Attack the Week (ATW)

July 7, 2024

Sunday Thoughts

Sometimes, life just throws you a massive curve ball, where you have to step back and reassess what’s important to you. It first comes as a shock, and then you consider a path forward. There is no other way around. I had to deal with quite a testing family emergency over the past fortnight. Luckily, things have emerged to be less serious than initially feared. I am eternally grateful for this outcome, and I thank all of you again who have messaged me and kept me in your thoughts and prayers.

I love this community we have all created on here, it’s simply amazing. I am now back in full-on steam mode, but I will reflect and adjust a few things in my personal life going forward. Don’t sweat the small things, people say. But that’s not the full story. I will write a thought piece on it at some point in the hope that it will help someone else if ever faced with a similar situation. My blessing and best wishes to all of you and your families.

Back to the financial and political world, it would appear that there is a bit of a shock result coming from the second round of the French election, with the left bloc NFP coming first in early polls (172-192 seats), ahead of Macron’s party Ensemble (150-170) and far-right RN only third (132-152). Remember that a party needs 289 seats to obtain a majority. I am not entirely sure what the immediate consequences will be, given that some of NFP’s economic reforms will be quite extreme. A hung parliament, while not the worst outcome, could be considered somewhat market-friendly but bears some more serious costs in longer terms as it will have to show what path France’s public spending will be taking.

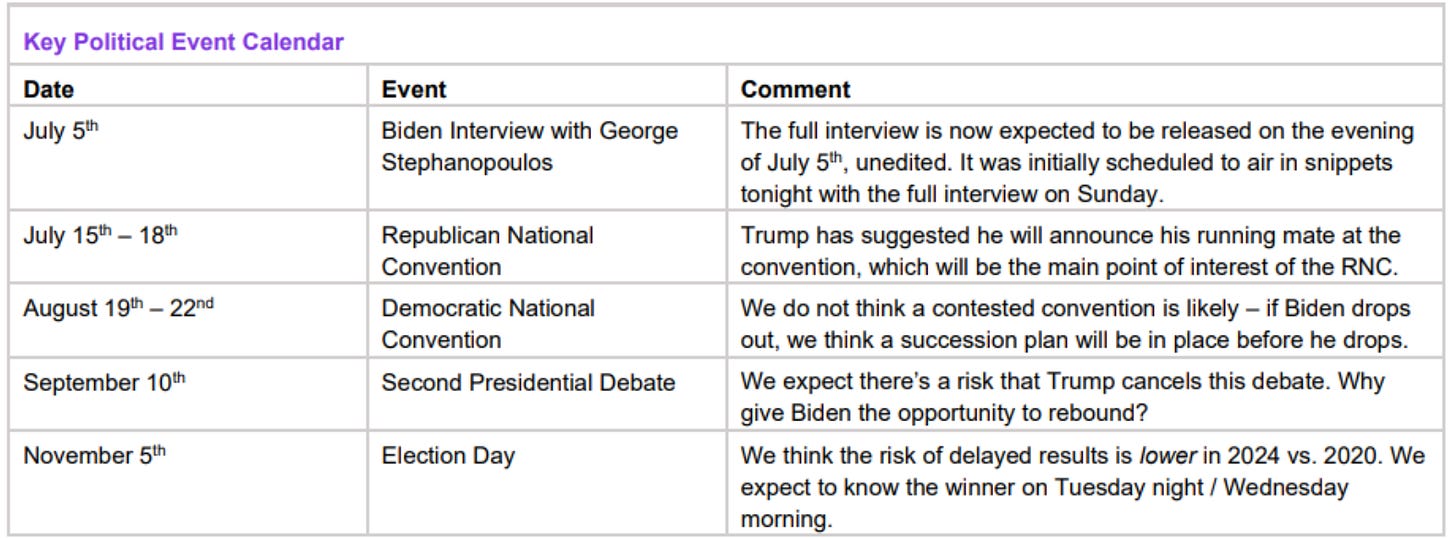

As for the US, it’s good to keep in mind what the event calendar looks like. You will find the most important key dates in the table below.

As for markets, Friday’s notable bond rally would suggest that steepeners (while carry negative) are back in popular demand. My models would agree. Treasury yields nosedived after the US jobs report, begging the question of how much conviction is behind the move. 2y yields were down 10bps at 4.60%, with key yield support at 4.55%. 5y yields have found some support at 4.20%, just ahead of their key support at 4.18%. The higher unemployment rate, alongside downward revisions to headline jobs, solidifies a September cut and creates a more fundamental case for curve steepeners.

The initial post-payroll response in equities was somewhat mixed, but this changed as we approached the close, with risk rallying back to expand on their old habits. July seasonals are very solid.

The following chart needs little explanation, which shows the average seasonality over the past 20 years.

Let’s now turn to Macro D’s thoughts before we scan through the most important macro events in the week ahead and look at the most important and informative charts we should consider as we progress into week 2 of the new quarter.

Let’s go!