Friday Chart Book

February 21, 2025

It’s been a busy week, and there are so many cross-currents at work it’s hard to digest what matters. There, however, are a few observations that I would like to share, which I think are relevant.

First, the Japanese bond market has put pressure on global yields and yield curves as 10-year yields have reached levels last seen in 2008.

The steepening of the Japanese yield curve is also at odds with the anticipation of the BoJ to hike rates further in the coming months. The market is seemingly telling the BoJ to get going.

Ueda even had to verbally intervene and suggest that they would step in to support the bond market, which stopped the sell-off and caused the Yen to sell off on Friday after Thursday’s strong surge.

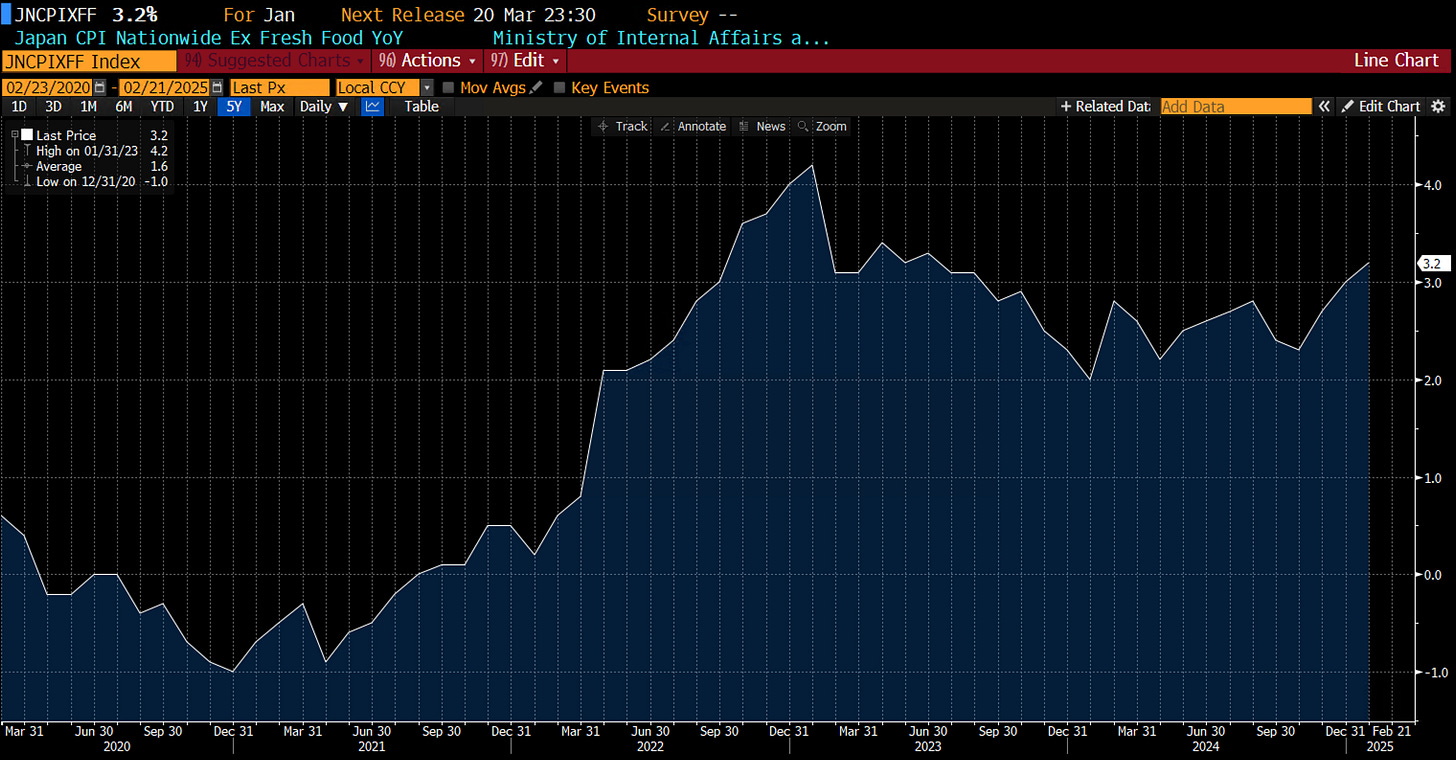

Meanwhile, core inflation accelerated in the land of the rising sun and is now tracking above 3% again. Real rates are still negative. Go figure.

This makes local government bond markets more attractive relative to, say, US Treasuries. 10-year Treasuries hedged back into JPY are yielding almost 50 bps less.

This is supporting the JPY, which is back to December lows vs the USD.

Another market that has caught my attention is Switzerland, where bond yields have exploded higher on no news. Maybe the market realises that they won’t really cut to negative to weaken the CHF when the USD is rolling over, and higher-beta currencies outperform the mighty Swiss currency.

US economic surprises have disappointed as of late and we are back in negative territory when looking at the Citi indices. It is noteworthy that these are mean-reverting, but the current impulse is negative, which so far hasn’t left a durable positive on US bonds yet.

The 10% Risk parity Index (Equities, Bonds and Commodities) is close to the September all-time highs. This has mostly been powered by equities and commodities this year. Do we roll over or make new highs?

US stocks are underperforming their global counterparts. It’s amazing that the 1-year return of the DAX beats the SPX (in USD terms). What is this telling us? A lot of it came after the November election, so is US exceptionalism under Trump now reversing?

Paper Alfa’s Long-term 2025 portfolio is up nearly 8% YTD and doesn’t hold any positions in US stocks. I still like all positions.

If you are curious about what Paper Alfa has to offer, I still have the 7-day trial for you unlocked. We offer timely insights and systematic allocation models, which have helped us well over time. There are also our momentum and reversal systematic models scanning all liquid global macro markets daily for any shifts and break-outs.

Further, our goal is to enhance our reader’s understanding of how the macro world works and offer free educational pieces. Macro D is constantly scanning the macro universe and has timely thought pieces. This week brought 2 Trade Corner posts on the EUR and AUD.

This is a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost. I am also in the process of making one of my intra-day models available. This will come at no additional cost to existing users, but new admissions will see a price increase.

Here is a little preview. These are 15-minute bars for the NQ (mini-Nasdaq future). I have now finished the overall code and colour-coded the major signals. I’m brushing it all up and putting a guide together. I hope this will be launched soon.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now go into more detail and read what my friend Macro D has in store for us. We then scan the multitude of charts I have updated below. 250+ charts, to be more precise.

Let’s go.