Friday Chart Book

January 31, 2025

Another week has brought quite the volatility with it. This time, it wasn’t directly related to tariff talk but more about the valuation of big tech companies, most importantly NVDA. Deepseek has entered the room. The evolutionary step of any new technology always faces the day of reckoning when innovation inevitably drives cost reductions. Now, I view this in itself as a positive development overall. Any end user of that system will be happy. The producers of chips, however, will likely see their valuations questioned. NVDA’s stock hasn’t recovered despite the SPX fighting back strongly from the early week’s losses. See chart below.

SPX is on course to close the gap at the time of writing.

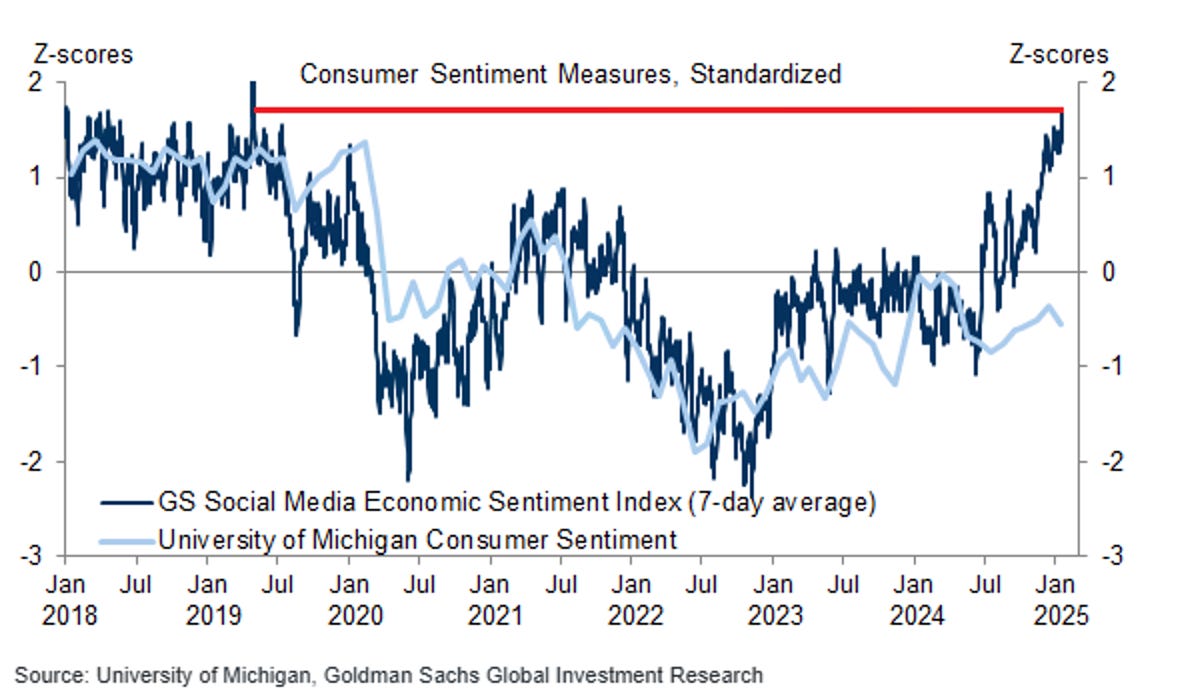

The ecosystem will have to be revalued. I get it; competition isn’t necessarily a bad thing. After all, the US tech giants have survived and thrived even with solid competition from their Asian counterparts. This, however, now questions the capex investments firms have front-loaded. Why would you invest in training LLMs if a competitor will offer something way cheaper going forward? Let’s see how it pans out, but I think this is a bigger deal than people currently give it credit for. It will always be easier in hindsight. I am watching this closely as an unravelling would likely cause sizeable wealth losses when market participants are most bullish. This will have a larger-than-normal knock-on effect on growth dynamics. Meanwhile, consumer sentiment is rather buoyant. See the chart below. What can go wrong? Keep in mind, though, that bubble reversals can take several years to play out.

Absent this equity-related growth scare, the picture for the US economy looks rather resilient. The Fed is now all but in pause mode, which will lower implied rates and FX volatility and boost equity valuations in the process. This status, however, can’t last forever and is ironically the most vulnerable equilibrium.

What can go wrong? Firstly, animal spirits are in full force; inflation is lower but still sticky and higher than the mandated target. Deficits are unlikely to shrink, supporting the current nominal GDP trajectory of just over 5% further. Where would markets trade if we flip STIR contracts into pricing hikes again? Everything I see still very much resembles the “imperial cycle” thesis from the 80s, where huge capital inflows keep the wheels spinning and support the US Dollar in the process.

Yields are assumed to have a 5% ceiling. What if that isn’t so? Gold is breaking out, and now Silver is also on the move. Is that a tariff valuation premium for Gold as a currency or a precursor of a weakening US Dollar in the making?

There are so many cross-currents, and it’s paramount to keep an eye on those developments. Tariffs are not going away and will come in one shape or form. I find the narrative of it being all peaceful and a happy event for everyone involved hard to believe. Deepseek’s arrival is not only a technological but also a geopolitical event. The world is shifting, always, but more so now than I was ever experiencing. This is a proper macro environment. There is volatility on the horizon.

If you are curious about what Paper Alfa has to offer, I still have the 7-day trial for you unlocked. We offer timely insights and systematic allocation models which have proven us well over time. There are also our momentum and reversal models scanning all liquid global macro markets daily for any shifts and break-outs. Further, our goal is to enhance our reader’s understanding of how the macro world works and offer free educational pieces. The year has started very well for us. The Long-term 2025 portfolio is up over 4% and doesn’t hold a basis point in US stocks. Rather than shooting darts at the board, we are all about the process.

This is a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost. I am also in the process of making one of my intra-day models available. This will come at no additional cost to existing users, but new admissions will see a price increase.

Here is a little preview. These are 15 min bars for the ES (mini-SPX future). This is still in refinement mode but the results so far are encouraging. I’m trying to incorporate volume into the mix as well, which should be interesting.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s now read what my friend Macro D has in store for us. We then scan the multitude of charts I have updated below.

Let’s go.