Attack the Week (ATW)

June 16, 2024

Sunday Thoughts

Happy Father's Day to all the amazing dads out there! Today, we celebrate the incredible fathers who fill our lives with love, wisdom, and unwavering support.

I wish you all good health and precious moments to spend with your families, free from the distractions of screens. May you enjoy laughter, heartfelt conversations, and the simple joys of being together. I am eternally grateful to my father and his endless dedication to the family. He is a legend.

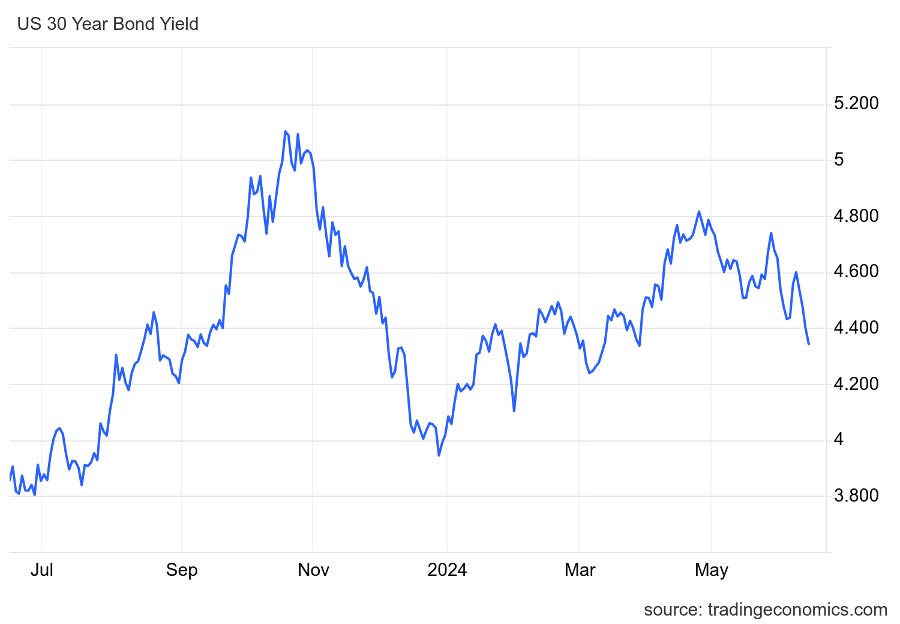

A very eventful week should give us pause to reflect on a few things. US yield curve steepeners is possibly the most frustrating trade over the past year that still continues to frustrate everyone. The last rate hike was delivered a year ago, and by now, the policy lag effects should be surfacing. Inflation is still sticky and is unlikely to return to target over the next year. While the yield curve flatness is a conundrum, it is hard to envisage how the Fed could inflict pain through a bear steepener. Their only tightening lever will be an unlikely hike, which would deliver more flatness to the curve. Historical precedents show a clear pattern that steepeners only work when central banks cut, resulting in a recession. Absent a recession, cuts will do nothing to steepen curves. The mid-90s is a good study (see Bloomberg chart below), which highlights my point pretty well.

Taking the same analogue from 1995 and US equities would reveal quite a bit more upside potential to the index. While I’m not a massive fan of analogues, this chart gives me some flavour as to what’s possible. Back then, the Fed cut rates from 600 bps to 525 bps in what was the last time we saw a soft landing scenario.

US risk markets had a very good week. Euphoric action in tech almost single-handedly drove equity indices to new highs. Notably, we saw equity index volatility go bid despite surging spot indices. VIX again showed support at 12 handles. Underperformance from the vulnerable is evident in both equity and credit arenas, with Russell and High Yield lagging materially.

We have witnessed the largest weekly outperformance from tech since May 2023. Before this, we have to look back to October 2008 for the last instance of tech outperforming so emphatically in a calendar week. This is comfortably a more than 2 standard deviation weekly move for this ratio, even if we stretch the dataset out to begin in 1990 to include the late 1990s tech frenzy (where outperforms like this were commonplace).

Also noteworthy is that the equal-weighted SPX (SPW index or RSP ETF) recorded a 2 standard deviation 214bp relative loss vs regular way SPX. The RSP/SPY ratio has had its worst two-week run since March 2023 and continues to plumb to levels not seen since the GFC's in 2009.

In terms of thematic baskets, there is a strong correlation between last week’s performance and their respective YTD % performance. Momentum is still at work, both for longs and shorts.

Macro D Thoughts

Before looking to the immediate future, I can't help but ask myself: What has this past week left us?

I would be tempted to immerse my thoughts in a hot bath of the Fed, inflation, labour market rates, and Dot Plots, but for now, I force myself to bite the bullet and leave my mental lucubrations in US sauce perched on a graph.

When I saw the auction of 30-year government bonds move sensationally, I immediately thought that soon there would be plenty of comments about the yield curve's departure (towards new shores); in the meantime, the yield on the 10-year, at a three-month low, has collapsed to the ground.

But let's not get stuck on the States now. There's something else going around.

It's not explicitly stated, but the events unfolding suggest a correlation between Macron and the French-German spread. The narrative implies that when a government is led by an individual unaccustomed to humility, a tumble is inevitable, and when it occurs, it's bound to be painful.

What is behind this graph? I believe that behind this graph, there is an insatiable thirst for glory and prominence for a man who raises the stakes every time it would be more appropriate to take a step back. The defeat suffered in the European Parliament elections was not enough.

Bad habits die hard, especially those rooted in the human soul—the French President, immune to any attempt at self-criticism, even during the Italian G7, dug his heels in, forcing the Italian Prime Minister Giorgia Meloni to dot the i's.

Putting a topic like abortion on the table (this is what Macron did) at a time (historical situation) in which there is much else to talk about (and discuss) is a bit like insisting on talking about the taste of caviar in a conference in which proposals are made to defeat world hunger.

France is in turmoil. The vertical collapse of its main index and the internal controversies within its political factions are clear indicators of this.

France has a public deficit of 5.5, a public debt of 113.8, and a total debt of 310 per cent, much higher than the German and Italian debts. I understand that over the years (in the more recent and less recent past), the ECB and the European Commission have always disregarded French public finances' (somewhat unstable) management.

Still, now I have the impression that the wind could really change and just as in the past, it was Italy's turn to do mea culpa, this time, it could also happen that France will be get scolded. Midweek, rumours of Macron's possible resignation (a rumour later denied) if he suffered a further collapse in the upcoming elections for the National Assembly pushed the French 10-year bond to close in the red. At the same time, the France/Germany spread reached its highest level since 2013. The current French fiscal policies do not convince anyone, and the alternative represented by the triumph of Marin le Pen cannot bring peace beyond the Alps. Without hesitation, It is natural to say that a France in Le Pen format could enter into conflict with the European institutions, creating a bond turmoil of epochal proportions.

I noticed with curiosity that among the diners seated at the table of the greats of the Earth, only the Italian Prime Minister Giorgia Meloni is practically sure that she is the only one who will not have to look for a new professional position next year, the others, more or less, will be called upon to recycle themselves.

Speaking of recycling, does an event like the G7 still make sense? It doesn't make sense if its attitude is to close up like a hedgehog, but it does make sense if its purpose is to open up. Well, the Italian Prime Minister has perfectly understood the global need to shine a light on a G7 that is based on "an open approach", and for this reason, she has widened the circle by inviting those who would have done better to stay out (Pope Francis) and those who were waiting to be asked, namely countries like India, Brazil, the Middle East and Africa.

In short, Prime Minister Meloni has shown that she has a far-sighted eye.

In 1975 (when the G7 was formed), the countries that represented it constituted more than half the global GDP. However, things have changed over time, and today, the countries of the group represent 40% of the global GDP, and in all likelihood, this 40% is destined to decrease further in the near future.

And now, let's move on to the States. Larry Fink and Jamie Dimon have never made a secret of their fear of the fiscal direction of the United States. The debt contracted in Washington will soon need a new noun to be explicitly coined for it (considering that it is now out of nature); we are faced with a monstrous debt growing day by day at the rate of 500 billion dollars per quarter.

In the short term, what could keep American bonds afloat? In my opinion, Washington would be breathing a sigh of relief right now if 1) Europe were to arm itself with courage (and weapons) and send its soldiers to the Ukrainian front, and 2) Europe were to manage to extend (in practice) the agreements that allow Russian gas to pass through Ukraine.

After all, if we began to believe that the most significant dangers flow on European soil and not on American ones, a return to the unconditional purchase of American debt would be plausible.

And if this did not happen? What would happen if no involuntary support for Biden came from Europe?

American fiscal policy is not convincing, neither within its borders nor abroad. Yet, the United States has always shown itself capable of sustaining debts, deficits, and interest rates that are unthinkable for any other state on the face of the Earth. The White House can always count on the dollar as a reserve currency, and in terms of natural resources, it has within itself everything a nation needs to face even difficult times. Will it be enough this time, too?

I have no reason to think otherwise, but what do Trump and his next Treasury Secretary think?

If a room in the house of finance risks going up in flames before the others, it is undoubtedly "the debt room". Deciding to enter this room requires the investor to have particular antibodies. Which ones? First, the antibody consists of courage and the ability to predict when the firefighters will arrive.

For now, I will remain and watch, starting from a basic assumption; when in doubt, buying options is always a choice that diligently moves between the hills of the possible and that of the impossible.

Let’s now focus on what is in store this week, which is anticipated to be relatively quiet. Yet, we can never lose focus as we forcefully attack markets. Let’s also scan some charts to give us a clue where opportunities lie.

Let’s go!