Sunday Thoughts

Over the weekend, I watched one of those old films that I had never fully managed to embrace, Beverly Hills Cop. This one was the 3rd part. There is a particular scene in it that I think is particularly entertaining and funny. I must have watched it several times by now. I have no idea how Bronson Pinchot didn’t win a prize for playing this extraordinary character.

In the motion picture, Axel Foley's investigation leads him to an upscale art gallery in Beverly Hills, where he encounters Serge, the eccentric and flamboyant art dealer. The scene unfolds with Axel entering the gallery, a stark contrast to the posh environment in his casual attire. Serge, dressed in his usual vibrant and eye-catching ensemble, greets Axel with exuberant enthusiasm.

Their interaction begins with a humorous exchange about the pronunciation of their names — Serge emphasizing his with a French flair, "Sairzh," and Axel clarifying his straightforwardly as "Ax-el which Serge fails to grasp as he repeatedly calls him “Achwell”. Despite their stark differences in personality and background, they quickly establish a connection.

You can watch the main sequences of their encounter below.

This unlikely partnership between Serge and Axel was much like the relationship between the market and central banks these days. At times, it seemed as though they were speaking entirely different languages. Yet, there seems to be an inherent understanding between the two at the current juncture as the market seems to patiently accept a delayed rate-cutting cycle while painting a remarkably flat yield curve and implied volatilities across major asset markets as if to say, we got you.

Nobody seems discontent with the current status quo and equilibrium, and I wonder what can break the calm. There will likely come a point when the market will force the Fed to potentially re-think its current policy setting more seriously. This, however, could be still months away. However, the breaking point is slowly approaching as everything we are currently seeing and experiencing would strongly suggest that we are not at the correct policy setting.

Macro D Thoughts: 6 Troubles

"If I had only one hour to save the world, I would spend 55 minutes defining the problem and 5 minutes finding the solution."

- Albert Einstein

I spent over 55 minutes defining a problem, but reading my partial conclusions will take less time. We are talking about trouble (global and very big).

Trouble Number 1

The number one of NATO is raising his voice with increasing frequency, and it now seems clear to me that he is hoping for a clear and decisive change of pace, where the fate of the conflict between Russia and Ukraine is decided. I read it this way. Jens Stoltenberg is acting for the American government rather than for the European Union. Moreover, now, what does the USA want? The United States want Europe to take a step forward, and when this happens, the United States will take a step back. However, is Europe in a position to take this step? I do not think so. Europe, as usual, does not have a shared strategy; it goes right then left, hesitates, thinks and thinks again, organizes convenient meetings, and its representatives are content with the compromises they make with each other. Let us find an excuse: European politicians have other things to consider now. The votes are now approaching both in the EU and the United Kingdom. I realize it is not a good excuse.

Trouble Number 2.

Yellen did not go to Stresa on vacation; she had other things to think about. One of them was the buybacks of US government bonds. Question: Are we facing a new Operation Twist 2.0 that must remove those mountains of dollars from the banks' balance sheets that no one wants any more?

This buyback is set to last until July, and each operation will be worth 2 billion dollars (considering that 500 million are made up of Tips or bonds indexed to inflation). If we wanted to think badly[1], we would say it is a new bank bailout in disguise. This bailout would take the chestnuts out of the fire for the US regional banks before they are overwhelmed by the defaults of the Cmbs (or those types of bonds strictly linked to mortgages and real estate leases intended for commercial use).

Trouble Number 3.

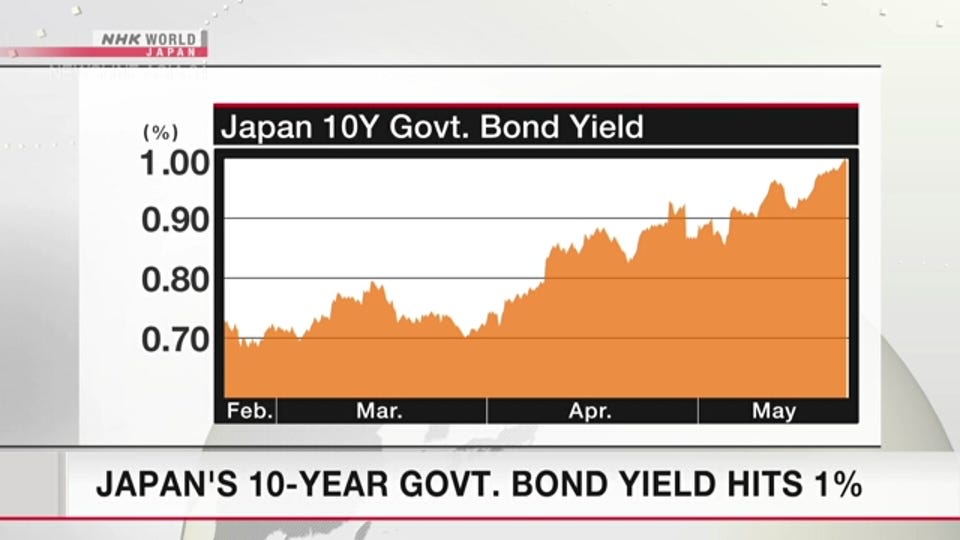

What does this chart mean? It means that with this 10-year yield, more money needs to be printed to ensure the tolerability of Japanese debt. What could be the consequences of this 10-year Japanese yield that (for the first time since 2011) has exceeded 1% after being in negative territory for long periods in these thirteen years? Answer. Japanese savings have been the lifeblood of global financial markets for years (both in US and European government bond auctions). However, the rise in Japanese government bond yields could reduce demand for foreign bonds to benefit domestic bonds.

Trouble Number 4.

The European Central Bank has been telling the world that it will cut interest rates next Thursday. In the meantime, however, we have the data on inflation for May, which has risen again to +2.4% after +2.2% in April. In particular, the Spanish inflation data for May say that the price index in Spain rose by 3.6% in May, while in April, it had been 3.3%. Inflation also rose in Germany. The consumer price index rose by 2.4% on the year (after 2.2% in April) and by 0.1% compared to the previous month. Then, there was the grand finale: According to the flash estimate by Eurostat, annual inflation in the euro area should settle at 2.6% in May, up from 2.4% in April. This is higher than the 2.5% expected by the markets. It is too late now. As we have already said on other occasions, bringing wild horses back into the enclosure is pretty complicated after they have escaped.

Trouble Number 5.

In the latest Beige book, I noticed the use of terminology that made my ears perk up. What did I read?

In particular: "Negative employment gains" and "More pessimistic outlook."

But what does this really mean? The mainstream press is constantly bombarding us with news of skyrocketing wages, yet the Beige book presents a completely different narrative. It is a stark contrast that demands our attention. What is the real story here? Something does not add up.

Then I read another sentence: "Several districts reported that wage growth has returned to pre-pandemic historical averages or was normalizing toward those rates[2]”.

This sentence does not tell the story of a world grappling with inflation. Instead, it tells the story of a world that has gone back in time a few years.

Trouble Number 6.

Like all of you, I was also waiting for two critical data points from the USA. The new estimate of the GDP of the United States speaks of a growth of 1.3%, compared to a previous estimate corresponding to +1.6%. Considering the various internal items, this data is neither infamy nor praise; in short, it is a somewhat undecided scale that cannot tip to the right rather than to the left. The second data I was waiting for with greater impatience. The PCE Core is an acronym for the Personal Consumption Expenditures Core Price Index (the price index for personal consumption expenditures, the one that excludes the most volatile components: energy prices and food prices). Jay considers this data the fundamental indicator for understanding the inflation trend in the United States. In simple terms, if the PCE Core increases, inflation increases.

What came out of it? The PCE figure increased by 0.3% compared to the previous month, which is in line with expectations and equal to the March figure, but it grew by 2.7% compared to the previous year. The "core" component, cleaned of volatile elements, grew by 0.2%, which is equal to estimates, and is still down by 0.3% compared to the previous month and also by 2.8% compared to the previous year.

How do I evaluate this figure? The word "depends" should be inserted at the beginning of every reasoning. Generally speaking, it does not seem to me that this core PCE is very toxic (if it were, the Fed could also permanently suspend the idea of monetary easing until the end of the year), but it is not a dormant Core PCE either (if it were, the Fed could also decide to push the monetary easing button immediately). I looked at the markets' reaction while waiting to find a way out of my dilemma. Overall, the market welcomed the PCE inflation data positively. Why? The market saw in these data a limited cooling or at least did not see any particular concern regarding a hypothetical rise in inflation. This should allow the Federal Reserve to manoeuvre to lower interest rates during 2024. I confess that, in general, I aligned myself with this view.

I do not read a limited cooling of inflation but a general context in which inflation has not sunk the knife in the wound. That is all. This does not mean that the knife has been sheathed, far from it. The knife is always on the table and can hurt a lot. In short, both data from the US make me lean towards a solution that encourages me to think there will be no cuts until the November elections. We will see. In any case, the fact that I cannot find a more reliable clue to the problem (than the one I described) does not mean someone else has not found it. I am sure that out there, in some human minds, there is a solution to the dilemma of when "the next cut will come" or maybe "the next hike"; after all, as good Voltaire said, "No problem can resist the assault of deep reflection."

Let’s now focus on the events of the week ahead and consider which charts are most relevant.

Let’s go