Attack the Week (ATW)

Quick Fire Thoughts / Calendar / Chart Setups / Allocation Model

Sunday Thoughts

As we enter a shortened trading week due to the Thanksgiving holidays, markets are raising more questions following last week’s risk market drawdowns. Sentiment has deteriorated, and traders have grown nervous about the prospect of a more significant setback in their YTD P&L. It’s rational human behaviour to try to bank some gains before the year is over. After all, you don’t wish to stress over the holiday season when your in-laws mention the recent equity stresses.

With so many cross-currents impacting global markets at once, I am sharing my quick-fire thoughts on the most important questions below. I will discuss trades & setups behind the paywall further below.

The current Nasdaq drawdown is close to 8% so far. Is it the beginning of a deeper setback or a buying opportunity? I have highlighted the previous meaningful declines below, which have all had their own hallmarks and narratives. There is plenty of negative news flow on AI currently, with macro conditions also providing more headwinds. I am not looking to buy the setback, and I like selling rallies from here.

Paper Alfa’s 2025 portfolio also saw a performance setback, but it is still up 20.72% YTD in USD terms. I am currently concluding my thoughts for the 2026 portfolio allocation, which I will share at the end of the year.

High-Yield Spreads are still relatively low when compared to history. A breakout might take time, but I am pretty confident that spreads will move higher over the medium term.

The upcoming UK budget (26th November) has been chewed over several times. There were leaks, trial balloons and a weird press conference. The current UK government has little idea what they are doing. UK 30-year gilts (shown below) have benefited from the talk around tax rises and a more austere budget proposal. Chancellor Reeves is playing with fire. I doubt anything magical will appear from her budget plans.

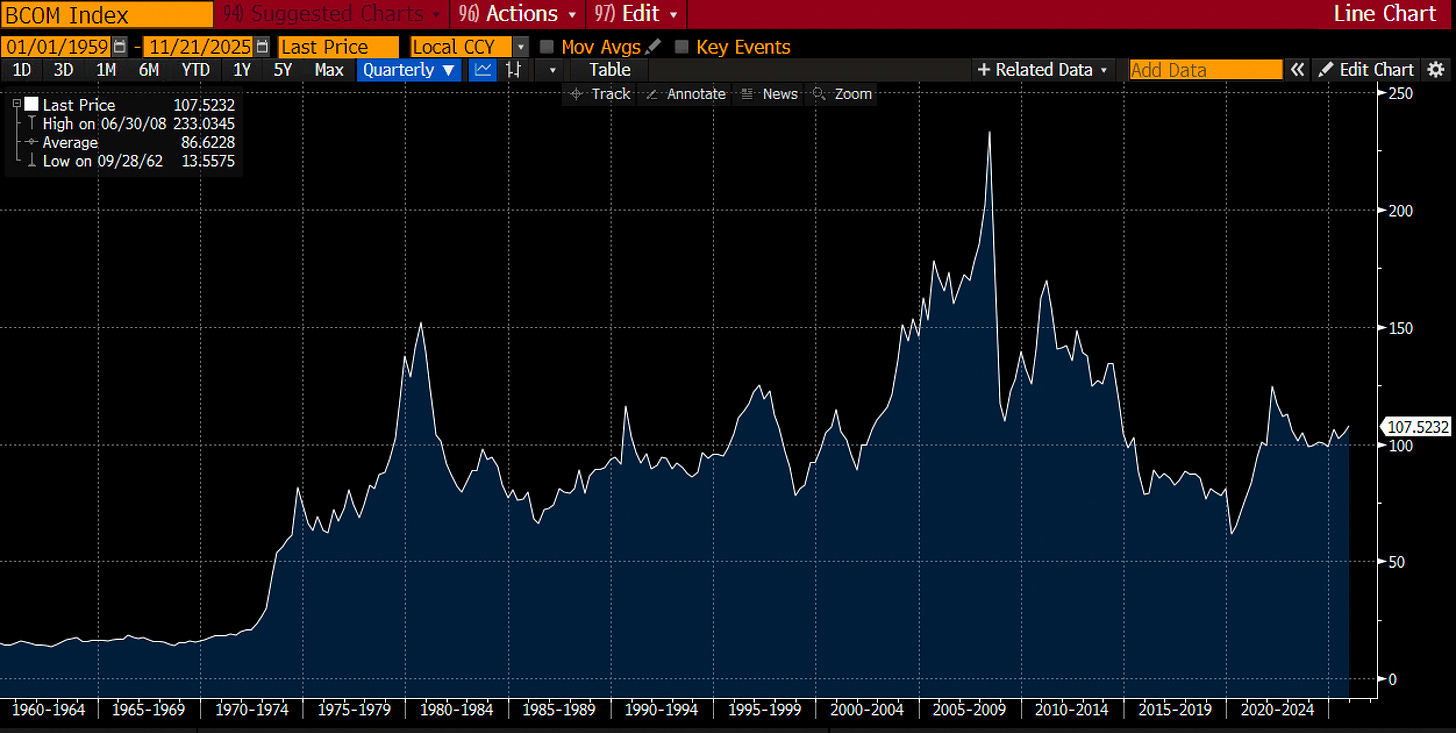

Commodities have seen mixed fortunes as of late. Part of it is a rising Dollar, geopolitics and correlation breakdowns related to monetary policy uncertainty.

The Dollar has continued its rally, not driven by yield differentials but its seemingly lost risk-off benefits, while positioning is still relatively short.

Global yields (Global Sovereign yields below) in aggregate haven’t moved much from the hiking cycles. A weakening global growth picture should be reflected in lower aggregate yields, but given deficit dynamics and fiscal impulses across many developed countries next year, bonds are still stuck and don’t offer the diversification benefits needed.

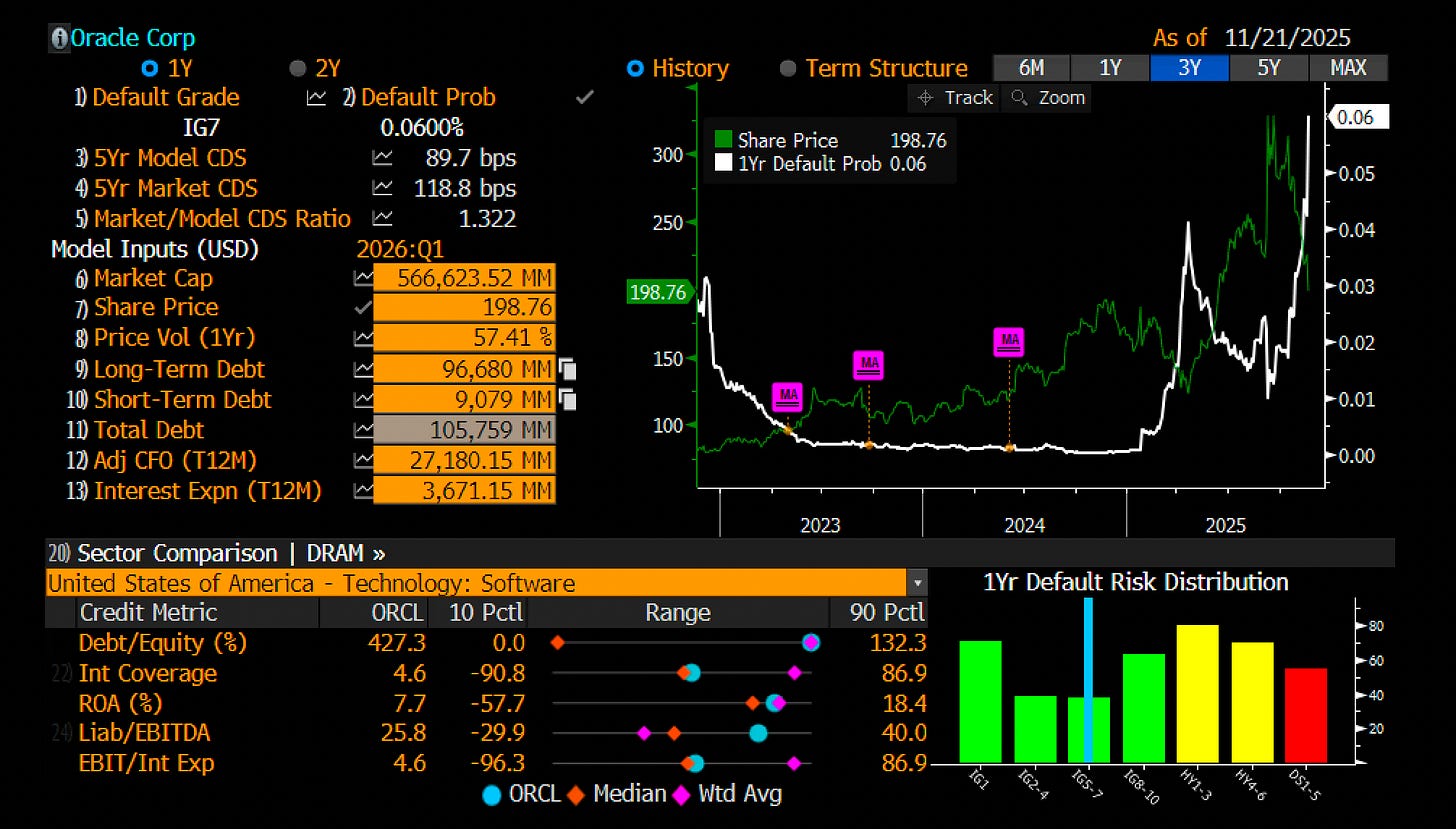

Oracle’s CDS are on everyone’s radar. Yes, they have shot up a lot, but in default risk terms, we are currently “only” discounting a 6% default probability over a 3-year horizon.

Japan’s new PM and her vision of an Abe-style policy have pushed the Yen to new lows in trade-weighted terms. Yield curves have steepened back, and the BoJ is now in the limelight again. The Nikkei has also lost the positive impulse, although that’s related to generally weak equities globally. Something will have to give.

Let’s now read some Macro D’s latest thoughts on the BoJ and some FX trades before we analyse the weekly calendar and interpret the output of our weekly asset allocation model.

Still running the 20% discount for the rest of November.

Have a wonderful week ahead!