Attack the Week (ATW)

July 10, 2023

This is week two of our regular ATW publication. It gives you good guidance on what macro factors and events could influence markets on which day. As mentioned in my previous ATW article, the first couple of weeks usually provides the macro impulses for the rest of the month, new information that the market discounts and has to grapple with in search of likely narratives and paths FORWARD.

Discounting forwards, not backwards

Why am I capitalising on that word? Because it is still astonishingly common amongst investment professionals to discuss yesterday’s and last week’s events. This will not happen at Paper Alfa. FOMC minutes and payrolls are last week’s manifestation and firmly cemented in prices. We are not using our intellectual capacity to analyse the past as it virtually has zero value (in monetary terms, that is). Financial markets are highly complex fast adaptive systems that are forward-looking in nature, discounting future probabilities into today’s price.

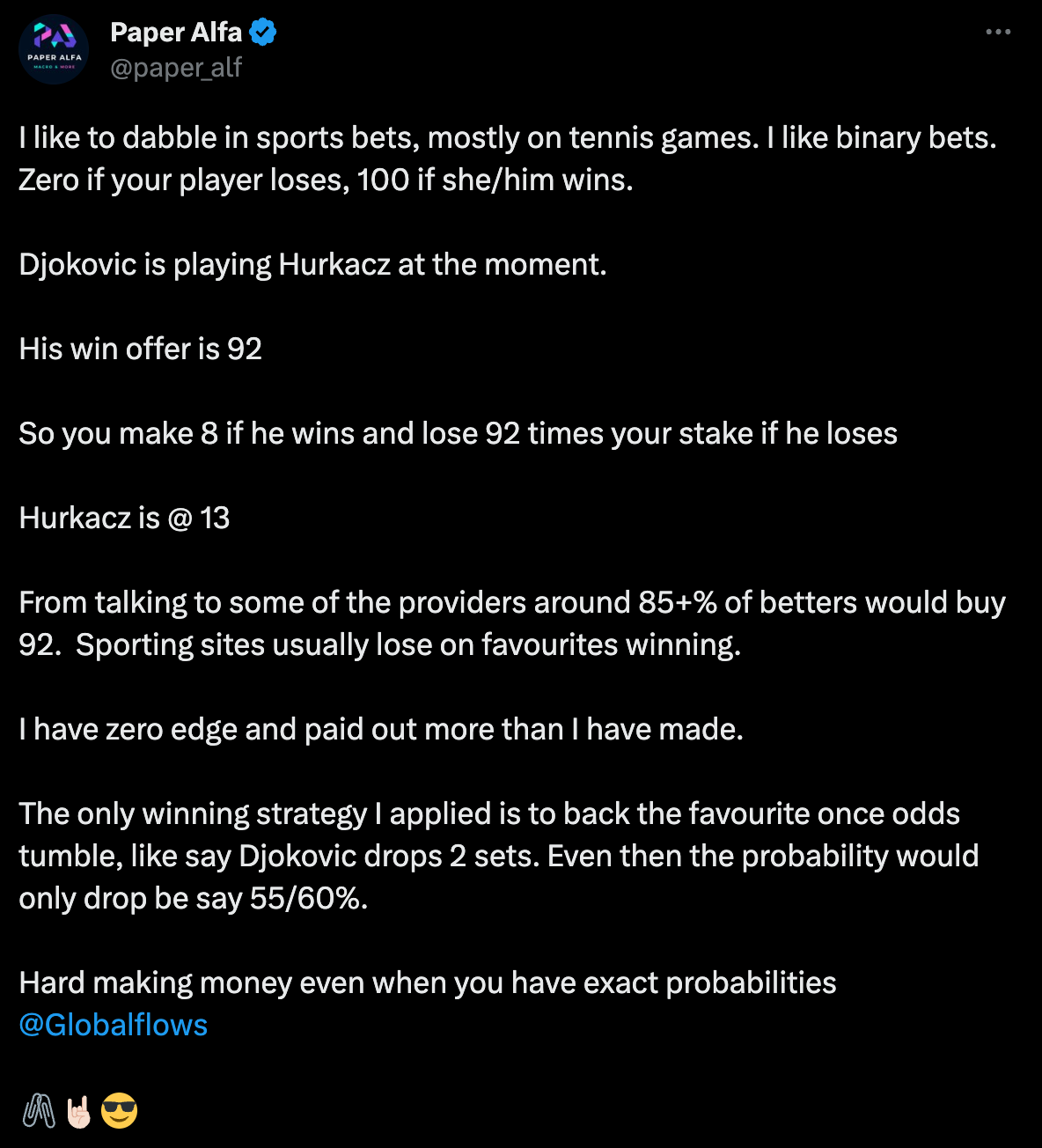

Using my sports betting analogy from yesterday’s tweet (see below). Do you think the price changes with every point? Yes, absolutely, it’s constantly moving. Will the last point influence the next one? Possibly but it is no guarantee. If you watched the match, you might have realised Djokovic’s amazing record when it comes to tie-breaks. He won 12 Tie-Breaks in a row. When his opponent was hammering down aces and had 3 set points at 6-3 on his own serve, the match probability only moved down a bit. And as it happened, he turned that first set around and won the breaker 8-6, as well as the next set’s tie-break (match suspended and will resume today).

Following up on Capital Flows’s excellent post on probabilities; that’s exactly what we have to deal with in an even more complex system where there are infinitely more possibilities in almost perpetuity. As such, the momentum of a series, for example, labour market data, will certainly raise the probabilities of future expectations. This conditional probability or Bayes’ theory of the influence of events changing probabilities of future events is what the constant discount mechanism of markets is playing with. There are going to be dedicated posts to this vast field, so bear with me.

What seems like a one-dimensional aspect in terms of expected values, given its probabilities, is, in reality, way more complex. We have to take the distribution of paths and probabilities into consideration. Something I always pay much attention to is the diversity of views. Say we are all looking at the expectations of this week’s CPI YoY, which is expected to come in at 3.1% vs 4% prior. Now, I don’t have the precise range of views at hand but say it’s ranging from 2% to 3.5%. I would regard this as a pretty wide distribution. Alternatively, think of the range to be only 3 - 3.2%, a pretty narrow window. Which expectation is more prone to potential market moves?

Diversity breakdowns are what I am excited about; that’s where money is on the table. I can hear you say, well, that’s just being contrarian. That’s only a minor part of the condition. It needs an intricate view of how diversity is distributed and how conditional probabilities are likely set out to change over time.

A current example could be looking at the next six months and asking yourself at which of the six coming NFP and/or CPI prints can we expect a sizeable downward surprise which would change both the expectation and the distribution of forward pricing? Take your probability, and compare it to what you think the market is pricing and expecting. This will give you a foundation for forming the basis of what is generally known as macro investing.

Looking at all those complexities and working through those gargantuan probability trees, do you still believe yesterday’s data has any intrinsic value in building profitable strategies?

I discussed the institutional world in my free post here, where way too much time and energy is ironically given to the past. Why? Because that’s what people feel comfortable talking about. That’s what sounds great and knowledgeable to others because it’s already cemented as a fact. Storytelling about possible future outcomes, however, is something people struggle with. It’s uncertain, and as such, discussing it in larger meetings makes you potentially vulnerable to ridicule. I have seen people being laughed at for coming up with future scenarios (which proved to be true). I will have a few good stories coming up in my “Stories of the Institutional past” series on those topics, so stay tuned.

Now, with that and the past behind us, let’s attack the week ahead.