Attack the Week (ATW)

March 23, 2025

Sunday Thoughts

Trying to zoom out from the weekly financial market gyrations is quite a task these days. I sometimes wish I possessed one of those man-in-black neutralizers that flashed your short-term memories. Instead, I am trying not to think about markets for most of the weekend to get some well-deserved rest and leave my bias of last week behind me. Current market setups can leave one too narrowly focused on what has been quite a noisy trading environment. Let’s forget last week. We always look forward.

It’s so easy to get sucked into the most recent narrative and then extrapolate. Looking, for example, at EUR/USD (white line) and the corresponding positioning (blue line) would highlight that people follow the direct trajectory of the move in general. There is nothing wrong with it, but it also highlights that markets direct narratives, not the other way around. Reflexivity would also stipulate that markets can dictate economic outcomes; I believe there is a lot of truth in that.

If we are really entering a recession, US tax receipts are running rather hot and beating previous year's records handsomely.

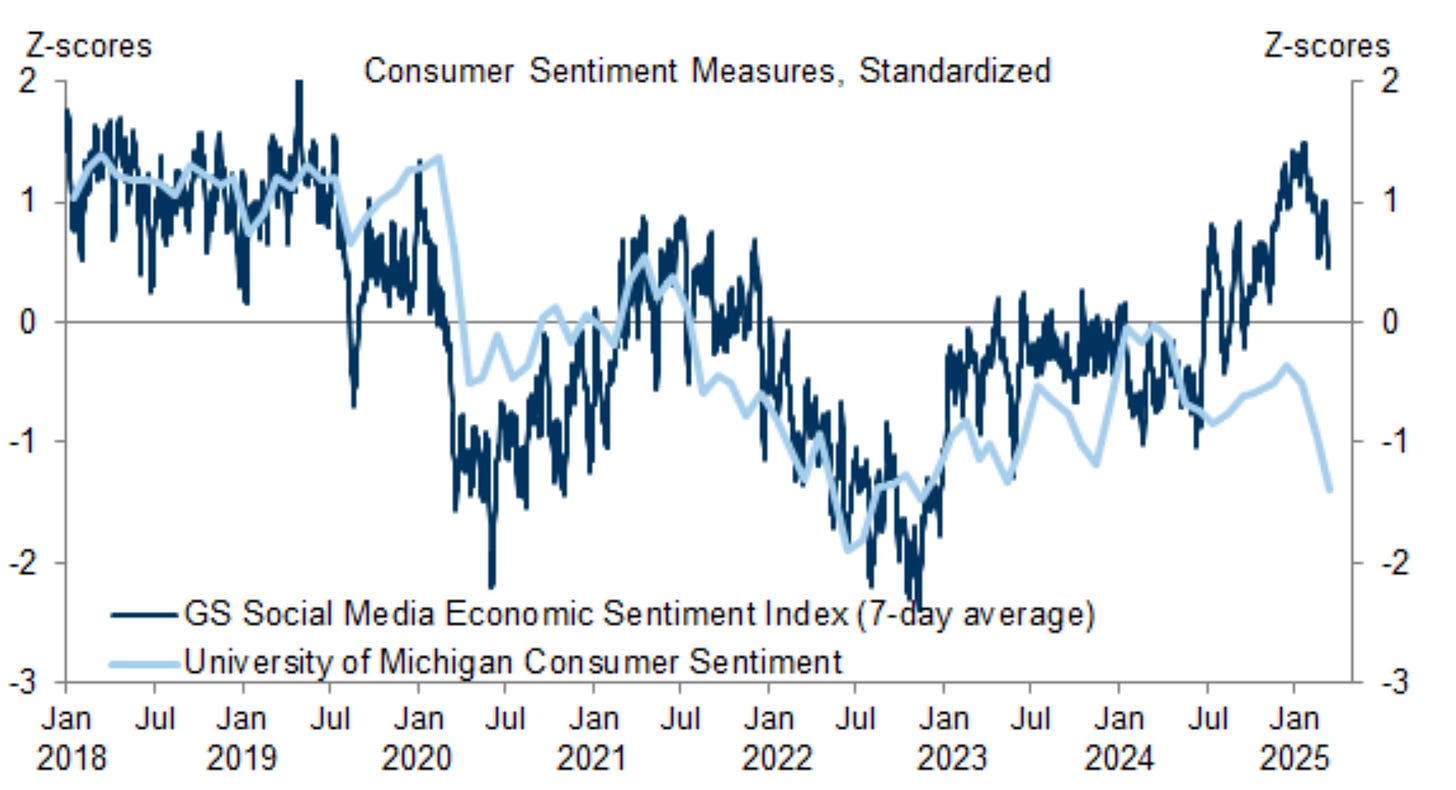

All soft data points to a downtrend, with hard data still to follow. The chart below from GS highlights their social media economic index, which has admittedly deteriorated, but the gap to the University of Michigan consumer sentiment index remains rather large. Which one is wrong? Are tariffs and Trump’s first few months on the job having an overproportional impact?

Inflation trends over longer time horizons have picked up again, as the chart from TD shows. Correlation in global goods inflation dynamics is especially worrying as this has been the major disinflationary contributor over the past several months and years. This is potentially keeping central bankers away from pressing for further rate cuts in the near term.

Macro is a tricky beast. It’s about recognising the current trajectory and narratives but always results in connecting all the dots and current pricing relative to one’s forward macro vision. People are bearish on US stocks, and there are tons of good reasons for it. Tariffs are coming, and the US administration seems very willing to engineer a slowdown to get their agenda across. What if that macro scenario has already arrived and is priced? I ask myself, what does it require to launch the SPX back to 6000?

Easier tariff outcomes? Stronger US data? A more supportive rate structure? Sure, all of this could work. But it might also have no effect at all. Markets don’t give us the luxury of ever knowing; they just move, and then the market pundit wizards will have to find stories to backfill and justify the reaction. Let’s not fall into this trap and be flexible in our macro thinking but also search for good risk/reward setups.

For a sizeable SPX rally to 6000 I like options structures, which offer great risk/rewards payouts over the next 3 months. I will show them further below behind the paywall.

If you are interested in exploring what this place has to offer, I would invite you to join the pack. 7-day trials are open.

This is a reminder that you can now also use my models in TradingView scripts, which I made available for subscribers to use on their charts. This is not for free and incurs an additional cost.

If you are interested, ping me an email with your TV username. Note that only paying subscribers will be granted access. No exceptions.

Let’s read Macro D’s latest thinking before briefly scanning the week’s upcoming calendar. We then revisit some charts, which give us some interesting set-ups. As always, we close with a look at the output of our asset allocation model. It had another positive week last week. Let’s see what it decides to do for the upcoming trading days.

Let’s go!