Attack the Week (ATW)

3 Year Anniversary / Ultracrepidarian / Calendar & More

This weekend marks three years since I launched Paper Alfa. Amazing how quickly time flies. What started as a place to share thoughts and experiences has blossomed into a growing community, and I couldn’t be prouder of how far we have come.

Three years of building, refining, writing — and more than anything, connecting. What started as a way for me to structure my thinking has evolved into a genuine platform. One that’s not just about markets and models, but about mindset, integrity, and discipline. I couldn’t be prouder of how far we have come.

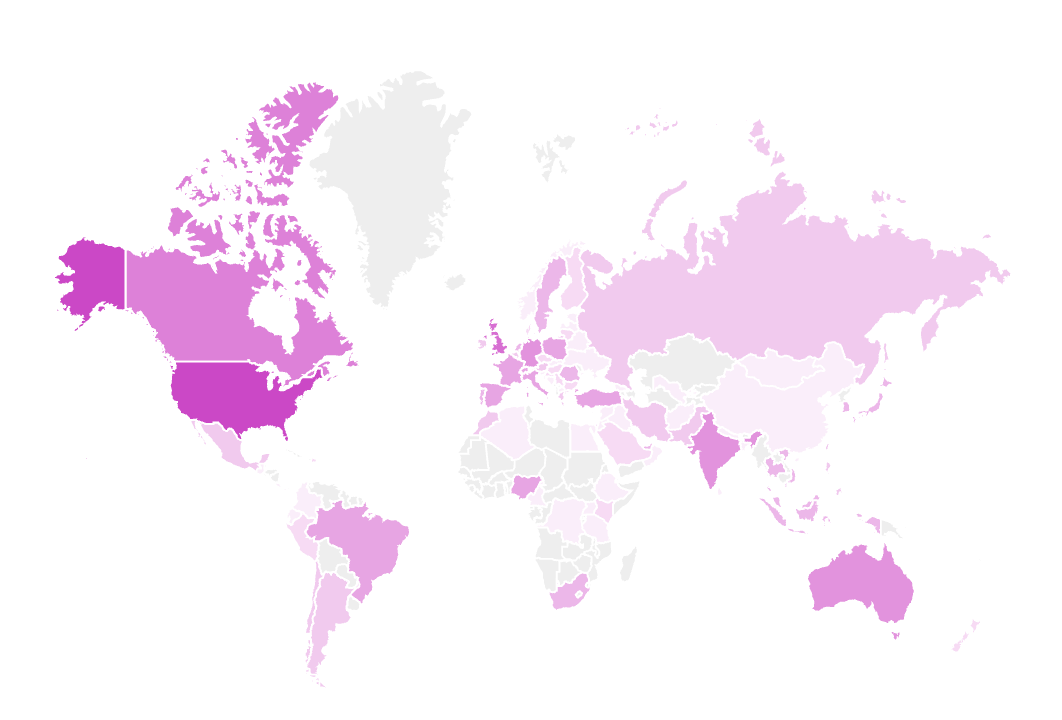

I have said it before, but it’s worth repeating: it’s the people who make this worth doing. The readers and subscribers from 104 countries shared in the journey. That connection is powerful. It motivates me every day — not just to stay on the grind, but to help others educate themselves, in every domain that matters: finance, markets, risk, and trading psychology.

Recently, I came across a word I had never heard before: ultracrepidarian. It describes someone who offers opinions well beyond their actual knowledge. If you’ve spent five minutes on FinTwit or certain corners of macro media, you know precisely how common that is. In fact, this was precisely the reason why this place was formed in the first place. Here we don’t deal in noise. We don’t posture. And we don’t sell fairy tales.

Here, we are driven by our principles and frameworks that have proven effective. We share only what we have earned through testing, failure, and iteration. No hot takes. No fluff. No bullshit.

Over the past three years, we have done more than post models and track signals. We have firmly anchored our macro roadmap, built a repeatable way to assess risk and positioning, and developed tools that perform — without needing to chase or guess. Our Momentum and Reversal Models have kept us aligned through regime changes and volatility cycles. They have taught us when to be patient, when to lean in, and when to step back.

But more importantly, we have built this with a firm eye on drawdowns. We haven’t just tried to win — we’ve wanted to win well.

And the results speak for themselves.

In 2022 — one of the more chaotic macro years in recent memory — our buy-and-hold portfolio outperformed the S&P 500 by over 30%. No trades. No high-frequency magic. Just allocation, conviction, and a clear roadmap. That meant positive returns in a year when most were in the red. It wasn’t luck. It was built.

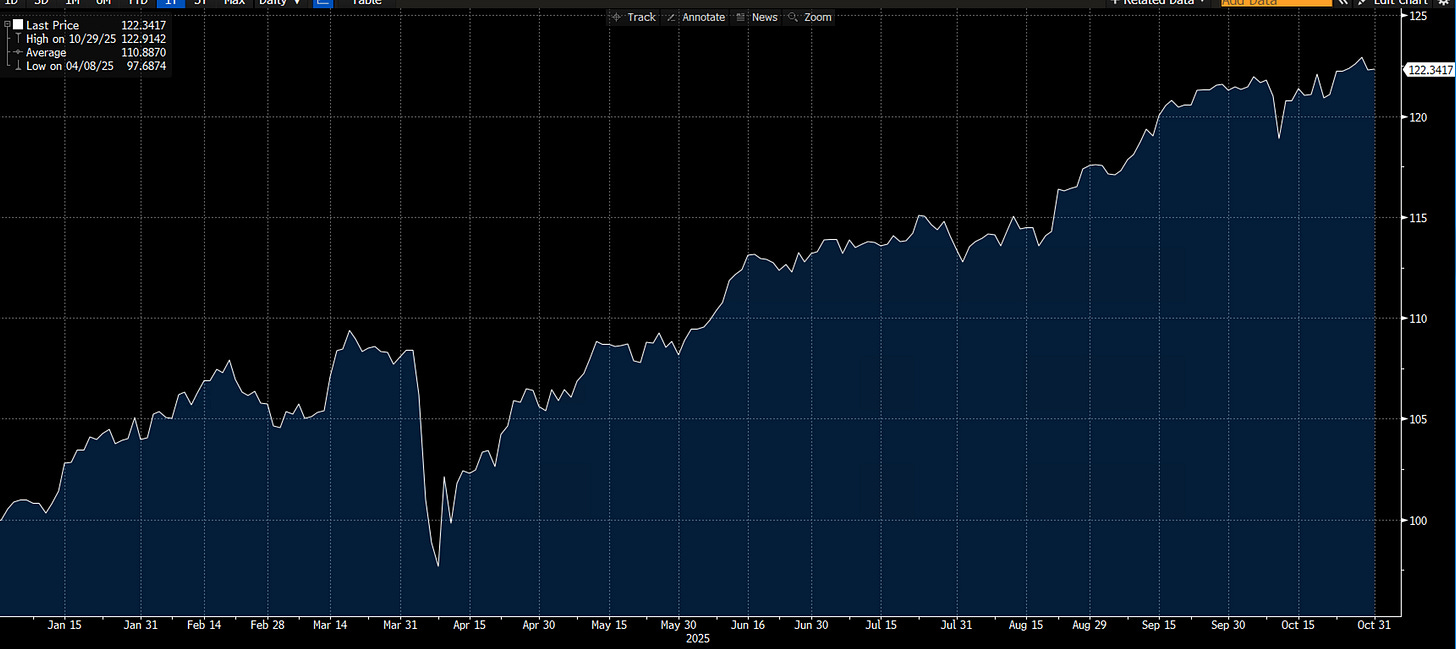

We’ve posted positive returns every single year since launch. 2023, 2024, and now 2025 are shaping up to be no different. As of this writing, we’re tracking over +22% year-to-date (see chart below). Again, without dancing in and out of every narrative shift or chasing momentum headlines.

So yes, it’s been three years. And I will keep showing up — building, testing, refining. Because investing is an evolutionary process, and what worked in the past may not work again, we adapt while staying true to frameworks that have always served us well.

If you’re here, reading this, you already get it. For those interested in joining the pack, I am running a 20% discount in November.

Let’s now read some of my loyal friend Macro D's thoughts on the Fed and ECB, before we analyse the weekly calendar, some interesting chart setups and interpret the output of our weekly asset allocation model.

Let’s go!