Attack the Week (ATW)

Seasonality & The Return of Volatility

Monday Thoughts

September is already here, and we are entering the final third of the year. Seasons are changing, and many punters will be returning from their holidays to sit in front of their screens and reassess markets and their intentions. The summer lull may finally be over, as some typical seasonal patterns are reappearing.

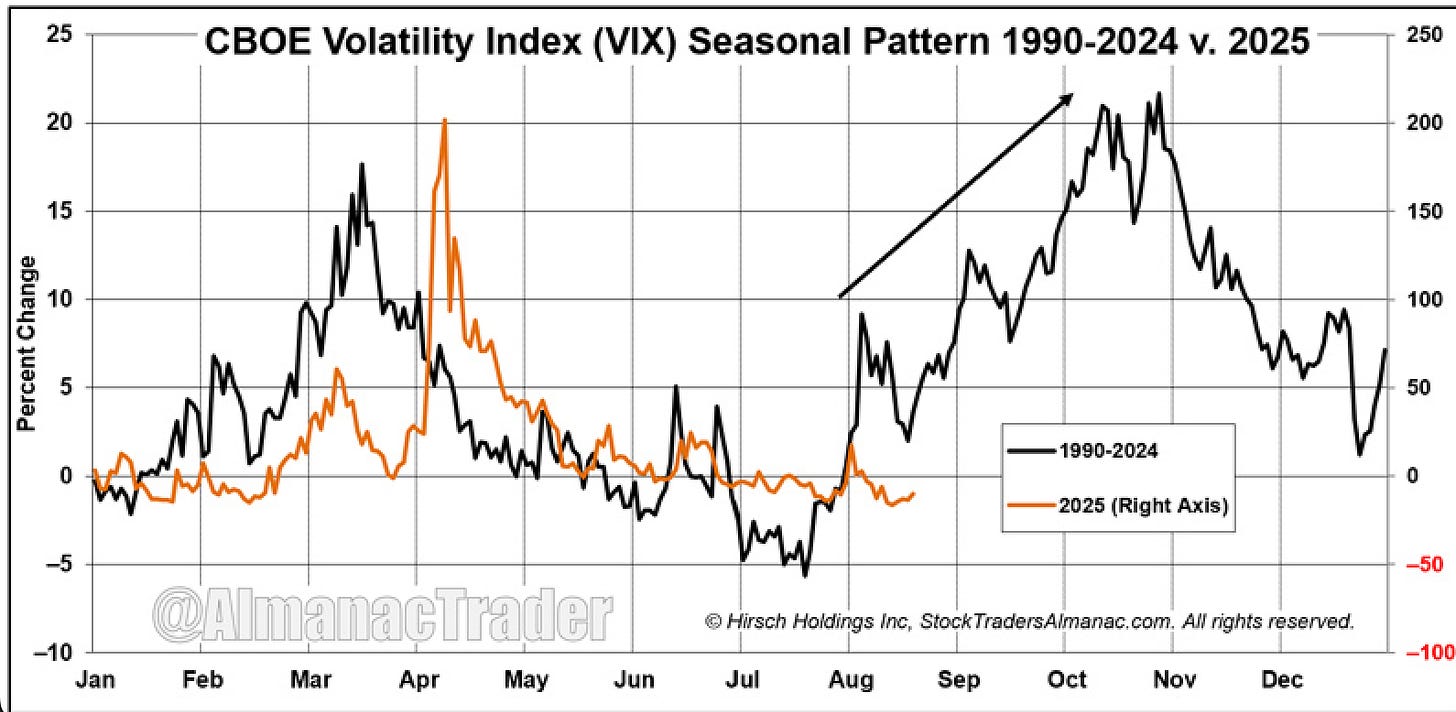

Below is the VIX, which typically sees a higher tracking number in the second half of the year. August, however, has only seen a modest uptick at the beginning of the month and then drifted back to the lows.

This is obviously all known to all market participants, while short positioning in the volatility future is currently at record highs since 2022.

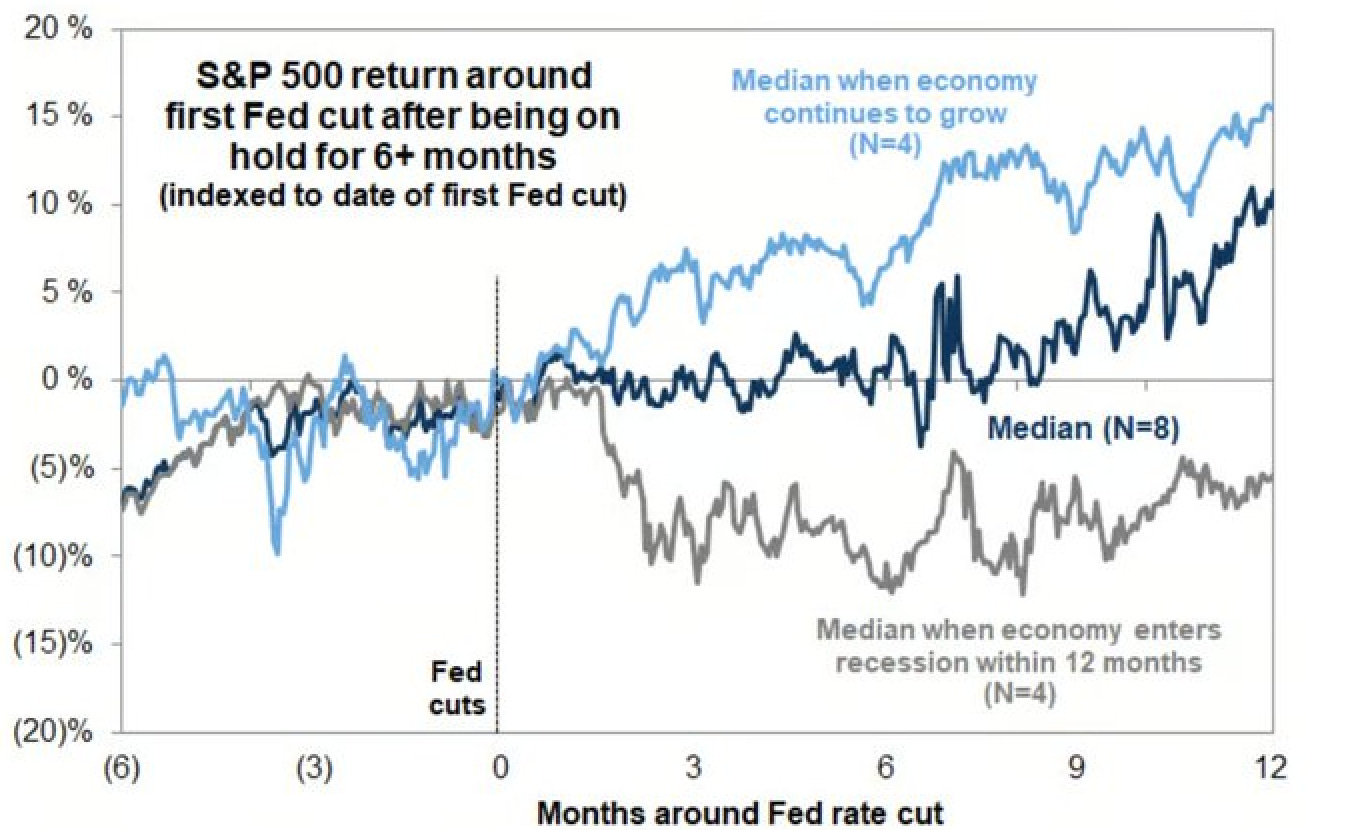

Part of the more buoyant equity and volatility pricing comes once more from the expectation of a September rate cut. The chart below shows the follow-on returns for equities after a Fed cut, after rates being on hold for more than 6 months. Only in a recession scenario do we see market deterioration.

Low implied volatilities across major macro markets are a gift, not an input for levering up positions. Trump’s slow chipping away at institutional credibility is giving me tingling vibes to buy optionality. Vance’s recent interview in particular was a signal to me. The appeal court’s illegal ruling on tariffs only means more pressure to come from the White House. Watch this space.

I will review and update my macro roadmap, which has made most of my returns this year, in due course. Things are lining up nicely, and I am ready to pounce once again. See the previous statement ahead of tariff day below.

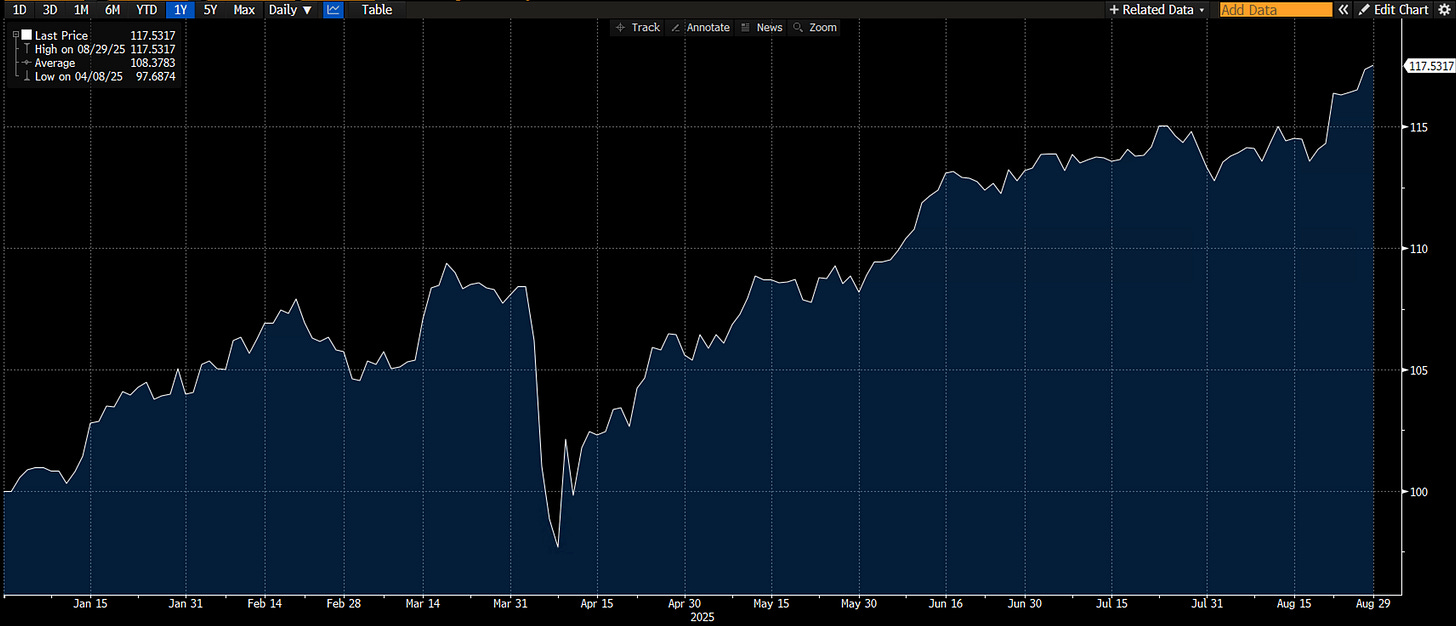

My 2025 buy-and-hold portfolio is closing in August with a high watermark at +17.5% in USD terms.

Let’s now read some of Macro D’s thoughts on US macro data and Ueda’s thoughts, before we analyse the weekly calendar, some interesting chart setups and interpret the output of our weekly asset allocation model.

To all my American and Canadian friends, a happy Labour Day!

Let’s go!