Friday Chart Book

Geopolitical & Macro Observations / Silver speculation or shortage? / 250+ Chart Book

Week two is done and dusted. Further political noise involved rumours about an imminent attack on Iran around mid-week, which didn’t materialise. This turned the risk-on engines back into gear as we are closing the week. Oil had a decent setback after Trump miraculously de-risked the situation.

I have shared some geopolitical notes from a gathering I attended during the week on the chat with subscribers, which can be generally summarised as follows:

Iran

The Iranian regime is assessed as stable, with no significant protests and cohesive security forces.

There is no credible opposition capable of taking power.

Any U.S. response under President Trump is likely to be limited and targeted (e.g. strikes on senior figures), not a broad escalation.

Israel is not expected to strike Iran in the near term; doing so could undermine dynamics that currently work in Israel’s favour.

Iran is not viewed as an imminent or fully credible nuclear threat.

The most likely path is gradual internal evolution, not revolution.

Greenland / Transatlantic Relations

Greenland rhetoric is largely political signalling, not a genuine takeover plan.

A U.S. takeover by force or purchase is considered highly unlikely.

The underlying objective may be to pressure Europe to raise defence spending.

The probability of a U.S. force against a NATO country is estimated at ~5%, constrained by military, political, and economic realities.

European defence demand is expected to remain structurally strong, with opportunities in advanced defence technologies (e.g. drones).

Ukraine / Russia

No major change in the conflict is expected over the next six months.

Putin is broadly content with the current trajectory, making incremental gains.

Russia’s military performance is improving tactically.

Any negotiations are expected to involve repeated additional demands from Russia.

There is a deep-seated belief in Russia that Ukraine is historically Russian, implying long-term conflict tolerance.

Ukraine faces growing mobilisation challenges.

Zelenskyy remaining in power beyond 2027 is considered unlikely and would be welcomed by Moscow.

Even a Donbas settlement would not satisfy Putin if Ukraine remained stable and aligned with Europe.

Lower oil prices (e.g. $50/bbl) would materially weaken Russia fiscally.

The scale of the front line (>1,000 km) makes monitoring or peacekeeping extremely difficult.

China

China is not expected to take imminent military action against Taiwan, absent a sharp political shift by Taipei.

Coercive measures short of force (e.g. blockades) remain a disruptive tail risk.

China is unlikely to retreat from South America despite losses; instead, setbacks will be used rhetorically against U.S. pressure.

South America is increasingly hedging between the U.S. and China.

Xi’s third term ends in 2028; historical precedent suggests late-tenure policy risk.

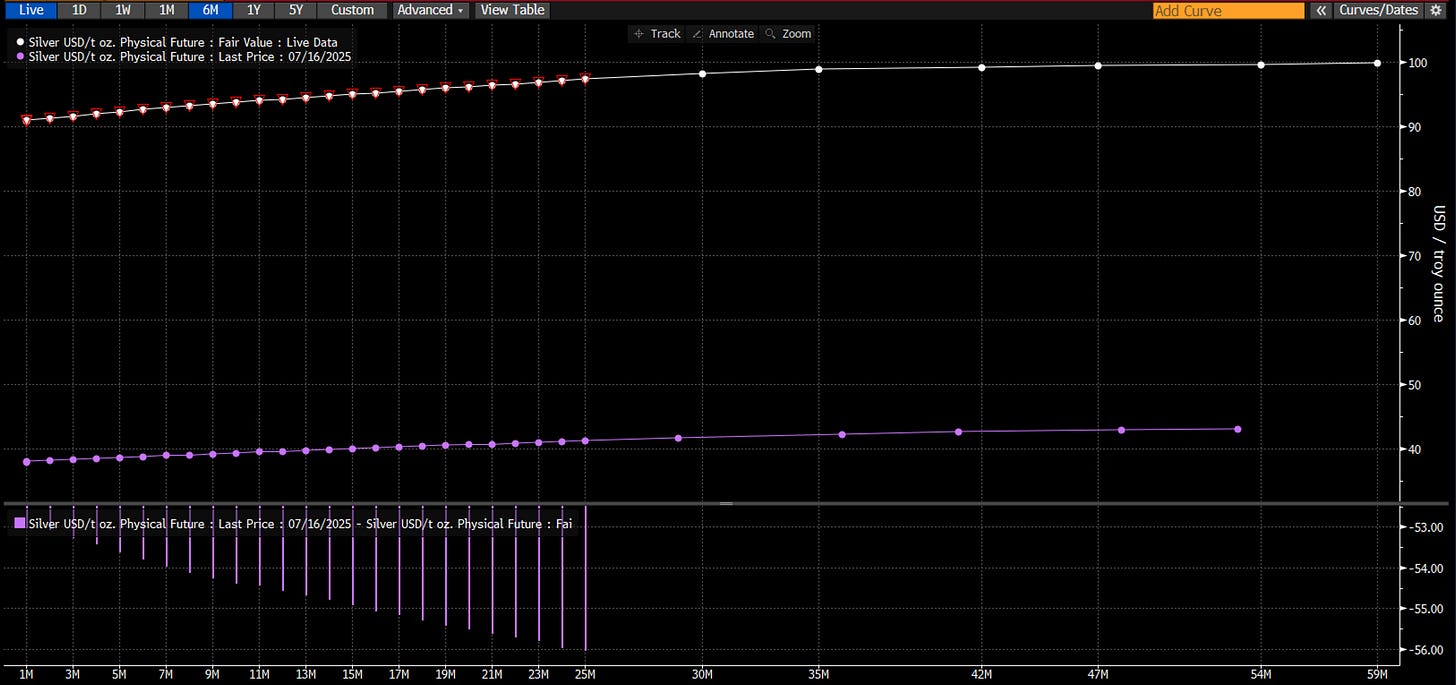

Silver is still very much the talk of the town, but what astounded me a bit is how well behaved the forward curve is, which is not exhibiting any supply stresses. I have plotted today’s curve and the one from a year ago below, with both showing “rational” contango.

What’s driving it, if it's not an actual shortage? There are tariff- and export-ban-related localised issues, which would indicate some constraints, but at this stage and looking at the chart below, we are clearly in high speculative territory. The previous expansions from previous lows were 10x. An admittedly naive chart would indicate that a 10x from prior lows should take us north of 135 usd. Can we get there? Nothing is impossible, but as I said, the volatility explosion makes this metal harder to trade. Be nimble and adjust your trading sizes accordingly.

1m ATM Vol for Silver is trading at 75%, doubling in the past month

Another noteworthy development was the sharp flattening of yield curves, which coincided with a rebound in the Dollar. This smells like a stop out or de-risking move of consensus trades. Below is the 2-10s US yield curve, which has seen a 13 bps move since the beginning of the year.

Somewhat surprising, this seems to be entirely front-end-led, with 30-year U.S. Treasury yields actually lower YTD.

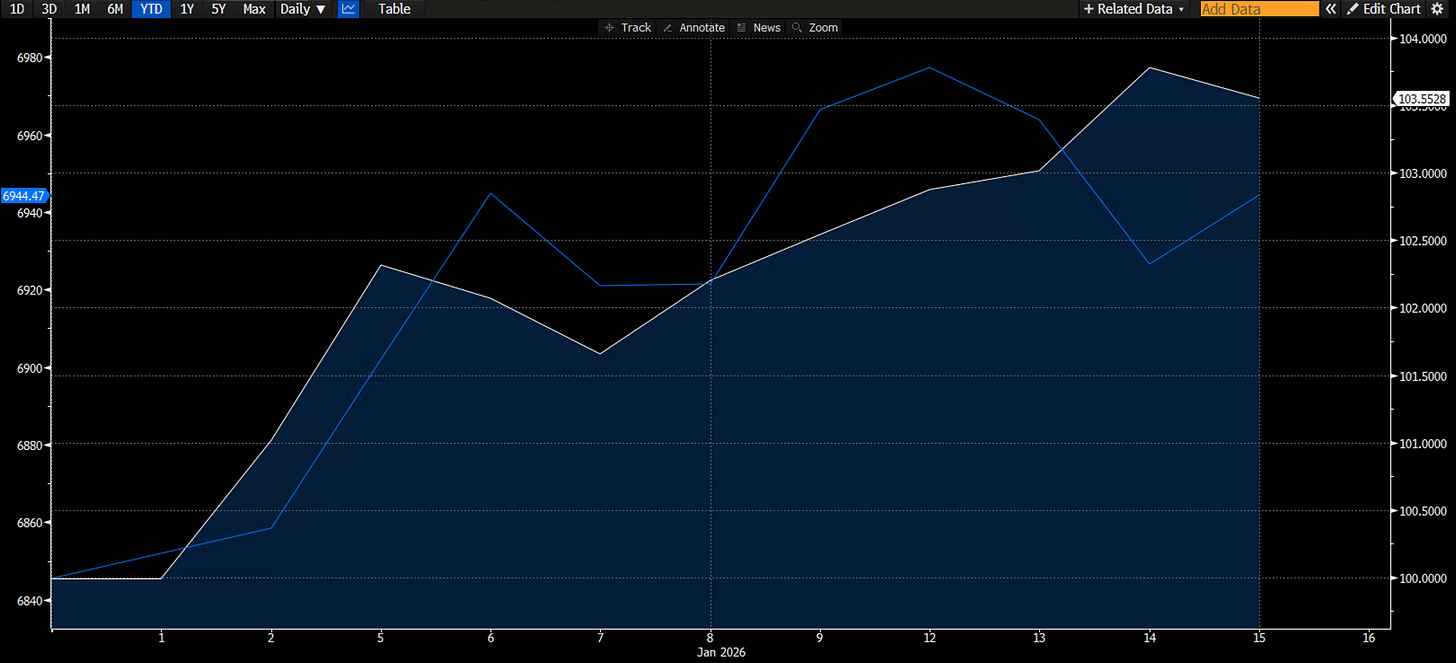

Our 2026 buy-and-hold portfolio has had a great start to the year, tracking +3.5% YTD (white line), compared to the SPX (blue line), which is up just below 3%. The more defensive stance has not only outperformed but also allowed for the distribution of positive returns when volatility picks up, as was the case mid-week.

For a detailed rationale and allocation, please read the piece below.

Let’s now read some of my friend Macro D’s detailed thoughts on this week’s macro data before we go through the entire chart book. I would also recommend reading Macro D’s January Trade Corner, where he details his thoughts for 12 Global Macro FX trades.

Have a blessed weekend, and if you are interested in joining the growing community, why not subscribe and give it a go?