Attack the Week (ATW)

A struggling New World

Sunday Thoughts

Just as we thought the summer lull might take hold, we are awakened to the fact that this year is still a complex, multifaceted affair, with economic, social, and geopolitical aspects intertwined in a system that has been evolving over decades. Norms and standards of the old world are being challenged. We have written about this over the past few months, and the current escalation between Iran and Israel is just a reminder that we are on track.

“The crisis consists precisely in the fact that the old is dying and the new cannot be born; in this interregnum a great variety of morbid symptoms appear.” - Antonio Gramsci

Markets are facing this tug of war, where the new world order and the old status quo are fighting over their stakes. I’m not a geopolitical analyst, but I am well aware that the game is played in many arenas, while tariffs are just one symptom of the overarching desires for the new brave world to emerge.

I would recommend everyone watch or listen to the conversation below, which was highly rewarding and made me think about possible scenarios. The world is way more complex than I previously thought. And that’s not going to change quickly.

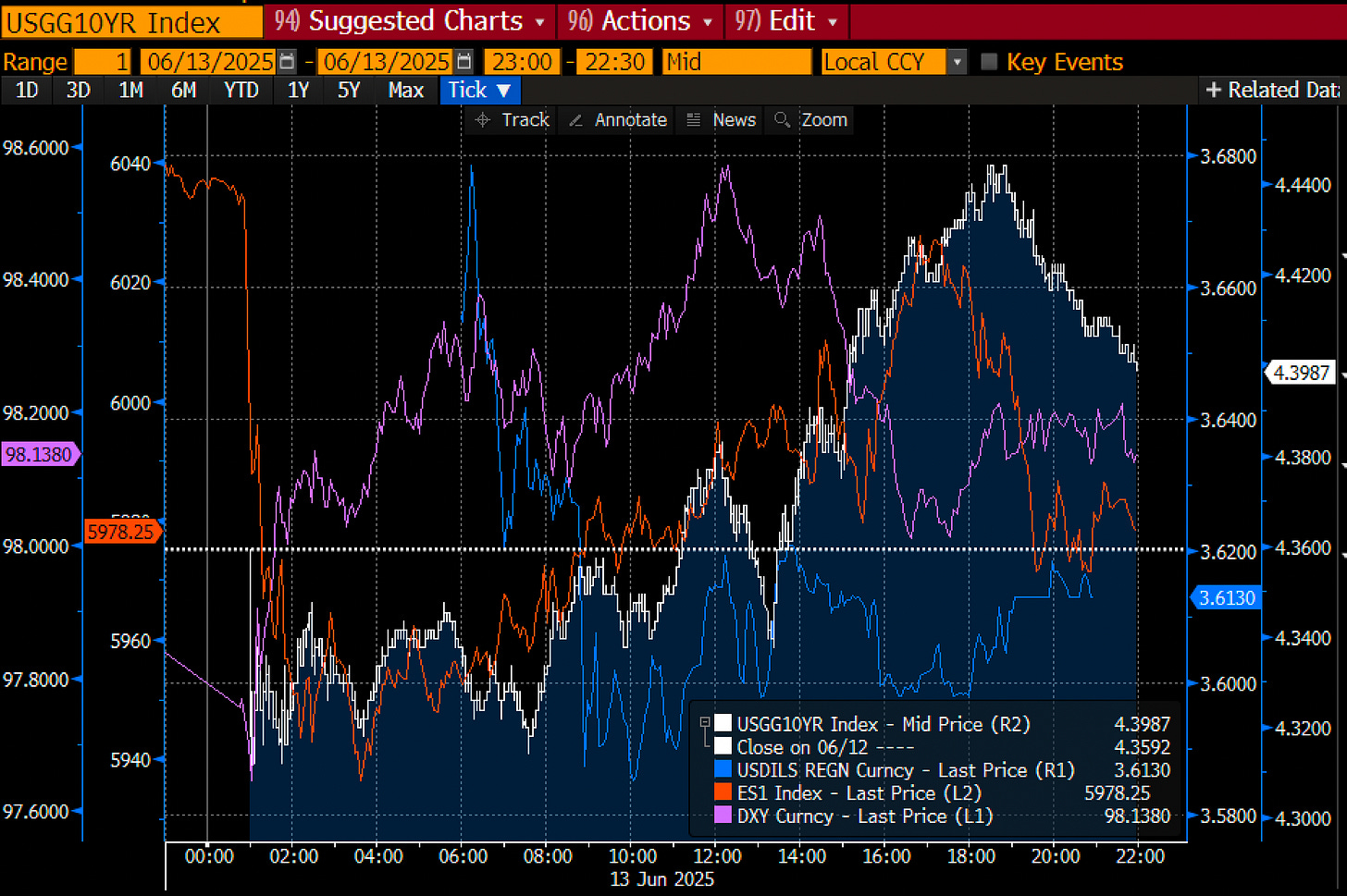

As for markets, Friday’s intra-day action was quite telling. The Dollar (DXY pink below) initially rallied but then started selling off just as the US came in. This coincided with the sell-off in Treasuries, which is quite telling and possibly a continued warning sign for further USD weakness ahead.

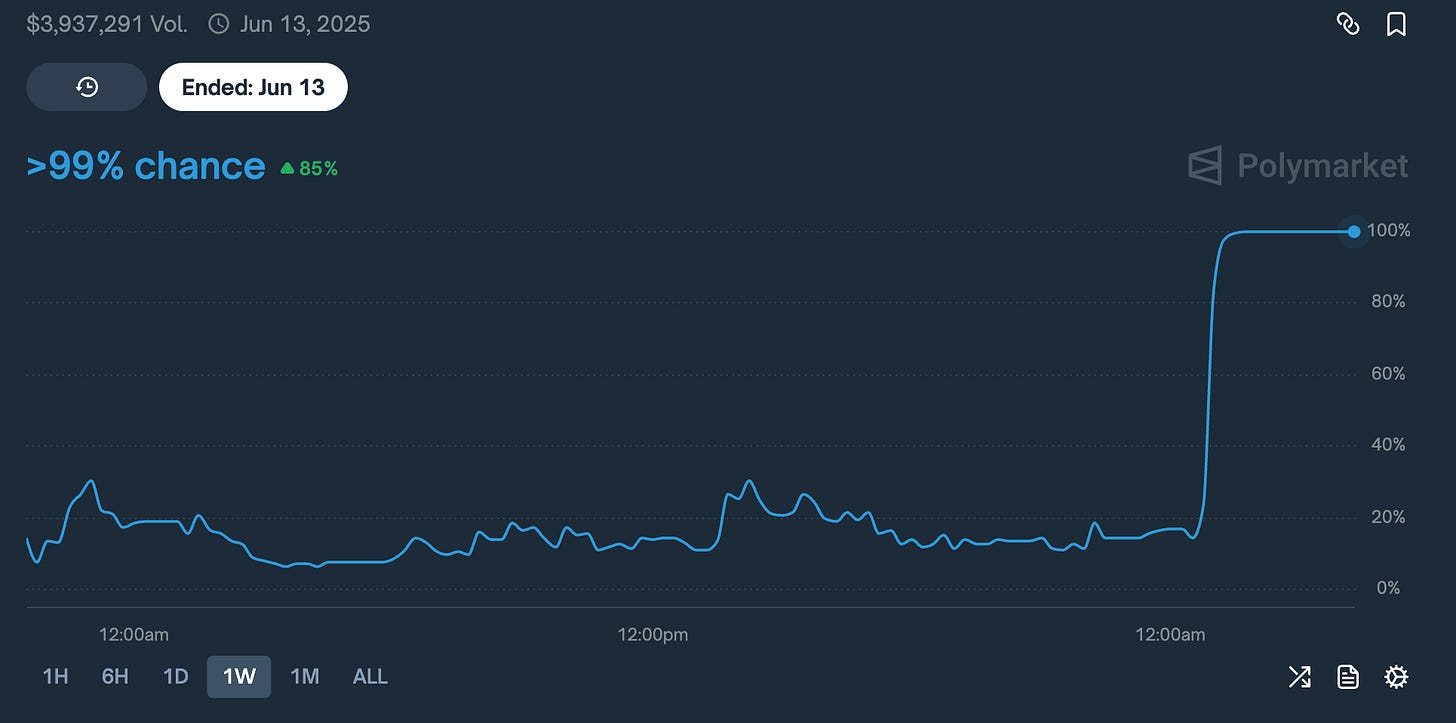

While the relatively muted market reaction was related to the fact that some kind of intervention was expected as the polymarket odds ramped to 30% at some point, options in Oil were still relatively cheap.

25 delta call implied volatility spiked from 50% to just shy of 90% in early Friday trading.

Taking the Monday expiry CLN5 75 calls, for example, were trading at 20 cents, giving you a nice 25x overnight if you were able to cash them out at the maximum point. A stark reminder that the geopolitical world offers plenty of opportunities if you look for them.

Regardless of Friday’s volatility, the buy-and-hold portfolio still managed to perform and close at new highs at 12.4%.

That’s what Paper Alfa was built for. Digging through the top-down macro world and its drivers and solidifying this approach by combining it with time-tested tactical models, underpinning our quest to provide strategic and tactical trade ideas over time. Interested in exploring? Why not try it for free using a 7-day trial?

Below are additional thoughts from Macro D on the current conflict narrative and macro implications, before we scan the weekly macro calendar, check a few interesting chart setups and update the weekly asset allocation model for its latest change and performance.

Wishing you all a successful week ahead!