Attack the Week (ATW)

September 18, 2023

Monday Thoughts

Summer is over. At least, it would appear so in London town. Returning from Italy, I was greeted with stunning late summer weather, temperatures reaching 27 degrees / 80 Fahrenheit. This turned into a rainy and much cooler Sunday. I have a small obsession with anticipating those last and first days of summer. There is a certain energy that usually takes people’s moods with it. The upcoming equinox on September 23 is one such day many esoteric market believers are looking at for the timing of a turn. I personally don’t believe in it being a lasting strategy, although a good friend of mine who was a credit trader swore not only by the equinox but all sorts of different lunar and astrological cycles. He did very well.

As in any complex system, small, subtle changes can affect bigger things. Given the plethora of psychological factors affecting decision-making, a shift in overall mood will affect markets. On this and more, please read my piece on technical analysis. I shall follow up with more thoughts on this soon.

The anticipated last-in-cycle rate hikes are either being completed or already behind us. This forming belief system is widely held, although no such thing is still observed in bond markets. Below is the short-end pricing for G-10 central banks. The first (small) cut probabilities appear in 2024. With the Fed mostly expected to hold rates this week, is this the shift-change that will prove a potential turning point in markets?

While some late hikes are still priced, many G-10 central bankers are expected to catch up to the FED in the years ahead. Remember how this was more extreme a few weeks ago, as the Fed was the only one expected to cut aggressively? ECB and BoE have now caught up, which has boosted their currency’s underperformance vs. the USD.

Here are all the relevant numbers for your information. G-10 markets cumulative bps pricing.

This is also visible over time, with the USD OIS curve (green lower) line trending higher (rate cuts priced out) while most other curves (aside from Japan’s) are trending lower.

Also, remember to look at it in the context of emerging markets, which have mostly started on their easing paths (cumulative bps in the table below).

Many anticipate a pausing monetary policy stance to be positive for bond markets. I disagree. Things are relatively predictable if you have a tightening or easing bias as you have policy momentum. This usually keeps volatility subdued and thus offers better investment opportunities. If you are setting for up a pause, volatility and risk premia are increasing. That keeps bond markets on their toes for now, especially as quite a bit of easing is still priced relative to previous easing cycles.

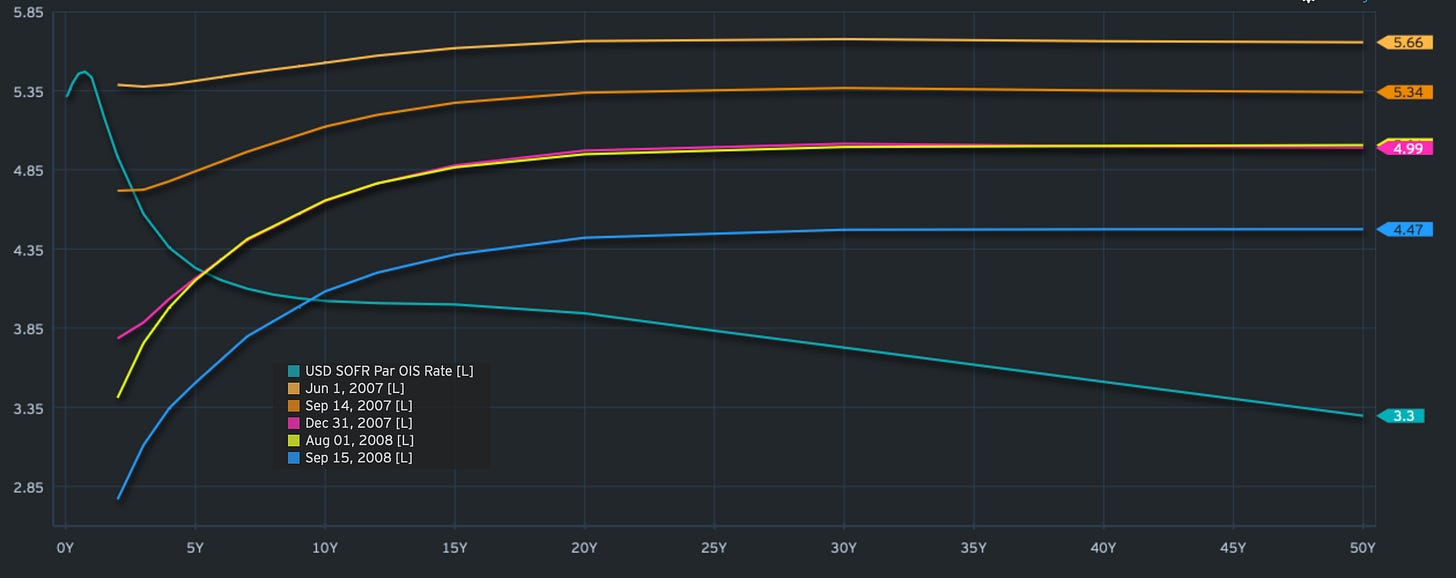

The chart below shows the SOFR (OIS) curves at various historical points. The greenish line is the current pricing. The top light orange line is the June 1, 2007 curve, roughly 3.5 months before the first rate cut (50 bps September 18, 2007).

There are never perfect historical analogies, but it is fair to say that the current OIS curve is anticipating quite a bit of easing in a cycle that, inflation-wise, cannot be compared with the 2007/08.

Now, let’s attack the week.