Attack the Week (ATW)

September 22, 2024

Sunday Thoughts

First of all, a warm welcome to all new subscribers and joiners of the pack. I am eternally grateful to have you join my journey. Hopefully, you will learn a few things (good ones, ideally) and get some inspiration as to where the macro road is likely taking us next.

My friend Macro D is also on call to share his thought-provoking thoughts on the state of the world. Our styles couldn’t be more different. I am more straight-talking and eyeing up near to medium opportunities, while Macro D hits a philosophical note to decipher the larger trends going forward. I think it's a good mix, and your feedback has led me to believe that we are onto something good here.

His JPY-long idea from July was a monster call against the prevailing consensus. That’s how large macro bets and payoffs are generated. You have to be contrarian. But you have to be right as well! Therefore, mixing momentum-based, thematic trades with strategic non-consensus views is itself a solid investment process.

It’s easier said than done, however. For anyone new here, I would therefore highly recommend reading the Macro Book series, where I lay out a start to finish investment process, which goes from idea generation to the sizing and risk management of an entire macro portfolio. I will also be expanding on more articles in that part of the blog in due course.

My Sunday thoughts whirl around the fact that we are moving very quickly into a cashless society. For most people, that’s not a problem. I don’t remember when I last carried a wallet on me. Maybe I should bring a card just in case, but normally, I do everything over my phone. Last night, I had a nightmare where I lost my phone, and all my endless possibilities, contacts, emails, Bloomberg b-unit login, and payment possibilities disappeared in one go. Very fragile, and I have to re-think my fallback options.

There are, however, vulnerable people out there who still rely on cash as their main means of payment. My father goes to his post office to pick up a bunch of notes and then goes to the bank next door to pay his bills. He never used online banking. And guess what, his bank branch is closing.

Similarly, homeless people don’t have card readers and are suffering even more. I was once looking into the option to provide them with a QR code, which would enable a person to send them money for either shelter or food banks. I will write about it another time. Needless to say, a simple model like this hasn’t been implemented in the UK yet. A real shame. It seems to work in Amsterdam, however.

While travelling in the US, I was shopping in an NHL store, where an old grandmother was shopping the new season’s jerseys for her little grandson. The little man was excited, and as they approached the till, the lady noticed that they were only taking cash. Very disappointed, she explained to the gentleman on the counter that she only had cash on her, to which he replied that they unfortunately don’t take good ol’ bills. The little boy’s face changed, and he looked very disappointed. I offered to pay for the goods in exchange for the cash. Damn, those jerseys ain’t cheap, but the little fan’s happy face was worth it. I have no idea when I will ever be able to redeem that cash, and who knows, it might be outdated the next time I try to buy anything with it.

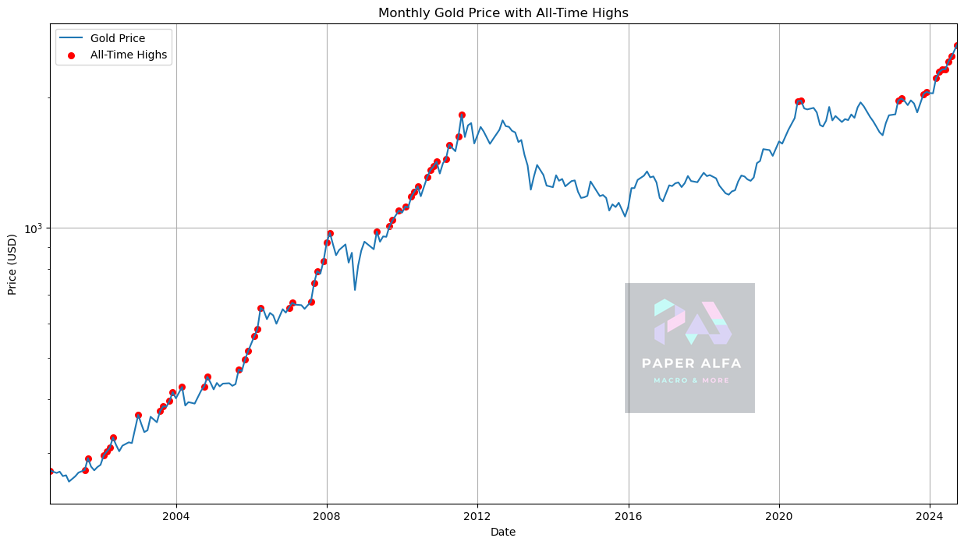

Talking about debasing cash, Gold broke new highs again last week, and you wonder what it is trying to tell us. There have been technical aspects, such as large retail buying in Asia as well as numerous central banks accumulating it as a reserve asset over the past couple of months. Looking at longer-term charts (see below, my preferred monthly view), would show that we have been above the upper bollinger band, since march of this year. The recent break-out, therefore, shouldn’t come as a surprise.

A quick analysis using my Python engine (no guarantee for accuracy) would reveal that the follow-through from all-time highs usually means that further gains are ahead. The chart below, which only goes back 20 years, would indicate the autocorrelation. The top in 2020, however, was unique, and it took 3 years for new highs to be printed. Mind the gap, as they say.

The table below summarises the results and indicates the 3, 6 and 12-month forward returns following an all-time high.

These results suggest that while gold tends to continue rising after hitting all-time highs, especially over longer time periods, there's still a significant risk of drawdowns.

Let’s now hear Macro D’s latest musing before we track and analyse the calendar for the week ahead. We are now adding EM countries to the mix to widen the scope. After that, we shall explore the 10 most intriguing charts for the week ahead.

And yes, after reaching 10k Twitter (X) followers, as promised, I will be releasing my article “Bondfire” very soon. I am just brushing it up and scanning it a few more times before it’s ready to be sent out.

Let’s go!