Attack the Week (ATW)

Confidence / Pyrrhic Victories / Calendar / Charts / Allocation Update

Sunday Thoughts

Confidence is a funny phenomenon. It’s a state of mind, unobservable to others, often mistaken for arrogance. It doesn’t announce itself, it accumulates—slowly, quietly, like layers of sediment over time. It isn’t something you decide to have; it’s something you build over time, through pain and relentless learning.

When you start investing, confidence feels like adrenaline. Every idea feels fresh, every conviction unshakable. You catch a few good trades, and the story you tell yourself begins to harden into truth. But as Richard Feynman warned, “The first principle is that you must not fool yourself — and you are the easiest person to fool.”

Confidence in life, much like in markets, is forged not in moments of triumph but in how we respond when things unravel — when uncertainty tests whether belief can hold without proof.

Fooling yourself is, of course, the default setting in markets. You win a few times and call it skill. You lose and call it noise. Kahneman and Tversky spent decades showing how overconfidence blinds us to uncertainty, how we draw straight lines through random dots and call it pattern recognition. Traders are just the most monetised version of that human flaw.

Real confidence, though, doesn’t live in the outcome. It lives in repetition. In execution. In the quiet observation that your process, however imperfect, keeps you standing while others chase the next miracle. It’s not the thrill of being right; it’s the relief of being consistent.

Barber and Odean once showed that the most confident investors trade the most — and earn the least. I’ve seen that movie in every cycle. The loudest confidence burns the fastest. Scanning through the Twittersphere would confirm this view. The one that lasts is built in small, unglamorous increments: following stops, managing size, logging trades, knowing why you did something even when it didn’t work.

Confidence is not a mood; it’s muscle memory. It’s what’s left after you’ve been humbled enough times to stop confusing luck for edge.

And yet, confidence oscillates. It swells when everything goes up —when equities, credit, commodities, even crypto move in unison. Those moments blur the lines between brilliance and beta. The feedback loop turns intoxicating: every buy looks smart, every dip feels like an opportunity. But that’s not confidence. That’s inertia dressed up as genius.

Sooner or later, the air thins. Markets decouple, volatility returns, and the tide of easy gains retreats. Then, and only then, you find out what your confidence is made of — process or price.

In the end, the traders who endure don’t chase confidence; they accrue it, one trade, one mistake, one recovery at a time. They know that real confidence isn’t loud. It’s quiet, disciplined, and slightly suspicious of itself.

“As in nature, things move violently to their place and calmly in their place.” – Francis Bacon

Many point to equities outperforming many macro hedge fund strategies this year. Below, the publicly available Brevan Howard returns (white) versus the SPX (blue). There is an air of arrogance and overconfidence in the fintwit community, many seemingly not understanding beta versus alpha. Do you think hedge funds have lost their mojo? I very much doubt that; they are lurking in the background, ready to pounce once dislocations become more pronounced. As such, I would expect the blue and white lines to converge again.

On the recent banking tremors. Regional banks hold 44% commercial real estate loans, whereas large banks hold 13%. Florida Atlantic University analysis found that 59 of the 158 largest banks have CRE exposures exceeding 300% of total equity capital. New York Community Bancorp’s Flagstar subsidiary shows a particularly dangerous 477% CRE concentration ratio. That’s worrying.

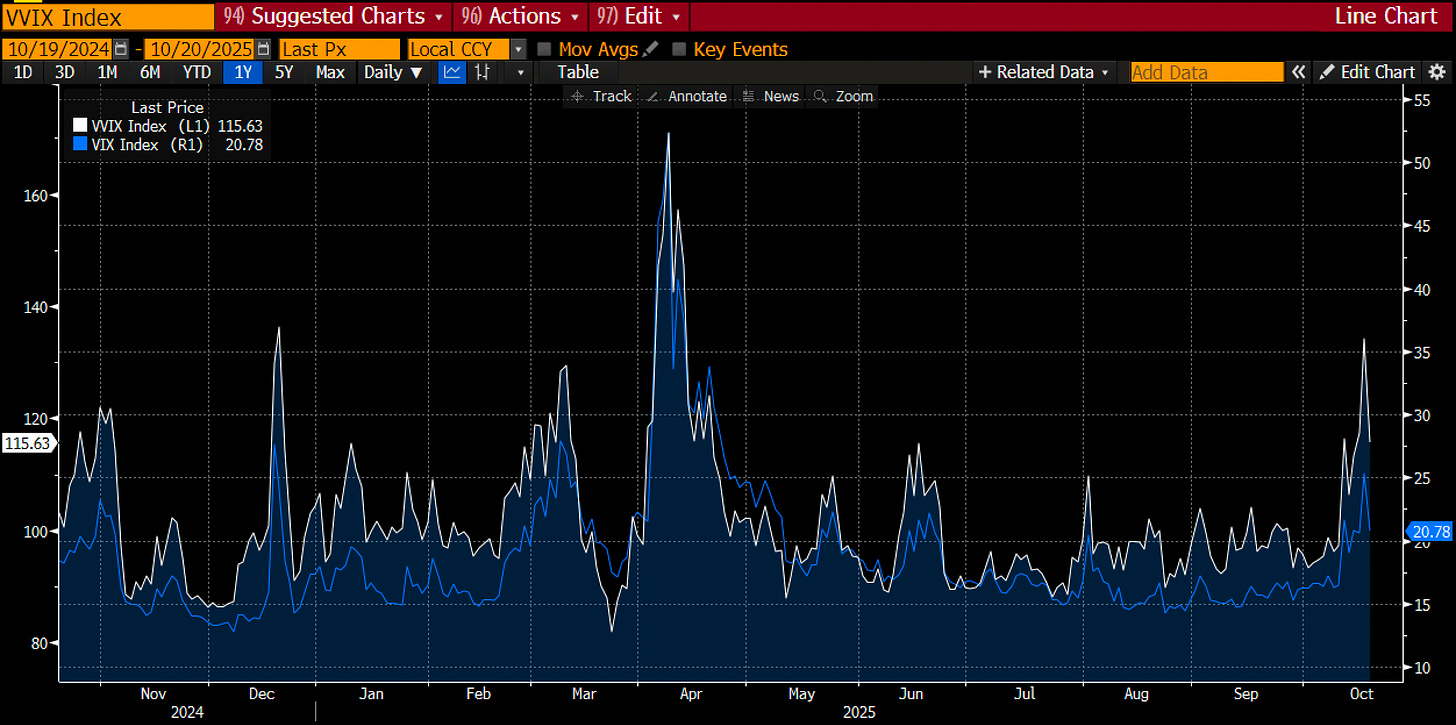

VVIX (see below) has spiked into April/May territory. Gold has seen its best bull run since 2010, which was a 9-week run. Regional bank credit tightening aligns with repo tightening and record margin debt. It is also notable that SOFR options now price in both a small probability of 50 bps cuts in the October and December FOMC meetings. Clearly, this is still related to a possible 2023 SVB replay. Bonds have seen a reversal on Friday as negative risk sentiment was somewhat overextended, but I think the bid in bonds is not over yet.

Confidence comes from a repeatable process. A disciplined framing and scanning of market narratives, free of biases, equipped with tools and frameworks to build resilient portfolios, scaled with downside risk in mind and a relentless drive to understand the drivers of different market regimes, past and present. That’s what we strive for in this space. If you are interested in joining the pack, click the button below.

Let’s now read some of Macro D’s thoughts on geopolitics, before we analyse the weekly calendar, some interesting chart setups and interpret the output of our weekly asset allocation model.

Let’s go!