Attack the Week (ATW)

Experiences, Analogues and another Fed cutting cycle

Sunday Thoughts

I’m returning to the desk from a fabulous weekend in Northern Spain. I have travelled to the same spot twice before, and I absolutely love the local food and drinking culture. I had friends with me who wanted to experience it all for their first time. We went to some spots I knew from my previous visits, and it was fabulous. The experience, however, is never re-lived twice, which is great as there is always something new to discover. And boy, did we discover new things to love.

For many people, there is a peculiar melancholy in revisiting a place you love. You return, hopeful. You trace your steps. You order the same dish, and even try to feel the same feelings. But something is different. And that something is everything.

This is the silent truth about time: it never leaves anything untouched. The buildings may be intact, the streets unchanged, and yet the experience is unrecoverable. Not because the world has changed drastically — though it often has — but because you have. The first visit was a meeting between you and that place at a specific moment in time. And time, ever-slippery, has since moved on, pulling both you and the world with it. You cannot reconstruct the past with perfect fidelity. It’s a lost chemistry.

Financial markets work similarly. Every investor, strategist, or economist has, at some point, reached for a historical analogue. “This feels like 2008.” “It reminds me of the dot-com crash.” “We’ve seen this before.” But the echo is a deception. Just as you cannot relive a place, you cannot replay a market event with the same outcome. The actors are different. The context has shifted. Yet, we feel the muscle memory of time in our minds to justify a likely path ahead. I have seen so many analogue charts, but not one of them has ever played out the same way.

History may rhyme, but it doesn’t repeat. The rhyme itself is bent by perception — by the biases we bring, by the narratives we construct, by the data we choose to highlight or ignore. Our memory simplifies; it draws outlines and forgets the nuanced texture of what it felt like then. In that forgetting, we become overconfident in our ability to draw straight lines from past to present. But markets, like lived moments, are too complex for that kind of symmetry.

The art, then, lies not in prediction, but in perception — in accepting the impermanence of experience and the limits of analogy. Whether it’s walking the same cobblestoned path or positioning a portfolio in what seems like a familiar cycle, we do better when we allow for uncertainty, when we honour the differences, when we stop trying to recreate and instead begin to re-see.

I have to remind myself of the above as we are entering another September FOMC meeting, again expecting a rate cut as we did a year ago. Once again, there are varying degrees of justification as to why a cut is needed. Yes, labour market weakness is apparent, but tariff-related uncertainty, as well as reversing migration flows, are giving us reasons to pause and ask whether supply dynamics are potentially at work.

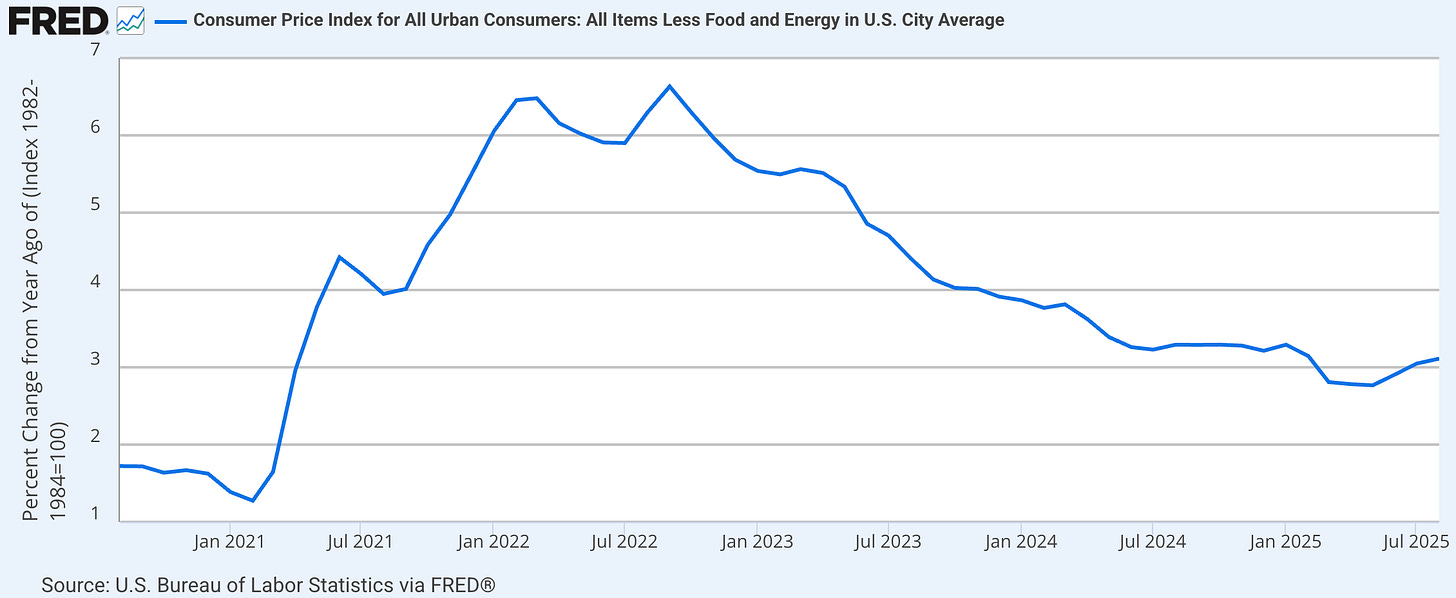

Rate cuts just as core inflation (see below) is accelerating might feel uncomfortable to some FOMC members. Yield curves flattened aggressively last week, which isn’t normally an observation as rate cuts progress.

Recent data supported the recent bond rally. The labour market is showing clear signs of weakness. The BLS made a significantly larger downward revision to job growth than anticipated (911,000 versus a 700,000 consensus), and jobless claims jumped — although that may prove to be a statistical blip. Part of the softening in job growth could be due to tighter immigration policies, which may explain why unemployment hasn’t surged.

There are plenty of angles to explore, and charts have given us a warning on the recent flattening trend, while the allocation model (see further below behind the paywall) has led us to dive into bonds and equities again. What’s next? I shall explore the most important chart setups below and will communicate any interesting trades in the Substack chat app.

Let’s now read some of Macro D’s thoughts on the ECB and the Fed, before we analyse the weekly calendar, some interesting chart setups and interpret the output of our weekly asset allocation model.

Let’s go!