Attack the Week (ATW)

May 6, 2024

Monday Thoughts

We are celebrating a long bank holiday in the UK, which has given me a bit more time to think through what has transpired last week. The Fed delayed the rate cut, which has now seemingly moved further away from its existence just to be brought back to life by last week’s FOMC performance. Fireworks or just a false alarm? As I reflect on Powell’s performance it would imply a few things, which are particularly important.

He did not acknowledge that even the possibility of a rate hike is a big deal. The bar for rate hikes has just moved much even higher.

Powell is a dove, and his power within a 12-member committee should not be disregarded. If he moves, others will follow.

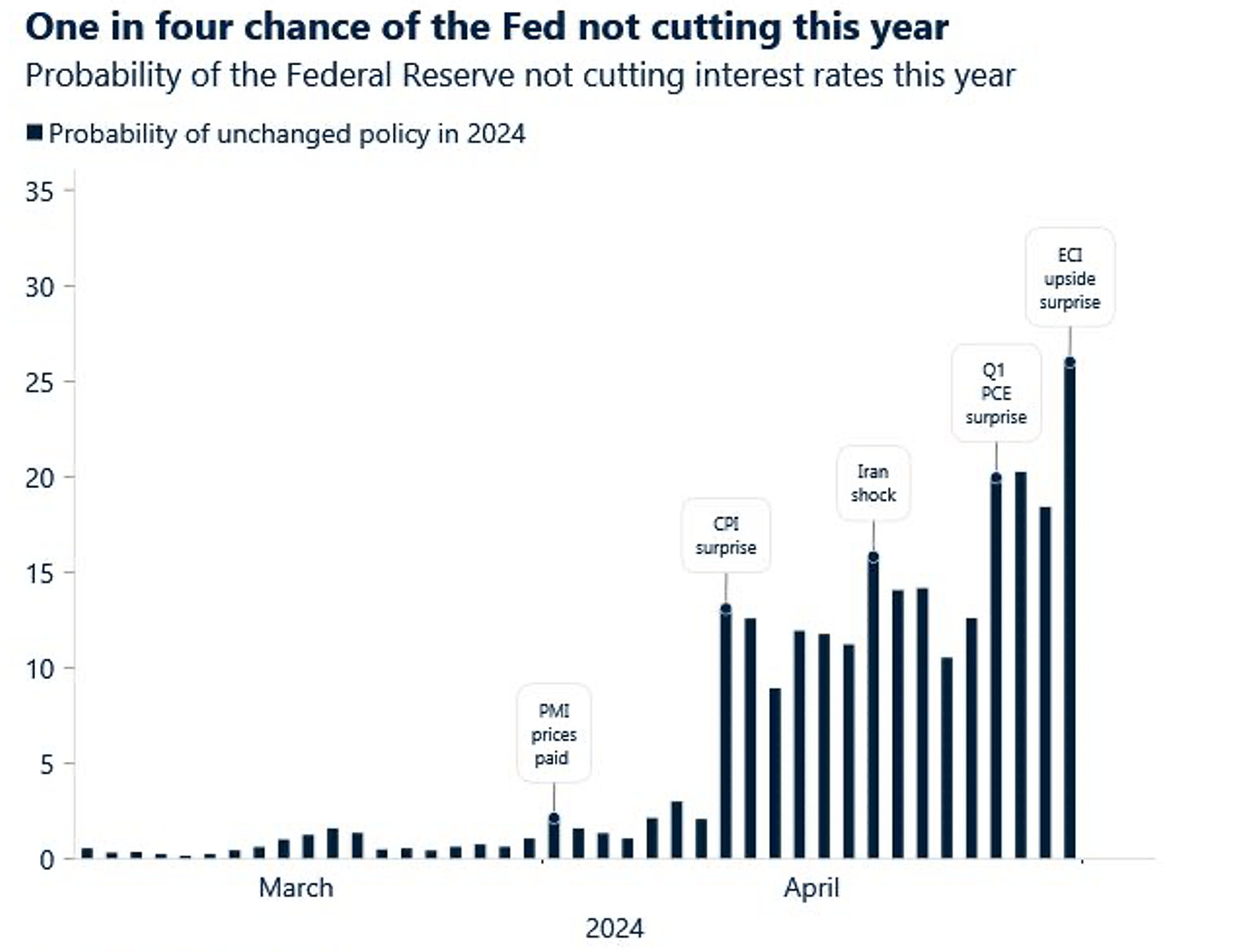

Probabilities (see chart below) of no rate hikes this year have increased over the past month. Are we seeing green shoots of a long bond trade emerge?

The key to those questions is obviously in the data, with a particular continued focus on inflation prints. If we follow the monthly prints of the first quarter, PCE YoY inflation will print back north of 4%, which would certainly bring rate hikes back on the table. The Fed’s dovish forecast (see chart below), however, is very hard to achieve with a 3%-handle sticky PCE environment, which is the most likely outcome going forward.

On Friday, the market firmly set its sights on US employment. 175,000 jobs were created, less than the expectations of analysts who were betting on 240,000, and the unemployment rate stood at 3.9%, above the 3.8% the market was expecting. The reaction to data dump was rather euphoric. A jump in indices and Treasuries was responsible for putting investor sentiment back into something they had been waiting for a while - a slowing labour market, which will give the green light to the monetary leaders to cut rates.

Since Macro trading reflects an unbridled passion for both the future and the past, I shall leave you with some sweet words that our dear Jay spoke in June 2022 in front of the Senate Banking Committee.

“We’re not trying to provoke, and don’t think that we will need to provoke a recession, but we do think it’s absolutely essential that we restore price stability, really for the benefit of the labour market, as much as anything else.”

Let’s now see what is in store for us this week.

We will also look at what charts matter for the week ahead.

Let’s go!