Attack the Week (ATW)

Featuring the Friday Chart Book

Sunday Thoughts

Apologies for the late running of Friday’s Chart Book, which is going to be incorporated in this piece at the end. I was away, travelling with friends to see one long-lost artist live again: Jamiroquai.

For those who don’t know, Jamiroquai is a British funk and acid jazz band fronted by the unmistakable Jay Kay, known for his wild hats, velvet vocals, and genre-bending sound. Rising to fame in the ‘90s, the band blended soul, groove, and futuristic themes—none more iconic than in their hit “Virtual Insanity,” a track that now feels eerily prescient in today’s macro world.

It’s a track that once sounded futuristic. Today, it sounds prophetic. But the insanity isn’t virtual anymore. It’s real. It’s policy. It’s a strategy. And it’s being priced as if it doesn’t matter. Let’s take a look at some examples below.

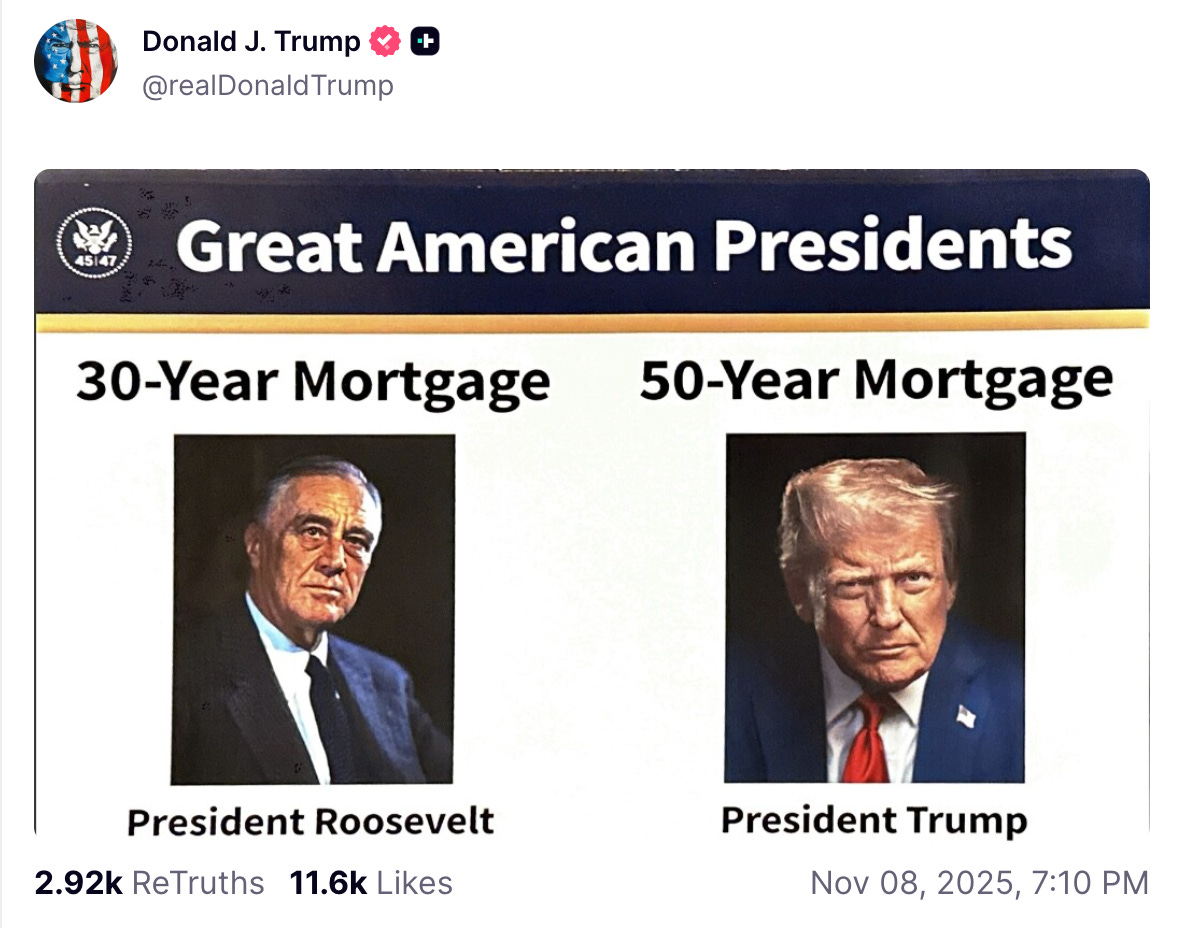

50-year mortgages — an attempt to stretch affordability not by lowering prices or increasing productivity, but by time-warping debt into the next generation. This isn’t just poor policy. This is economic surrealism, being paraded as innovation. A world where government-backed debt is being packaged as venture fuel, and homebuyers are being asked to trade liquidity for legacy—signing mortgages they’ll be lucky to see half of.

Then I saw this headline on my timeline.

What we’re witnessing now isn’t just breaking with orthodoxy. We’re abandoning the gravitational force of common sense. Debt dynamics are being redefined. Fiscal anchors are being unmoored. Market psychology is being tested to the edge of narrative elasticity. We are entering a macro phase where volatility is being suppressed by policy and lack of imagination, just as fundamentals are being distorted by lack of visibility. And that, my friends, is the most dangerous cocktail of all. It creates what I call the “cosmic zone” of markets — where anything can happen, in any direction.

At Paper Alfa, our lens has never been about chasing hype or reacting to the day’s headline. It’s about recognising risk in all its forms — not just nominal drawdowns, but real purchasing power erosion. Our focus is multi-dimensional: drawdowns, dislocations, and the durability of value. Our 2025 buy-and-hold portfolio is up 22% YTD, no trading, just holding still.

We aim to build strategies that not only survive but also thrive in unusual regimes. If you are interested in joining the pack, I am still running a 20% discount on all new subscriptions in November.

Let’s now read some Macro D’s latest thoughts on the RBA and BoE, and additional thoughts on AI, Student Debt and the US Labour Market, before we analyse the weekly calendar and interpret the output of our weekly asset allocation model. The whole 250+ Chart Book is introduced in the last section.

Let’s go!