Attack the Week (ATW)

May 19, 2024

Sunday Thoughts

"When I am overcome with worry, I think of a man who, on his deathbed, said that his whole life had been full of worry, most of it about things that never happened."

- Winston Churchill

I confess that I have always been sensitive to worries, and I often wonder why an event that forces me to bathe in the lake of anxiety corresponds to the same event to which another human being responds with a healthy laugh and a smoked with counter flakes.

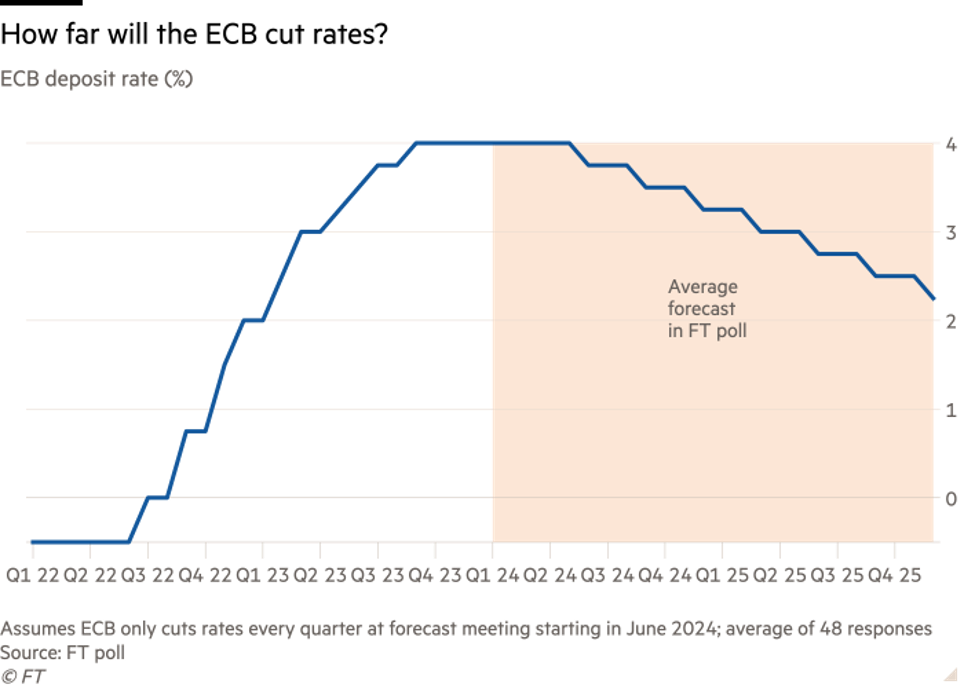

Let's take this graph below. It worries me.

Conversely, maybe this chart makes someone smile.

This happens: the Fed (not stupid) keeps borrowing costs below their natural area by using interest rates lower than the market and, more or less, hidden asset purchases.

Here's the real question:

Is this debt being used for a just cause, or is it simply money being squandered?

I still ask myself: But if let's say this debt is used for purposes that do not offer an advantage to the nation, which contracts this debt through the government, what fate awaits this nation?

I confess it; I got worried for the umpteenth time, so I decided to turn the page and take a look at the general situation, but promising myself not to go into details that could force me into yet another search for the truth with the highest probability of being recognized as such.

I returned to Europe and saw that thanks to the continuation of the conflict between Russia and Ukraine, Great Britain and Poland (and there is definitely someone else behind it, too) are pushing to develop a well-defined strategic plan whose objective is to be ready in case they decide to attack Russia head-on.

We know that once a conflict comes to mind, it is easy for all the others to follow suit.

Remaining in Europe, France and Germany are in trouble, and even Italy seems to have nothing to cheer on.

Meanwhile, the President of the Federal Reserve Bank of Kansas City, Jeffrey Schmid, proves that music changes faster than the instruments that need to be played. Nowadays, as far as the long-awaited concert called "Rate Cut" is concerned, the only certain news is that one day it will happen, but no one knows when.

"At a later date", so they say.

What did Schmid say?

"Politics is in the right place, and with patience, we are on the path to achieving our political goals. Nothing is specific, and continuous vigilance and flexibility are required. Over time, inflation will move back towards the Fed's 2% target”.

But Schmid is one of many bankers who have confirmed the new antiphon. Minneapolis Fed President Neel Kashkari reiterated that the central bank will likely have to keep rates at the current level "for a while longer" and questioned how much interest rates at the current level are holding back the US economy. This is a classic from the central bankers of the Fed; they are very skilled at taking their time by asking themselves questions that have the aim of forcing the markets to turn around in search of an answer, while instead, the answer to such an important question is contained in the question itself. It is not a definitive answer.

Then it was the turn of the President of the Federal Reserve Bank of New York, John Williams, who welcomed the arrival of more moderate data on inflation but put his hand forward by stating that the positive news was still not enough to convince the US central bank to cut interest rates quickly.

But what exactly did Williams say?

"While it's important not to overemphasize the latest economic data, the more moderate tone of April's consumer price index is "something of a positive development after a few months of disappointing data."

"The overall trend looks reasonably good" for a gradual slowing of inflationary pressures."

“Monetary policy is "tight" and "in a good place. I don't see any indicators that tell me there's a reason to change the stance of monetary policy now, and I don't expect to get the added security we need." to have on inflation progress towards the 2% target in the concise term".

"I see no need to tighten monetary policy today," Williams said.

Then, it was the turn of the Cleveland Fed President, Loretta Mester, and the Richmond Fed President, Thomas Barkin, who argued that inflation could take longer to reach their 2% target. In particular, echoing Powell, Barkin confidently stated, "To get to 2% sustainably in the right way, I just think it's going to take a little longer".

Atlanta Fed President Raphael Bostic opined, "I will watch the data for May and June to make sure there is no step backwards. If the outlook evolves as expected, i.e. with slowly moderating inflation and continued economic momentum, it may be appropriate for us to reduce rates towards the end of the year."

The line is drawn.

In short, more precise than that …

And in Europe?

Governing Council member Villeroy said, “Because we have enough confidence, we will most likely start cutting central bank rates at our meeting in early June”.

Caution appears to be dead and buried, as if the persistence of wage increases in the euro area did not exist and as if the uncertainty caused by the situation in the Middle East was no longer a bogeyman worthy of note.

But it may be true that I tend to worry about everything.

For a moment, I tried to convince myself that the chances that something catastrophic was about to fall on our heads were zero, then suddenly, the words of Nir Bar Dea, the CEO of Bridgewater Associates, which warns investors about overconfidence in their market positions; this overconfidence could become into unhealthy arrogance and presumption.

How come?

Nir Ban Dea clearly says that geopolitical tensions are very present and suggests they could unleash pandemonium at any moment. If this happened, it would have a concrete and immediate impact on the trading positions of all investors.

At that point, I gave up; I realized that I had just been condemned to yet another bath in the lake of restlessness, and when I was ready to abandon myself to my destiny, yet another coup de grace arrived.

Nir Bar Dea clearly stated that Bridgewater continues to fail on 40% of its bets, which is still a pretty decent hit ratio.

I bowed my head and made myself comfortable. The water of the lake of restlessness was boiling this time.

Having reached this point in the story, I decided to take stock and to do this (whether I liked it or not), I necessarily found myself reading between the lines of the words of the bankers of the central committees (both of the Fed and the ECB).

I always need to create similes when I try to read between the lines.

So, I tried it this time, too.

I tend to resemble the words of the central bankers to the speech that the chef of the starred restaurant makes to his team when, in the middle of the morning, he shows up at the restaurant with the shopping bags, puts them on the table, and says to his trusted collaborators, "These are ten lobsters. What do you think you should cook?"

The guys in the brigade will hardly think of having to prepare grilled beans or steaks.

Central bankers have just put their own shopping bags on the table.

Will the markets misunderstand?

Let’s now focus on the events of the week ahead and what charts are most relevant for us to consider.

Attack!