Attack the Week (ATW)

March 17, 2024

Sunday Thoughts

Once in a while, I stumble across a great podcast or interview, which I bookmark in my library of insights. This is the knowledge bank I want to reference and go back to from time to time.

The excellent and humble people at Macrostrategy always give me plenty of things to think about. Their work on money supply and related issues of deficit spending, productivity and implied growth outlook are always worth considering.

As typical monetarist, they scan for what they are currently witnessing and seeing in terms of monetary impulse globally. Back in 2020, they were one of the first that I can remember highlighting the inflationary impact the monetary base expansion would bring.

The key to the excellent interview is their assessment that the upcoming replenishment of the RRP facility signifies the end of excess savings in the system and that the current growth rate is artificially boosted by unproductive deficit spending from “idle” money.

The implication is that once this excess liquidity has dried out, deficit funding won’t be a “free lunch.” Simultaneously, the money supply will quickly fall relative to growth, which is analogous to a disinflationary impulse coming through. Watch the video below, which takes 50-odd minutes of your time but is worth it.

Interestingly, according to their research, both the UK and Europe are already witnessing the “crossover” of money supply falling below the nominal growth rate of the economy, which is highly disinflationary.

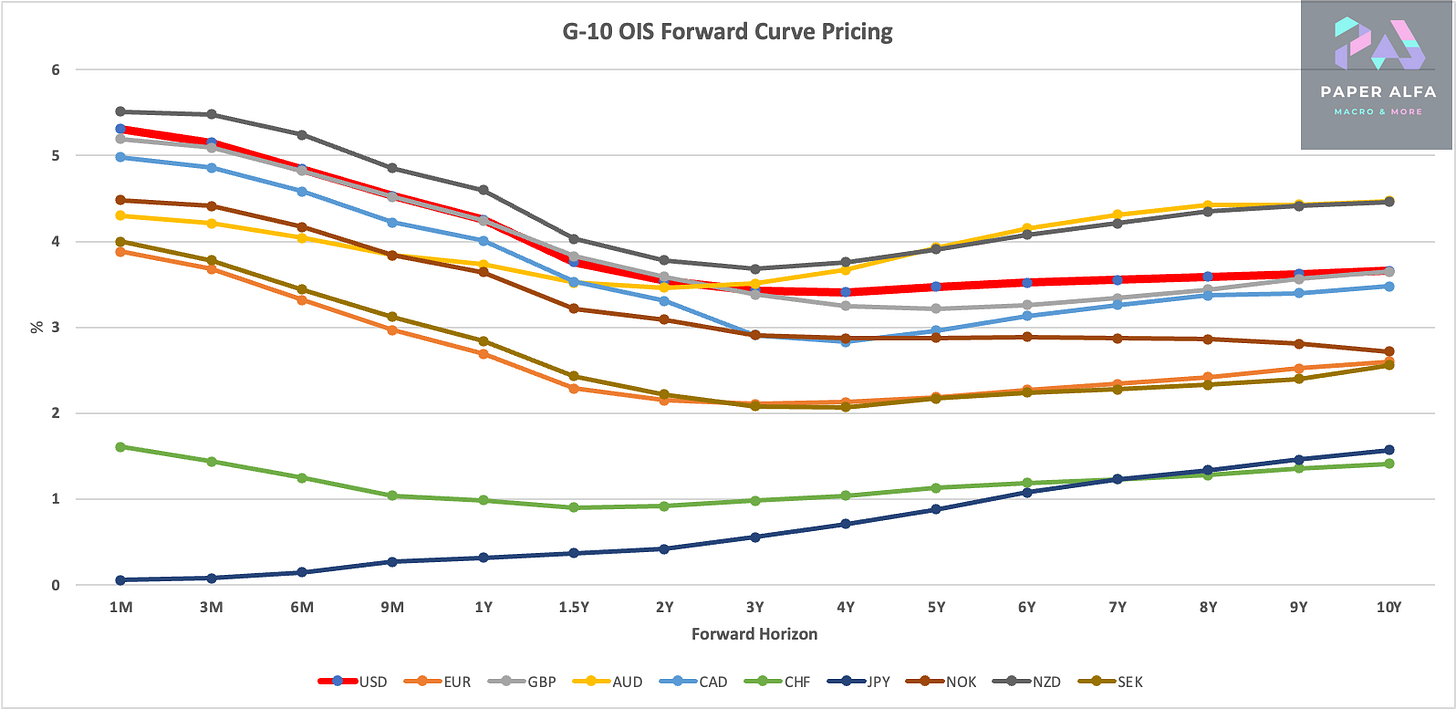

This fits in with my overall thinking that most developed central banks are playing a game of chicken with the Fed. For the majority, inflation is coming close to their targets, yet they are still beating the higher-for-longer mantra (see the OIS paths relative to the Fed below). Part of this is simply to keep their currencies appreciating vs the USD to help push imported inflation down further. This works only temporarily while causing undue stress on their domestic economy. The linking of domestic monetary policies to the Fed, therefore, is a policy error in the making. First, you are assuming the Fed is right (I think they are not), and second, you are trading short-term gains for longer-term issues.

One thing is for sure: not all of them will be right at the same time. Impossible, really, and hence, there are going to be plenty of opportunities coming up as those policy errors compound.

Let’s now turn our attention to what else the week will bring us. The biggies, of course, are the upcoming FOMC and BoJ meetings, and markets have already adjusted ahead of it following the stronger PPI print last week.