Friday Chart Book

May 30, 2025

As I mentioned in the Mid-Week Update, I am currently on holiday, enjoying the sun and water of the European seas. While I am trying to recharge, I am never entirely removed from thinking about markets. I am, of course, keeping up with all the latest news, especially the ongoing reality show in Washington. It’s a farce.

If you have ever read Sun Tzu’s “Art of War”, you would know and appreciate that any winning battle has to come from the importance of understanding both yourself and your enemy. By gaining a deep awareness of your own strengths and weaknesses, as well as those of your opponent, you can better position yourself for success.

One of the most striking aspects of The Art of War is the emphasis on strategy over force. Sun Tzu advises that the best victories are those won without fighting. The ability to deceive, surprise, and manipulate the battlefield from the shadows is a hallmark of the great strategist. If I look at Washington, I see none of this. There doesn’t seem to be a coherent strategy. Just a shock and awe approach, only to Taco out. All this disincentivises foreigners from allocating or holding US assets, a well-known threat. I think we are still in the very early stages of this reallocation turn, which plays out over a long stretch of time.

In a curious piece, a Financial Times article highlighted concerns over Section 899 in Donald Trump's recent budget bill, which proposes higher taxes on foreign investments in the US. Investors fear that this provision could deter foreign investors, potentially impacting corporate investment and asset markets. Critics argue it risks cooling foreign interest in US assets, complicating debt financing efforts amidst rising deficits. Analysts also debate the ambiguity surrounding its impact on US bond holdings, which could further unsettle international confidence in US economic policies. The underpinnings of the global monetary system, backed by liquid and most sought-after collateral in Treasury securities, are shaking. You don’t want to lose sight of this. Looking at the Bloomberg USD Index over time, the US Dollar has plenty of room to depreciate from current levels.

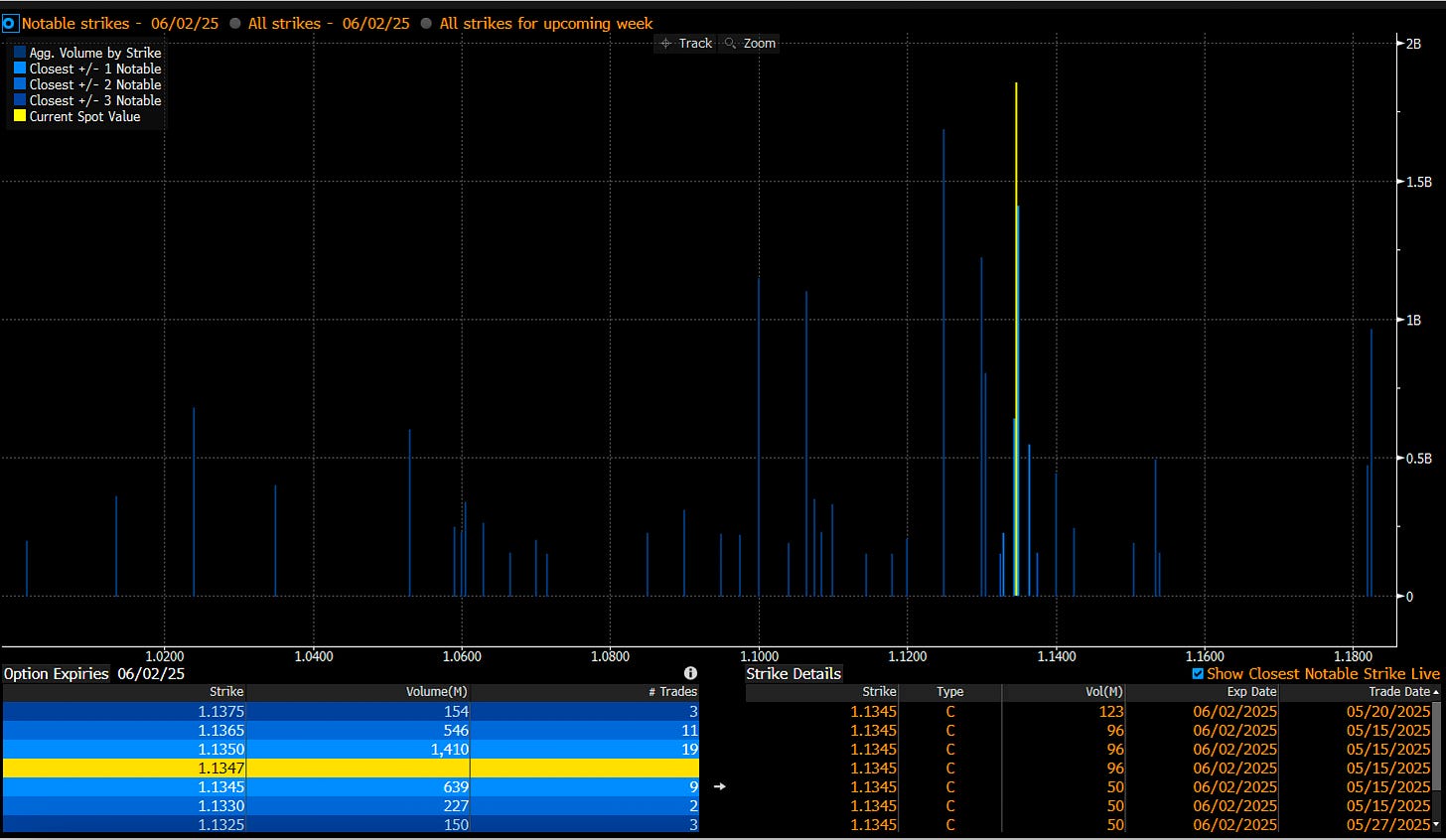

Secular trends take years to play out. This doesn’t mean there can be vicious counter-trend rallies. In fact, you can be certain those moves will occur. Looking at EUR/USD Risk reversals (25 delta calls vs. puts), it would indicate that there is heightened option activity already in play, as most Hedge Funds play OTC options to gain leverage from further Dollar depreciation.

Bloomberg does a pretty good job of analysing FX option activity, although I think they are not capturing all trades, while various option structures are also unknown. For hardcore FX traders, that information is very beneficial, as gamma profiles can detect barriers of activity and hence opportunity.

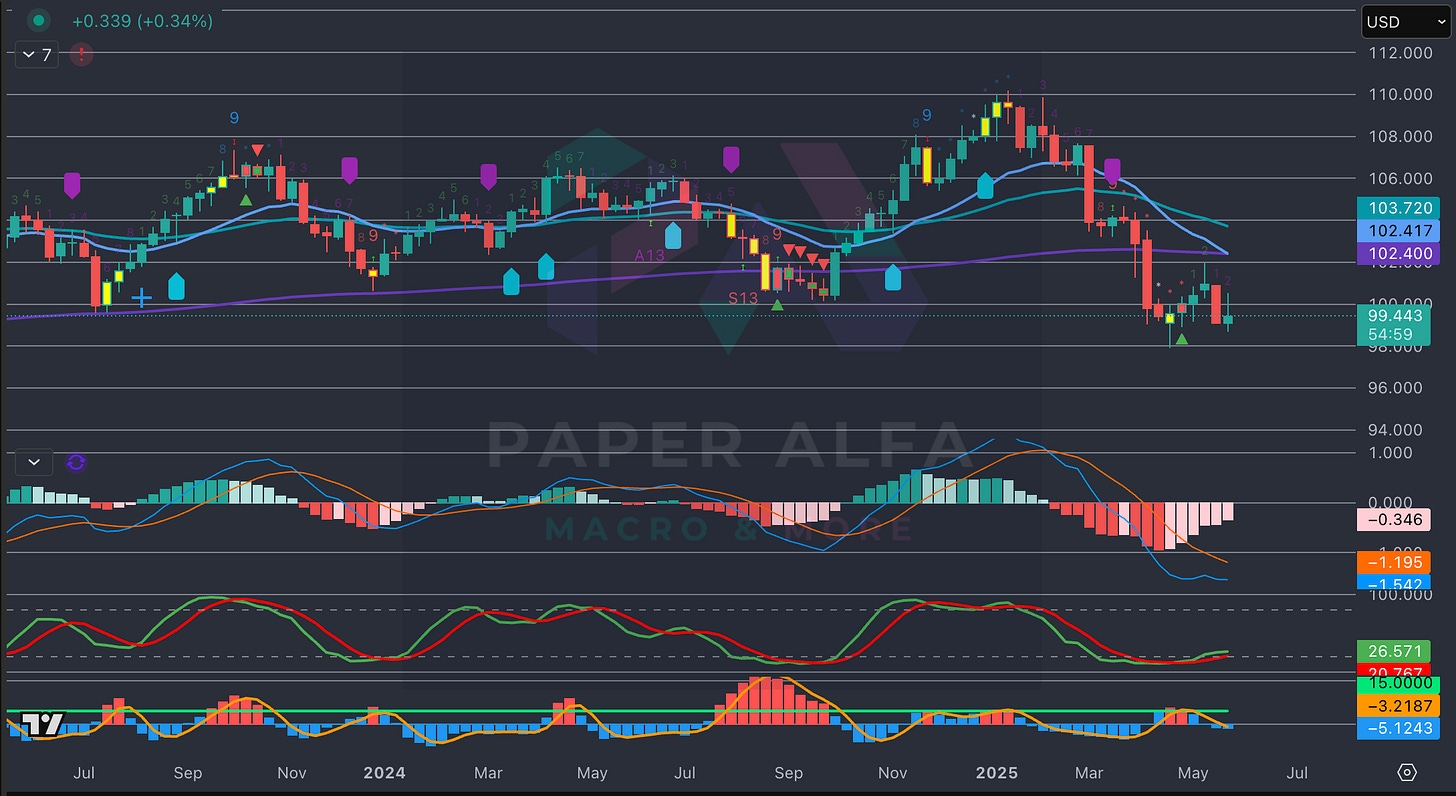

Combining this with our technical models (below weekly DXY) would indicate that we are potentially building a base and double bottom, from where more sideways choppy action could be expected. Shorts have to be prepared for a counter-rally, which could be fast in cleaning out weaker holders. Patience is warranted.

All information continuously flows through Paper Alfa’s process in untangling broader macro themes and combining them with our tactical models, aiming to generate returns both in the medium and short term. Our success so far is a testament to this process working, and long may it continue.

Let’s now read some of Macro D’s latest thoughts on current narratives, Europe & Japan and Bessent’s latest comments before we go through all 250+ chart setups across Rates, FX, Commodities, Crypto, Stocks, and ETFs.

Have a great weekend!