Attack the Week (ATW)

The Return of the Accord? / New FX Trades / Charts / Calendar / Asset Allocation Model

Sunday Thoughts

Welcome to PA – Global Macro, and welcome to our newest subscribers.

This space has evolved — and so has the name. Don’t you worry, though: the DNA and principles of this place remain exactly the same, but the branding better reflects what this place has become: a more serious, institutionally minded platform for thinking about macro, risk, and portfolio construction in a world defined by regime shifts rather than cycles.

Behind the paywall this week, we explore a theme that feels quietly consequential: the growing possibility of renewed coordination between the Fed and Treasury, and why a potential Warsh–Bessent axis may rhyme more with the post-WWII environment — and the Fed–Treasury Accord era — than with the last forty years of textbook central-bank independence. It’s a discussion about regimes, incentives, and what happens when policy institutions stop pretending they operate in silos.

PA – Global Macro exists to sit exactly at that intersection: macro thinking grounded in political economy, combined with technical models and well-tested asset-allocation frameworks built with one purpose in mind — structuring resilience. The aim is portfolios that can weather almost any environment: inflationary, deflationary, volatile, or deceptively calm.

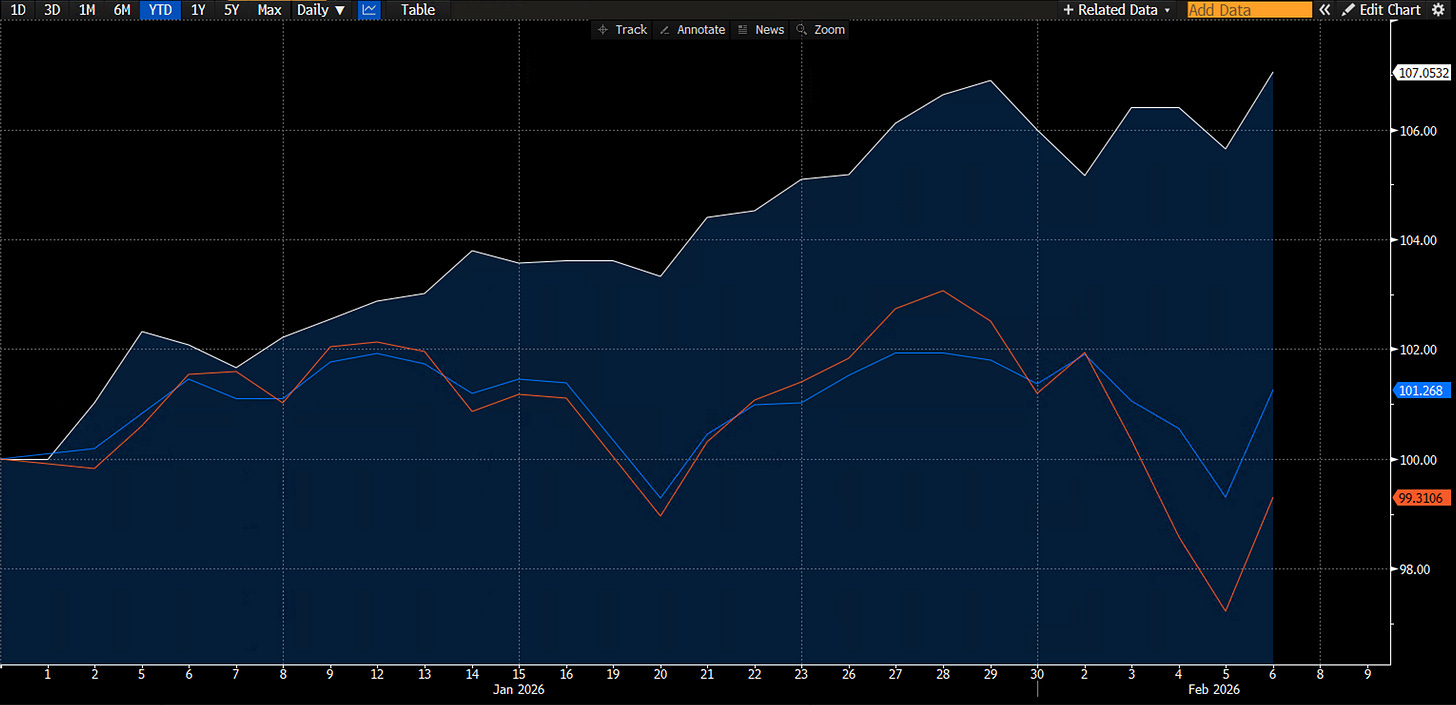

That philosophy is already showing up in the numbers. The PA 2026 portfolio is up +7% YTD, a strong start driven by process rather than prediction.

At the core of this place is information sharing—blending market insights with education. We’re here to compound returns, yes, but just as importantly, to compound knowledge over time.

In this week’s note, we’ll also:

Walk through the weekly macro calendar

Review Macro D’s FX trades after another successful week

Highlight a selection of chart setups

Revisit our asset-allocation model, built on an equity–bond framework that switches weekly with a firm focus on drawdown management — a model that, over 50 years of history, has recorded just three down years, all relatively mild

If you’re looking for noise or bravado, this probably isn’t the place.

If you’re looking for structured thinking, repeatable frameworks, and a platform designed to endure across regimes — welcome to PA – Global Macro.

Let’s dig in.