Attack the Week (ATW)

April 21, 2024

Sunday Thoughts

Saturday mornings are for Pilates. I have written about it before. It’s a one-hour ritual in a small studio not far from where we live. We book well in advance in order to claim one of the desired slots in the small 3-person class with our Colombian stretch master. She is great. We bring her a coffee every week.

A few weeks ago, we were blessed to have our kick-ass nephew join us for the session. He didn’t know what he was getting himself into, but he absolutely loved it. He is a legend.

On other occasions, we were paired with a lovely elderly lady who introduced herself as Pat (short for Patricia). She is fun and bubbly and still quite fit while well into her 70s. As we got to know her a bit better, it became apparent that she is a singer and performs in some of London’s hottest Jazz venues. A bit of research revealed that this is no ordinary singer but the pretty famous P.P. Arnold.

Pat, born Patricia Ann Cole, began her music career in the mid-1960s after moving from Los Angeles to London. She initially joined Ike and Tina Turner as an Ikette before being discovered by Mick Jagger, who helped her secure a solo record deal. Her early hits in the UK included songs like "The First Cut Is the Deepest" and "Angel of the Morning."

The first cut is indeed the deepest. Using it as a metaphor in today’s monetary policy dilemma poses the million-dollar question. Are we going to cut or not? The SNB has delivered, and the ECB seems to be preparing markets for a summer cut. What’s the Fed going to do?

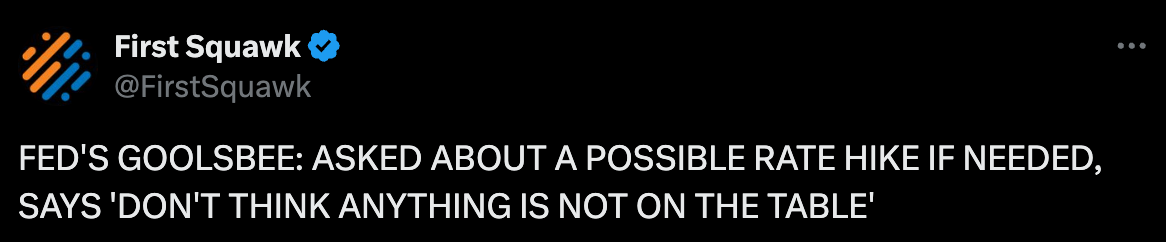

A whole rate cut was taken out of the 2024 curve last week. Now, we just have a skinny 45 bps of easing priced by year-end, which is prompting several houses to declare very attractive long-entries in bonds. That asymmetric risk/reward is predicated on the assumption of “peak rates” for the cycle, which has seemed a safe bet based on Fedspeak. But if the Fed narrative shifts to “maybe we shouldn’t cut this year”, then it’s not hard to see the market entertaining another hike. Recall that in election year 2016, the Fed hiked in December after holding rates steady for seven meetings.

The trend is pretty clear to me. Unless there is a marked slowdown from here and/or a cooling of inflation, the Fed’s window to deliver cuts is closing fast. The market will likely price in a cut possibility going forward, so there is going to be a skew to the downside within the distribution.

With multiple cuts touted as the base case 3 months ago, we are now talking about one or maybe two by year-end. In many ways, Pat and her song will possibly have a lot of meaning as we progress through the next months. Maybe the first rate cut will indeed be the only one and hence the deepest.

Let’s now see what is in store for us this week, where we will see 40% of the SPX report and 4 of the 7 MAG. We will also look at what charts matter for the week ahead.

Let’s go!