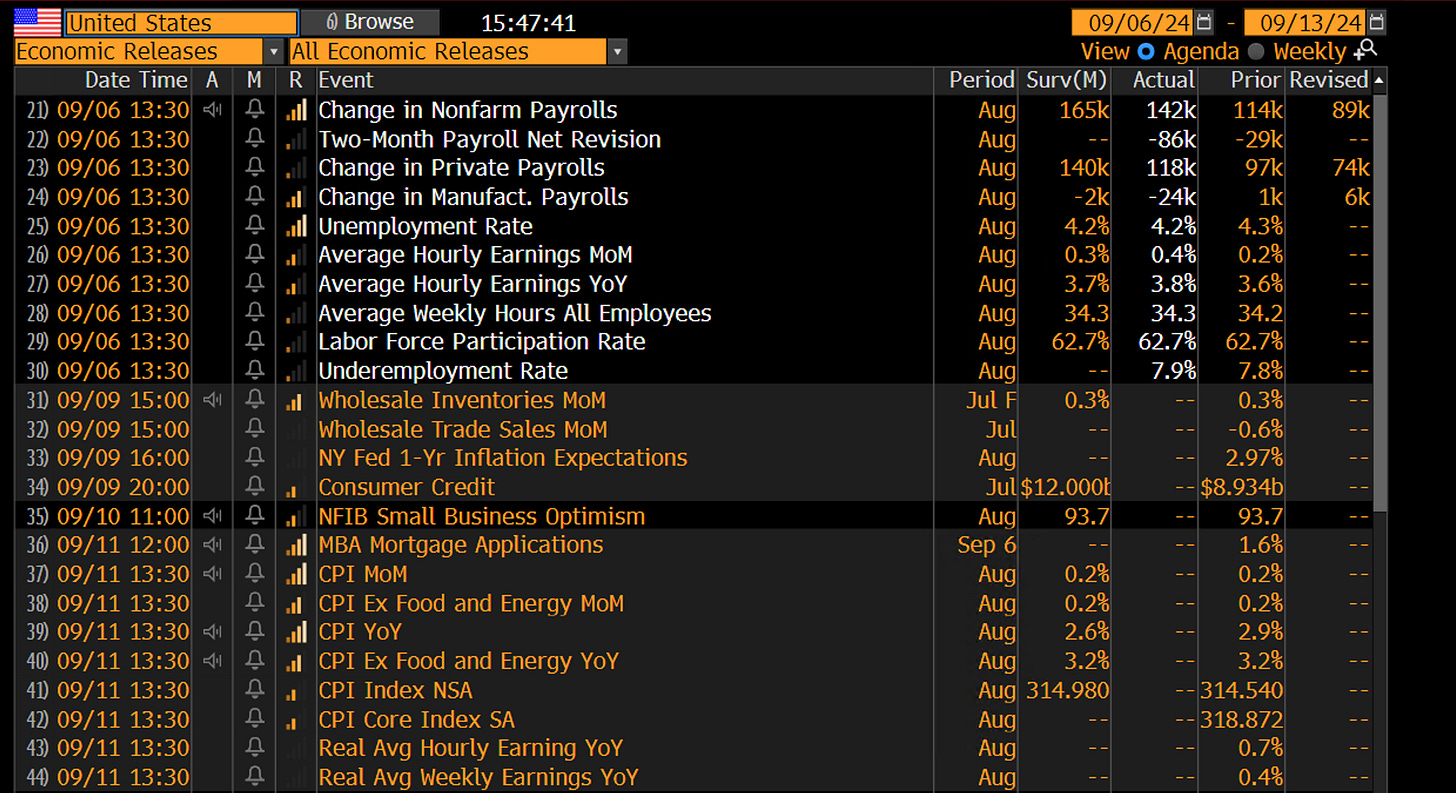

Payroll day meant I had to get up early to observe the much-awaited print as I am still travelling. It’s quite serene when you are in a bed watching numbers flash on the Bloomberg screen while your beloved wife peacefully sleeps beside you. As for the numbers, the largest fears of a labour market falling off a cliff have not come to fruition. A slightly softer print with negative prior revisions initially boosted rates markets and tanked the USD.

This then gave way to some profit taking, which is usually the form on payroll day, allowing people to re-enter trades at better levels. Today was no exception. Below is the ZN (TY) US 7-year Treasury future as of the time of writing.

The more interesting reaction came from Equities, with the mini SPX future below. The better data was firstly greeted with enthusiasm, but seemingly, the heightened question about a 50 bps dosage on September 18 is suddenly no longer good news for stocks, it would seem. Something has changed. Reactions have changed, and we should all take note.

The speaker schedule following the print included relatively balanced views from Williams and a firmer tone from Waller who argued for front-loaded cuts, cementing a higher probability for a 50 bps cut. Markets have now a 50/50 shot of a 50 bps cut after his comments. Below the Sep-24 implied cut in bps.

The question to me is still whether a front-loaded cut is warranted and whether risk markets will be happy with such an outcome. I have my doubts. In my view, I see a front-loaded path to open the requirement for sharper cuts down the line as equities take a further tumble. Markets might anticipate the Fed to be behind the curve. It is not all cemented, but there are tectonic plates rubbing at the moment, with such a scenario carrying a meaningful probability.

Much of it, as always, will be data-dependent. As such, today's and this week’s economic numbers appear to set the tone for a slowing economy and cooling labour market — nothing more or less. Sahm’s rule, while triggered, bears no meaningful signal, in my opinion.

Looking at Waller’s speech, which I recommend you to read, he highlights the following conclusion:

“Determining the pace of rate cuts and ultimately the total reduction in the policy rate are decisions that lie in the future. As of today, I believe it is important to start the rate cutting process at our next meeting. If subsequent data show a significant deterioration in the labor market, the FOMC can act quickly and forcefully to adjust monetary policy. I am open-minded about the size and pace of cuts, which will be based on what the data tell us about the evolution of the economy, and not on any pre-conceived notion of how and when the Committee should act. If the data supports cuts at consecutive meetings, then I believe it will be appropriate to cut at consecutive meetings. If the data suggests the need for larger cuts, then I will support that as well. I was a big advocate of front-loading rate hikes when inflation accelerated in 2022, and I will be an advocate of front-loading rate cuts if that is appropriate. Those decisions will be determined by new data and how it adds to the totality of the data and shapes my understanding of economic conditions. While I expect that these cuts will be done carefully as the economy and employment continue to grow, in the context of stable inflation, I stand ready to act promptly to support the economy as needed.”

In other words, let’s do 25 and keep another 25 bps in the back pocket should eco data deteriorate sufficiently, which is a very reasonable approach.

The Models have done a good job of keeping us out of trouble, mainly staying long in Bonds and shorting the US Dollar and commodities. You will find updated charts for all assets covered further below, with closing prices as of Friday evening.

By now, most of you will be familiar with the models and their signals. If not, please study the guide I have published. I would highly recommend you go through these notes and guides if you are new to the pack.

Further below, the full book of 250+ charts covers the whole asset spectrum from equities, bonds, commodities, FX, and Crypto to give you the most extensive view. On average, it will generally provide a good 5-10 set-ups on a weekly basis.

A reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts for a fee. If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s also read my friend Macro D’s recent thoughts on markets before engaging our scanning eyes across the multitude of charts that I have updated for you below.