Attack the Week (ATW)

Post-NFP Thoughts / Decline of the West / Charts

Sunday Thoughts

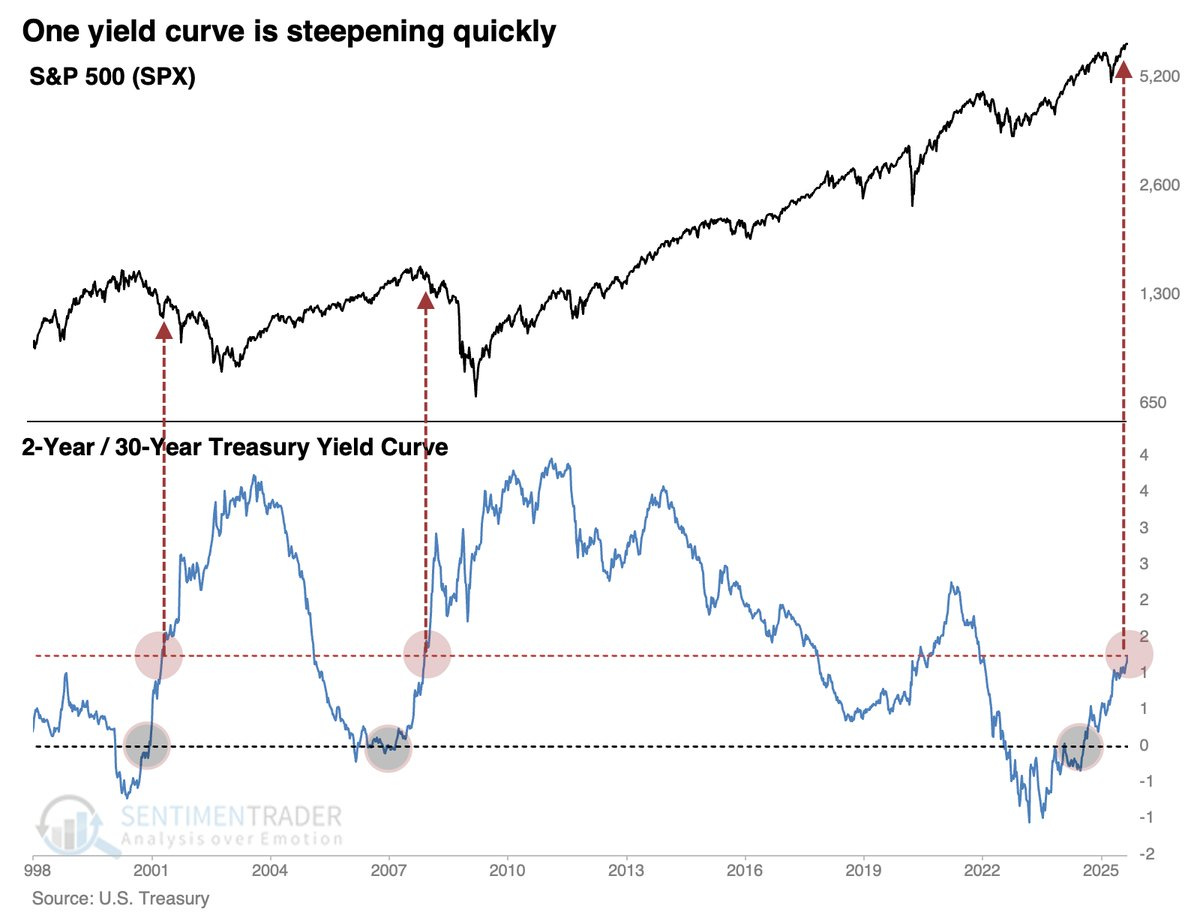

I wrote Friday’s Chart Book ahead of the labour data, which came in softer just as I expected and shared it with paying subscribers in Substack chat. Much of the bond market’s performance into the number, however, made me a bit more cautious on the resulting risk/reward opportunities. On the day, all market reactions in rates, curves, FX and metals made sense, aside from equities, which showed quite a sizeable intra-day reversal after leaping higher following the weaker NFP print. Most of it, I think, is related to the question about running nominal GDP given soft labour demand and supply, given immigration and tariff dynamics going forward. Could the economy be at a turning point where labour shedding becomes self-reinforcing?

We shall see. First of all, a great shout-out to our intra-day model, which called Friday’s reversal almost to perfection, as you can see from the screenshot below.

With the 25 bps September cut now all but cemented, markets currently see only a slight chance of a 50 bps cut this month, with about 69 bps priced by the end of 2025. The terminal rate sits near 2.9% (see 1y1y OIS below), roughly 10 bps below the Fed’s neutral estimate. The labour market is sending us a strong signal that payroll growth has averaged just 27k per month since May, which is the weakest four-month trend outside recessions in 2001, 2008, and 2020.

Back to equities, the open question remains whether the perceived easing will be supportive of valuations at this stage of the cycle, or whether lower nominal trend growth will re-rate earnings expectations, with tariff-related margin squeezes adding further pressures.

Cyclicals vs Defensives is still tracking higher, suggesting that the overall impulse continues to be relatively positive. My base case remains that the ongoing question on tariffs and growth deceleration will cause a bit more choppy market conditions in September.

Paper Alfa’s buy-and-hold 2025 portfolio is still tracking above +17% YTD in USD terms.

Let’s now read some of Macro D’s thoughts on US macro data and Ueda’s thoughts, before we analyse the weekly calendar, some interesting chart setups and interpret the output of our weekly asset allocation model.

Let’s go!